1. Skipping Pre-Approval for a Mortgage

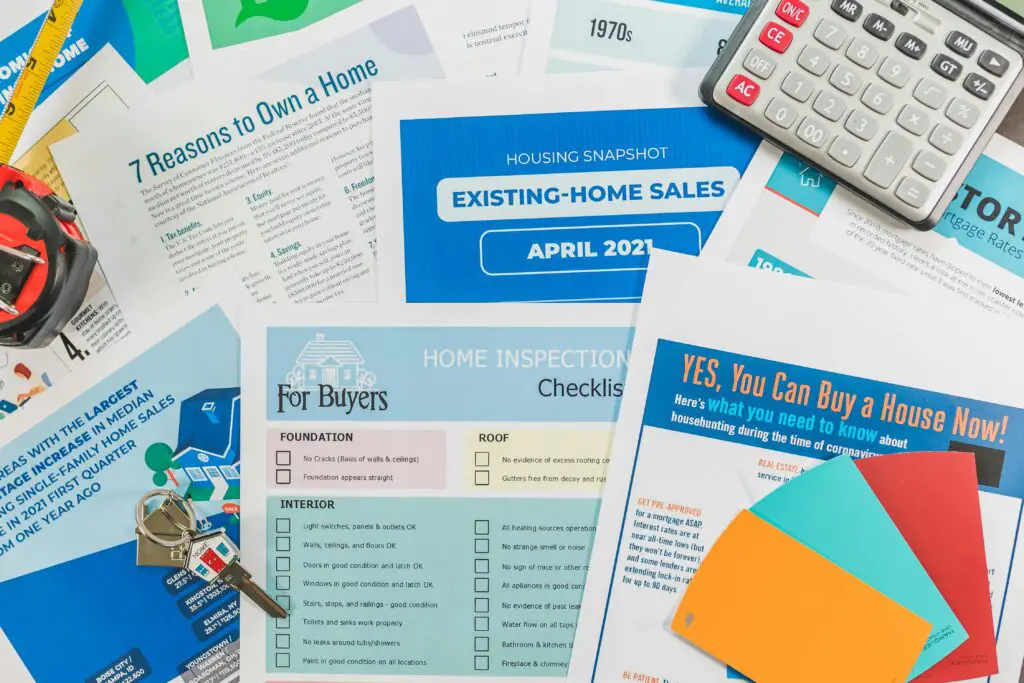

Many first-time buyers dive into house hunting without getting pre-approved for a mortgage. This can lead to falling in love with homes they can’t afford or delays in making offers. Pre-approval helps define a realistic budget and strengthens your bargaining position.

2. Underestimating Closing Costs

First-time buyers often focus solely on the down payment, forgetting about closing costs. Expenses such as inspections, appraisals, title insurance, and taxes can add up to thousands of dollars. Failing to account for these costs can stretch budgets thin at the last minute.

3. Overextending Their Budget

Buying a home that maxes out your financial capacity is a common mistake. Unexpected costs like maintenance or property taxes can quickly become unmanageable. Experts recommend sticking to a budget that leaves room for savings and emergencies.

4. Failing to Account for Future Needs

First-time buyers sometimes choose a home based on their current lifestyle, ignoring future changes. A small home might feel perfect now but could become cramped if your family grows. Always consider your long-term plans when choosing a property.

5. Neglecting a Home Inspection

Waiving a home inspection to make an offer more attractive is a risky move. Inspections reveal hidden issues like structural damage or faulty wiring, saving buyers from costly surprises. Skipping this step can lead to regret and major expenses down the road.

6. Being Too Emotional

Buying a home is an emotional milestone, but letting feelings dictate decisions can be costly. Falling in love with a property may lead to overlooking red flags or overpaying. Stay focused on your budget and priorities to avoid financial pitfalls.

7. Overlooking Neighborhood Research

First-time buyers often get fixated on the house itself without considering the neighborhood. Factors like schools, commute times, and nearby amenities greatly impact your quality of life. Visit the area at different times of the day to get a full picture.

8. Ignoring Resale Value

Some buyers forget to think about a home’s potential resale value when making their purchase. Features like location, layout, and condition play a significant role in how easy it will be to sell later. A house that doesn’t appeal to future buyers could hurt your investment.

9. Failing to Shop Around for a Mortgage

Many first-time buyers accept the first mortgage offer they receive, missing out on better rates or terms. Comparing lenders can save thousands of dollars over the life of the loan. Even a small difference in interest rates can make a big financial impact.

10. Making Big Financial Changes Before Closing

Taking on new debt, like a car loan or credit card, before closing can jeopardize your mortgage approval. Lenders recheck your finances before finalizing the loan. Avoid major financial moves until after you’ve closed on your home.

11. Focusing Solely on Aesthetics

First-time buyers often prioritize cosmetic features over structural integrity or functionality. While a fresh coat of paint is appealing, the home’s foundation and systems matter more. Always prioritize the bones of the house over superficial details.

12. Not Hiring a Real Estate Agent

Some first-time buyers try to navigate the process without professional help to save money. However, a knowledgeable real estate agent can guide you through negotiations, paperwork, and market trends. Their expertise often prevents costly mistakes and ensures a smoother experience.