The housing market is unpredictable, and as 2025 approaches, homeowners must be aware of the factors that could drastically reduce their property values. While some issues, like economic downturns, are out of your control, others can be mitigated with proper planning. From changes in buyer preferences to external economic pressures, the value of your home may not be as stable as you think. Here are 12 surprising ways your home’s value could take a hit in 2025.

1. Rising Property Taxes

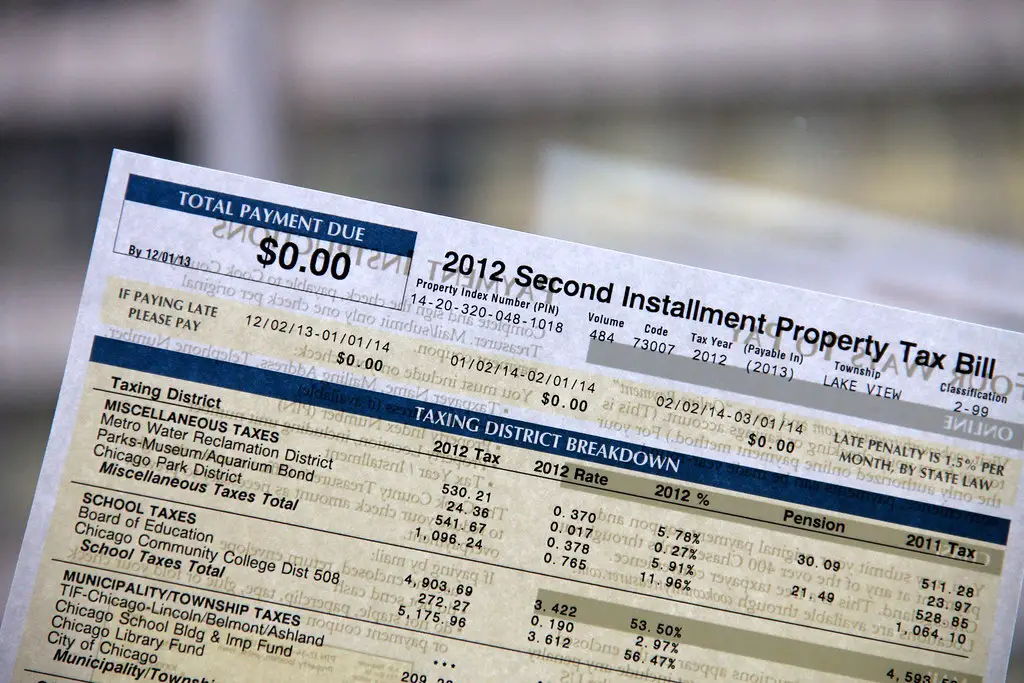

As local governments seek additional revenue, many areas are seeing sharp increases in property taxes. Homeowners who bought their properties at lower rates may struggle to keep up with these rising costs, making their homes less attractive to potential buyers. In some cases, higher property taxes can significantly reduce the resale value of a home, as buyers factor in the long-term financial burden. This trend is particularly concerning in states with already high tax rates, where affordability is becoming a major issue.

Additionally, tax reassessments based on inflated home values from previous years may push some homeowners into a financial strain. Even if property values decline, taxes don’t always decrease at the same rate, leaving homeowners paying more for less value. As a result, buyers may turn to areas with lower tax burdens, causing home demand—and prices—to drop. Without tax relief policies, some communities could see a sharp decline in home values throughout 2025.

2. Climate Change and Extreme Weather

The increasing frequency of hurricanes, wildfires, and flooding is making certain areas far riskier for homeowners. Properties in high-risk zones are losing value as insurance premiums skyrocket or companies refuse to provide coverage altogether. Buyers are becoming more cautious, with some avoiding these regions entirely to prevent future financial and safety risks. As a result, homes that were once considered prime real estate may see sharp declines in value.

Beyond immediate disasters, long-term environmental shifts like rising sea levels and extreme heat can render entire neighborhoods undesirable. Coastal properties, in particular, are at risk of devaluation as water encroaches on land, causing foundation issues and making homes unlivable. In other areas, persistent droughts and heatwaves are leading to water shortages, which can drive people away. Without major investments in climate resilience, these factors could devastate home values in affected regions.

3. Skyrocketing Insurance Costs

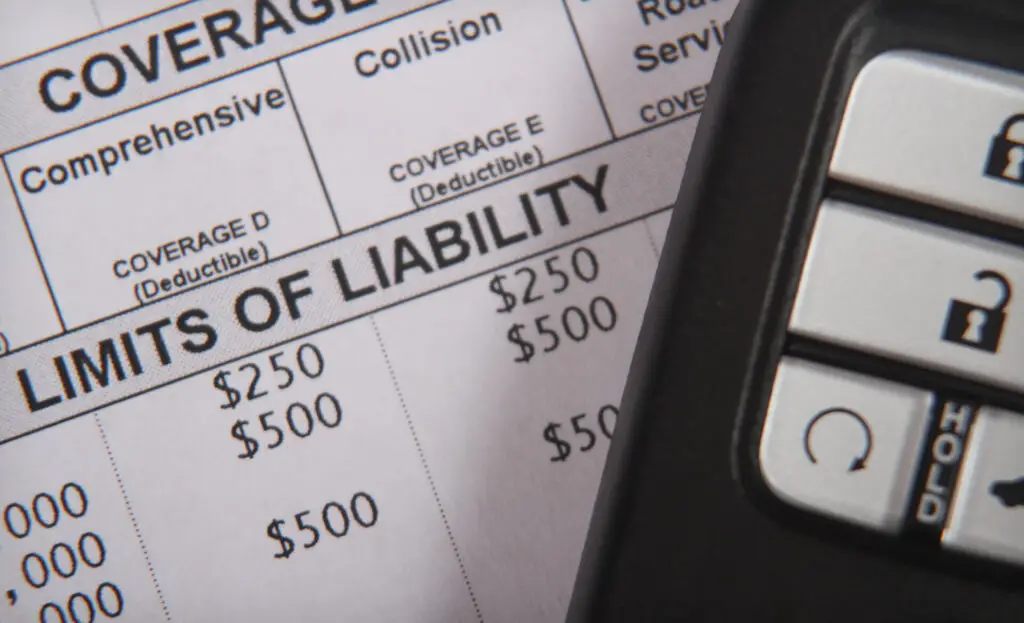

Homeowners insurance rates have been climbing due to climate-related disasters, aging infrastructure, and increasing repair costs. Some insurers are even pulling out of high-risk states entirely, leaving homeowners scrambling to find coverage. When insurance becomes too expensive or unavailable, selling a home becomes much harder, forcing owners to lower their asking prices. Potential buyers may be scared away by the prospect of exorbitant premiums or the inability to get coverage at all.

As more homeowners struggle with this issue, some neighborhoods may see declining demand, which will inevitably drive prices down. States like California and Florida are already seeing homeowners drop coverage due to unaffordable rates, leaving their properties more vulnerable to damage. Mortgage lenders often require insurance, meaning those without it may have difficulty selling their homes. With no end in sight for rising premiums, this trend could significantly impact home values in 2025.

4. Remote Work Declines

The remote work boom fueled demand for homes in suburban and rural areas, but as companies push employees back to the office, that trend is reversing. Many workers who moved away from major cities are now reconsidering their choices, leading to decreased demand in once-thriving remote work hubs. This shift could cause property values to drop in areas that saw rapid appreciation during the pandemic. As demand weakens, homeowners in these regions may struggle to sell at the prices they once expected.

At the same time, urban areas may not experience the full rebound they hoped for, as affordability issues keep buyers at bay. If hybrid work becomes the norm rather than fully remote setups, some buyers may opt for smaller, more centrally located properties rather than sprawling suburban homes. The uncertainty in work arrangements makes it difficult to predict housing trends, but areas that saw artificial price surges could face corrections in 2025. Without a stable workforce driving demand, housing markets in certain regions may stagnate.

5. Overbuilt Housing Markets

Some cities saw massive home construction booms over the last few years, but now supply is outpacing demand. When there are too many homes on the market, sellers are forced to lower prices to attract buyers. This is particularly concerning in areas where population growth isn’t keeping up with new housing developments. Investors who bought properties expecting quick appreciation may find themselves stuck with homes they can’t sell for a profit.

In regions with an oversupply of new homes, builders might begin offering steep discounts or incentives, further lowering overall home values. Existing homeowners who need to sell may have to compete with brand-new, more affordable houses, making resale even harder. Some overbuilt markets could experience significant corrections as demand slows down in 2025. For those who bought at peak prices, negative equity could become a real concern.

6. Interest Rate Uncertainty

Mortgage rates have fluctuated dramatically, and if they remain high, fewer buyers will be able to afford homes. This can lead to lower demand, forcing sellers to drop prices to attract buyers. Even if rates decrease slightly, many potential buyers may still be hesitant due to financial uncertainty. Homeowners who locked in low rates years ago may also be unwilling to sell, limiting inventory turnover and creating market stagnation.

As affordability remains an issue, some markets could see home values drop as buyers hold off on making major financial commitments. First-time homebuyers, in particular, are struggling to enter the market, which could slow demand even further. Without a strong buyer pool, sellers will be forced to negotiate more aggressively, leading to price declines. If economic conditions don’t improve, 2025 could see even greater affordability challenges, further weakening home values.

7. Aging Homes in Declining Areas

Many American suburbs and small towns are struggling with aging housing stock that is falling out of favor with buyers. Homes that require significant updates, such as new roofing, plumbing, or electrical work, are becoming harder to sell. Buyers are increasingly looking for modern, move-in-ready properties rather than fixer-uppers. As a result, older homes in need of major repairs may see steep value declines.

In some areas, declining populations are making it even harder for homeowners to sell. Cities with stagnant job markets or poor infrastructure may see an exodus of residents, leaving behind vacant homes that further depress prices. The cost of maintaining and upgrading older properties is another deterrent, especially with inflation driving up construction and repair costs. Without major revitalization efforts, these aging homes could become financial burdens rather than valuable assets.

8. Retail and Business Closures Nearby

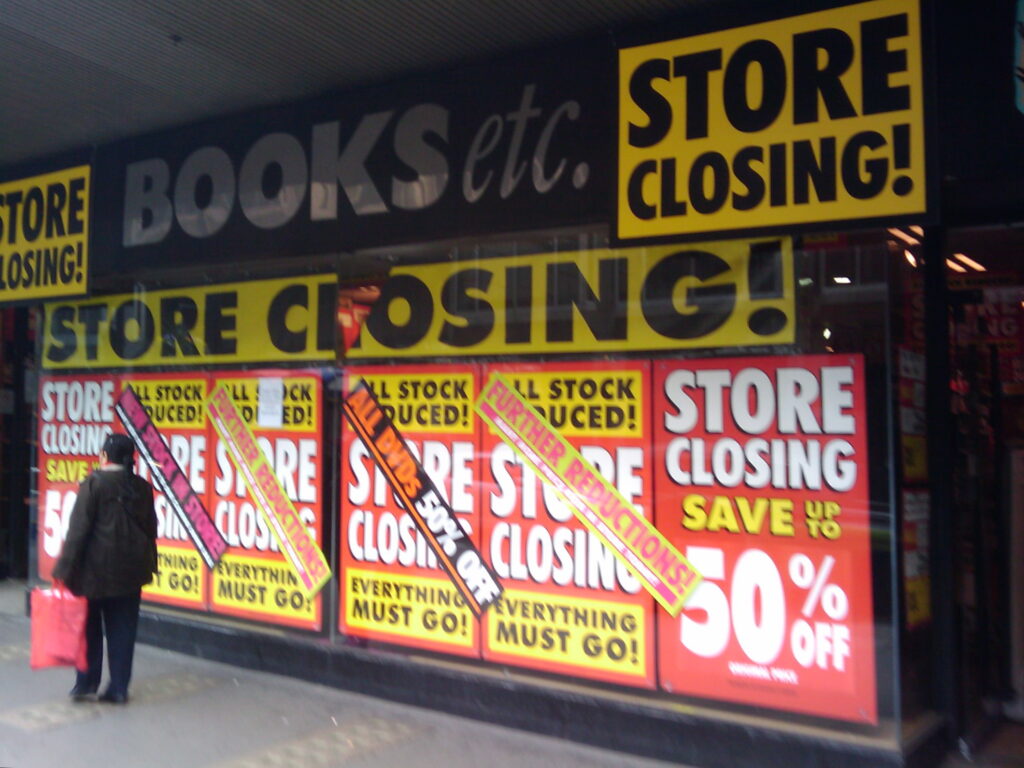

The health of the local economy plays a crucial role in home values, and the closure of major retailers or businesses can be devastating. When large employers shut down or relocate, job losses can trigger a decline in home demand. Fewer employment opportunities mean fewer people moving into the area, causing property values to stagnate or drop. Empty shopping centers and abandoned office buildings can also make neighborhoods less desirable.

Even small business closures can negatively impact home values, as vibrant local amenities attract buyers. A town that once had bustling restaurants, shops, and entertainment venues may struggle to maintain its appeal if businesses shut down. Homes in areas with declining commercial activity may take longer to sell, forcing price reductions. Without economic reinvestment, some communities could see their property values erode in 2025.

9. HOA Fees Becoming Too Expensive

Homeowners associations (HOAs) were once seen as a way to maintain property values, but rising fees are making them a burden. In some communities, HOA costs have doubled in recent years due to inflation, insurance costs, and maintenance expenses. Buyers are becoming wary of high fees, which can make homes harder to sell. If homeowners can’t afford to keep up with rising dues, they may be forced to sell at a loss.

Unpopular HOA policies and mismanagement can also drive away buyers, further reducing demand. Some associations have been criticized for excessive restrictions and legal battles with residents, creating negative reputations for their communities. If a neighborhood gains a bad reputation due to its HOA, property values may suffer as potential buyers look elsewhere. Unless HOAs find ways to keep fees reasonable, this issue could contribute to declining home values in 2025.

10. High Crime Rates

Crime is one of the most significant factors influencing home values. If a neighborhood experiences an uptick in crime, even a slight one, it can lead to a steep drop in home demand. Buyers are reluctant to purchase homes in areas where they feel unsafe, and those who already own homes may look to sell as crime rates rise. In 2025, areas with increasing crime could see home values plummet as families seek out safer neighborhoods.

Additionally, crime rates can impact local amenities, businesses, and schools, further detracting from a neighborhood’s appeal. If the schools in an area become less desirable due to safety concerns, families will be less likely to settle there. As the crime rate rises, fewer people will want to move in, leading to a downward cycle of falling home values. Homeowners may find themselves trapped with properties that are no longer seen as attractive investments.

11. Changes in Local Zoning Laws

Zoning laws play a critical role in determining the type of development allowed in an area. A change in these laws—such as allowing for higher-density housing or commercial development—can have a significant impact on property values. If more affordable housing is built near upscale neighborhoods, it may drive down the perceived value of nearby homes. Similarly, if new businesses or warehouses are built in residential areas, the resulting increase in traffic and noise could make the area less desirable.

Zoning changes can also increase property taxes, as the municipality may look to capitalize on the rising land values. For example, if an area is rezoned for commercial use, property values could drop as the neighborhood becomes more congested and less residential. Homeowners in these areas may find that their properties become less attractive to buyers, leading to falling home values. In 2025, zoning changes could result in sharp declines in real estate prices, particularly in suburban areas undergoing rapid redevelopment.

12. Economic Recession

A nationwide or regional recession can lead to job losses, decreased consumer spending, and a general economic slowdown—directly affecting home values. When people lose jobs or face financial uncertainty, purchasing homes becomes a lower priority, causing demand to decrease. Homes in areas where the local economy is tied to industries that are particularly vulnerable during recessions could see their values drop significantly. For example, regions dependent on industries like oil or manufacturing may be especially hard-hit in times of economic downturn.

Additionally, a recession can lead to lower mortgage approval rates, making it even harder for potential buyers to secure financing. When fewer buyers can afford homes, sellers may need to lower their asking prices or face longer times on the market. If the recession lingers into 2025, home values in some areas could plummet as homeowners struggle to sell in a weakened economy. Economic instability will be a major factor contributing to the decline in property values across the country.