The rich often make quiet moves before financial trends go mainstream. In 2025, many high-net-worth individuals are reevaluating their portfolios and cutting ties with once-coveted assets. Whether driven by taxes, performance, or lifestyle changes, these shifts speak volumes. Here are 13 assets the wealthy are subtly saying goodbye to this year.

1. Downtown Office Space

After a slow but steady recovery post-pandemic, downtown commercial real estate just isn’t bouncing back like investors hoped. High vacancy rates and shifting work-from-home norms are making office buildings a liability. According to CBRE’s 2025 Market Outlook, many institutional investors are pulling back from city-center real estate. The rich, taking note, are divesting from this once-solid pillar of wealth.

Family offices and private investors are increasingly shifting toward industrial and mixed-use suburban developments. The return on investment simply isn’t what it used to be in central business districts. Even trophy buildings in top-tier cities have lost their appeal. When prestige starts costing more than it earns, the smart money walks away.

2. Luxury Retail Stocks

Brands like Gucci and Prada once seemed bulletproof, but cracks are forming. High interest rates, inflation, and shifting consumer values are eroding profit margins for luxury retailers. According to a 2025 Bain & Company report, even the ultra-rich are spending less on logo-heavy luxury goods. Investors are selling off shares in retail giants while values are still high.

Today’s younger affluent consumers prefer experiences and sustainability over conspicuous consumption. The resale market has also disrupted new luxury sales. Analysts say profit forecasts are down across much of the sector. Wealthy investors are quietly reallocating to sectors like clean energy and tech innovation.

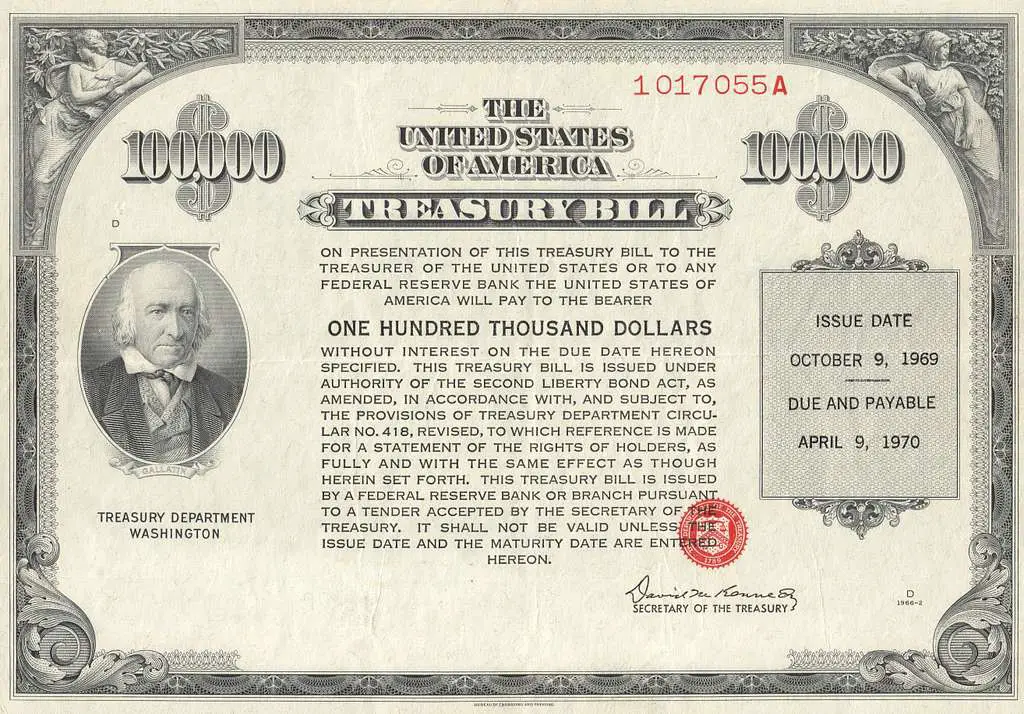

3. U.S. Treasury Bonds

Once considered the safest investment on Earth, U.S. Treasury bonds have lost some of their luster among the ultra-wealthy. Yields remain low compared to alternative assets, and inflation continues to erode real returns. According to Bloomberg’s Wealth Briefing, many high-net-worth individuals are selling off long-duration government debt. They’re turning instead to short-term instruments or inflation-protected securities.

With interest rate uncertainty continuing into 2025, locking into low-yield bonds seems unwise. Wealth managers are diversifying into private credit and municipal bonds for better returns. Even risk-averse investors are starting to favor non-traditional income plays. Treasury bonds are no longer the cornerstone they once were.

4. High-Maintenance Vacation Homes

Second homes in traditional luxury markets like Aspen, Martha’s Vineyard, and the Hamptons are getting the cold shoulder. Rising property taxes, upkeep costs, and climate risks are making these assets less attractive. A 2025 Knight Frank Wealth Report notes a drop in ultra-high-net-worth individuals investing in legacy vacation properties. Many are opting for luxury rentals or fractional ownership instead.

The trend is driven in part by lifestyle flexibility and lower commitment. Wealthy individuals want mobility, not maintenance. Airbnb-style investing and travel clubs are replacing traditional ownership. The result: less cash tied up in real estate that only sees a few weeks of use per year.

5. NFTs and Digital Collectibles

After the 2021 boom, many wealthy collectors dove into the NFT space with excitement. But by 2025, digital art and collectibles are struggling to hold long-term value. The market has cooled significantly, and liquidity has become a serious concern. High-net-worth investors are now selling off digital assets while they can still recover some capital.

Fewer platforms are supporting resale markets, and regulatory scrutiny continues to mount. Even top-tier NFT projects have seen dramatic drops in value. As with any speculative asset, once the hype fades, the money follows. The rich are moving back to tangible assets like physical art and rare watches.

6. Urban Luxury Condos

The demand for high-rise, high-priced condos in dense cities is slipping. Young affluent buyers are favoring more space and privacy, while older investors are downsizing. Many units in places like New York, San Francisco, and Chicago are sitting longer on the market. Maintenance fees, taxes, and association dues are driving owners to cash out.

Wealthy investors are focusing on boutique developments and custom-built homes in tax-friendly states. Even with luxury finishes, condos can feel impersonal and crowded. The math often just doesn’t add up for long-term gains. Better yields await in up-and-coming regions or international developments.

7. Classic Cars

Once a favorite status symbol and appreciating asset, classic cars are starting to stall. The cost of storage, insurance, and maintenance is rising sharply. Some collectors are quietly exiting the market before values plateau further. While icons like Ferraris and Aston Martins still command attention, their upside is shrinking.

New generations of the wealthy don’t have the same nostalgia for combustion engines. Electric vehicles and green regulations are also reshaping the future of auto collecting. Fewer buyers means slower sales and tighter margins. For now, the glamour of vintage rides is parked on the sidelines.

8. High-End Art Funds

Instead of owning individual works, many investors joined art funds to diversify their exposure to the fine art market. But fees are high, returns are inconsistent, and the market remains opaque. Wealthy backers are now moving away from pooled art investments. They’re choosing direct ownership where they can control appreciation and sales.

Art funds also come with long lock-up periods and questionable valuation metrics. Auction house results have become less predictable. This lack of liquidity and transparency no longer suits savvy investors. The rich are retreating to safer ground or collecting independently.

9. Large Yachts

Superyachts are the epitome of excess—but also of expense. Fuel, crew salaries, dock fees, and insurance make ownership a money pit. Many wealthy owners are now selling off or chartering their vessels instead. The market is flooded with gently-used yachts at increasingly negotiable prices.

Climate concerns and public scrutiny also play a role. Flaunting wealth in this way has become less fashionable. For the ultra-rich, discretion now outweighs display. And the open seas aren’t as enticing when quieter luxury is trending.

10. Private Islands

Private islands once symbolized ultimate exclusivity, but they come with headaches. Logistical issues, high costs, and increasing climate risk have made them harder to sell. Some island owners are offloading properties or turning them into eco-resorts to recoup value. Others are simply letting them sit, hoping for better markets.

Increased focus on sustainability is shifting tastes toward community and conservation. Remote locations can also feel more isolating post-pandemic. It turns out paradise isn’t always practical. The dream of private island living is quietly drifting out to sea.

11. Crypto Mining Operations

Bitcoin mining was a gold rush for the ultra-wealthy just a few years ago. But energy costs, regulatory pressure, and diminishing returns have dulled its shine. Many investors are now selling mining rigs and exiting partnerships. The high barrier to profitability makes mining more trouble than it’s worth.

Green initiatives are also pushing back against power-hungry operations. Countries once friendly to mining are now taxing or banning it altogether. Even die-hard crypto believers are scaling down. The rich are looking for cleaner, simpler ways to grow wealth.

12. High-End Timeshares

Luxury timeshares promised the best of both worlds—exclusive stays without full ownership costs. But hidden fees, restrictive schedules, and market oversaturation have changed the narrative. Wealthy investors are dumping these contracts or avoiding new ones altogether. They’re opting for flexible vacation clubs or bespoke travel services instead.

The resale value of timeshares is notoriously low, even in elite properties. Exit companies are popping up just to help owners break free. For a group that values freedom and control, timeshares have become a poor fit. In 2025, few are willing to sign on the dotted line.

13. Wine Cellar Investments

Fine wine was once a go-to alternative asset for wealthy collectors. But global shipping delays, climate-affected harvests, and changing tastes are affecting values. Fewer buyers are entering the market, especially younger investors. Wine auctions have cooled, and storage costs remain high.

Some investors are now drinking their collections rather than selling them. Others are quietly offloading rare bottles while prices hold steady. The emotional appeal remains, but the profit potential is drying up. In 2025, even vintage Bordeaux can’t hold its buzz forever.