When you take on a DIY project, the focus is usually on saving money or adding a personal touch—not worrying about your home insurance. But some common materials, even those sold at your local hardware store, could end up invalidating your coverage. Insurance companies expect that any updates or renovations meet safety and building codes. Using the wrong stuff might save you a few bucks now, but it could cost you big if something ever goes wrong.

1. Reclaimed Wood Without Certification

Reclaimed wood has rustic charm and eco-friendly appeal, but using uncertified lumber in your home can create hidden hazards. Country Living notes that without documentation about its origin or treatment, reclaimed wood may carry pests or chemicals, which can violate safety codes. That’s especially risky in structural elements or indoor furniture projects. If an issue arises later, your insurer may deny your claim based on improper materials.

Insurance companies typically require that structural materials meet specific safety standards. Using uncertified reclaimed wood bypasses that expectation. While it might look beautiful, it could compromise the integrity of your home or create fire risks. Always ask for documentation showing the wood has been properly treated and certified for indoor use.

2. DIY Spray Foam Kits

Spray foam insulation can be a cost-effective way to improve energy efficiency, but doing it yourself isn’t without risks. According to The Spruce, improperly applied spray foam can cause air quality issues or even fire hazards due to off-gassing chemicals. If these problems result in a claim, your insurer may take issue with the fact that a licensed contractor wasn’t involved. Some companies even list DIY spray foam as a red flag.

The concern lies in both the application and the material itself. Most spray foams require protective gear and controlled conditions. In an untrained hand, it’s easy to create voids, overapply, or spark long-term moisture damage—all of which can be considered negligence under your policy. In short: this is one shortcut that could end up invalidating your protection.

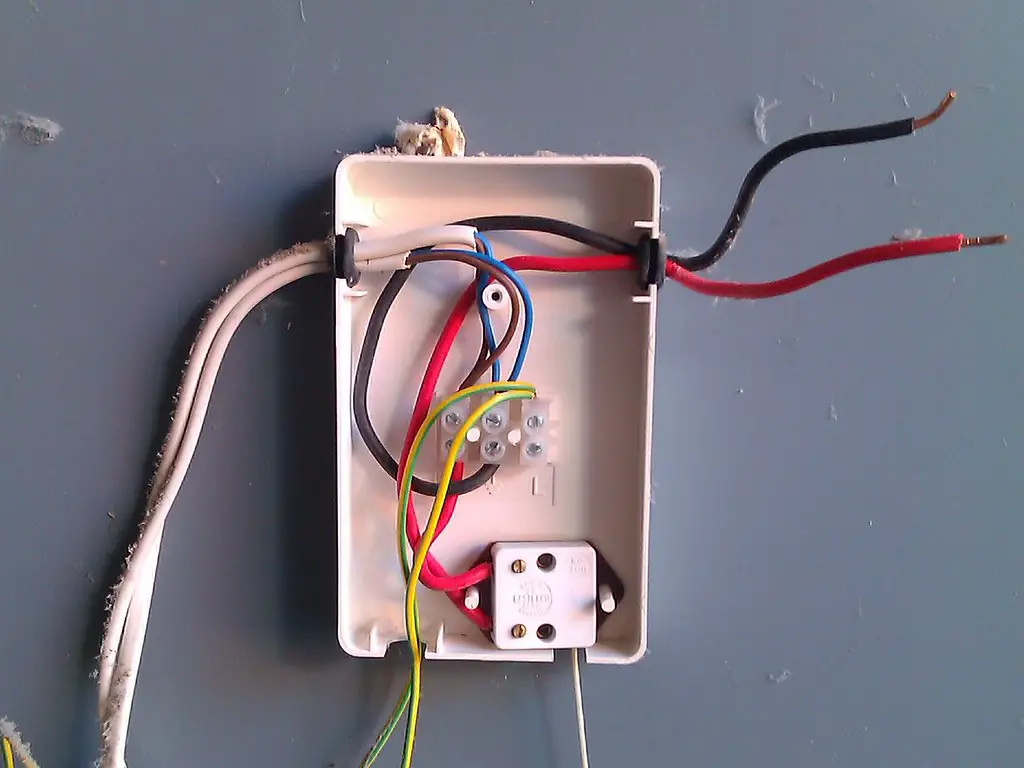

3. Unpermitted Electrical Wiring

Doing your own wiring might seem straightforward with a few online tutorials, but insurers draw a hard line on unlicensed electrical work. The National Fire Protection Association has linked faulty DIY wiring to house fires, and many insurance companies require electrical work to be done by a certified professional. If your DIY wiring sparks a fire—even years later—it could void your entire claim.

Even if the work seems minor, like installing a new outlet or switching out fixtures, it still needs to follow local code. Insurance companies will ask if the work was permitted and inspected. If you answer no, your policy may no longer apply, regardless of how small the job was. It’s a classic example of “what they don’t know can hurt you.”

4. Non-Approved Roofing Shingles

Choosing alternative roofing materials might seem like a budget-friendly or aesthetic decision, but it could cost you your insurance. U.S. News & World Report points out that some policies specify which materials are acceptable, especially in areas prone to severe weather. If you use cheaper, non-rated shingles, any storm damage may fall outside of your coverage. That’s a huge risk for one of the most expensive parts of your home.

Beyond durability, roofing materials must often meet fire resistance and wind uplift ratings. DIYers who don’t research or follow these specs could unknowingly install something non-compliant. The worst part? You might not even realize it until after a storm when your insurer refuses to pay for repairs. Always check your policy before starting a roofing project.

5. Peel-and-Stick Tile in Wet Areas

Peel-and-stick tiles have become a go-to for quick kitchen or bathroom upgrades, but they often aren’t waterproof enough for wet zones. If moisture seeps underneath, it can lead to mold growth or water damage behind the scenes. And when that damage is traced back to improper installation, insurers may refuse to cover it.

Water damage is one of the top causes of home insurance claims, and anything that increases the risk will be closely examined. If your peel-and-stick project doesn’t follow waterproofing standards—especially near showers or sinks—you could find yourself footing the bill for remediation. They may be convenient, but that convenience comes with fine print.

6. Flammable Wall Treatments

Certain decorative wall treatments, like fabric paneling, untreated reclaimed wood, or DIY wallpaper adhesives, can pose a fire risk. If these flammable materials contribute to the spread of a fire, an insurance adjuster may flag them as code violations. Even aesthetic choices can have big consequences when it comes to safety.

Most insurers expect fire-safe materials in wall finishes, especially in areas like kitchens or near fireplaces. Anything that increases the spread of flames could be used to deny a fire damage claim. When in doubt, choose fire-rated alternatives and double-check your local building codes.

7. Salvaged Fixtures with Outdated Wiring

Vintage lighting fixtures look stylish and unique, but they often come with outdated or frayed wiring. Installing them without rewiring can pose major safety issues. If a fire results, your insurance company might determine that the outdated fixture played a role—and deny the claim because it wasn’t up to modern standards.

Even something as simple as a table lamp or ceiling light should be evaluated for compliance. Old wiring can short out, overload circuits, or melt insulation. While the aesthetic is appealing, the risks are real. Have any salvaged item rewired by a professional before installing it at home.

8. Homemade Insulation Materials

Some DIYers try to get creative with insulation, using things like recycled denim, foam scraps, or natural fillers. While these might seem eco-friendly, they often lack fire resistance or moisture control. Using unapproved insulation materials can become a major issue during a home inspection—or after a fire or water claim.

Insurers expect materials with established safety ratings and performance data. Homemade solutions, no matter how clever, fall short of those benchmarks. If your insulation fails or contributes to property damage, that creative fix could result in claim denial or higher premiums.

9. Unrated Paint or Sealants

Using bargain paints or imported sealants without safety ratings might save a little money, but it could violate policy terms. Some of these products contain volatile organic compounds (VOCs) or flammable elements that don’t meet U.S. standards. If linked to damage or health concerns, your insurer may not cover the consequences.

Most policies assume that materials used in the home meet standard safety and environmental guidelines. That goes double for products used in enclosed spaces. It’s not just about looks—it’s about liability. Always check labels for safety certifications before applying anything in your living space.

10. Incompatible Flooring Adhesives

Flooring adhesives seem like a small detail, but using the wrong one can damage subfloors or void manufacturer warranties. If the adhesive causes long-term issues—like mold or structural damage—insurers may push back on covering the repairs. They’ll want to know if the installation followed industry guidelines.

Cheap or incompatible adhesives can also cause tiles or planks to shift, pop, or buckle. That could create trip hazards, property damage, or even injuries, all of which complicate claims. When DIYing flooring, always match the adhesive to both the flooring and subfloor types. It’s worth the extra few minutes of research.

11. Decorative But Non-Rated Fireplaces

Freestanding or wall-mounted fireplaces from online marketplaces can be tempting—but many aren’t rated for permanent home installation. If one causes smoke damage or fire, insurers may deny the claim if the unit wasn’t certified. Looks don’t equal legitimacy when it comes to fire safety.

Installation also matters. If vents are missing, clearances aren’t followed, or it’s placed on combustible flooring, you could end up voiding coverage. Before installing a fireplace, check for UL certification and review your policy. This is one area where cutting corners can truly burn you.

12. Faux Brick or Stone Veneer Panels

These panels are popular for creating accent walls, but not all are suitable for indoor use or high-heat areas. If a panel warps, melts, or contributes to smoke damage, insurers may trace the issue to inappropriate material use. They’ll want to know if the product was installed according to manufacturer instructions.

What seems like an easy upgrade can turn into an expensive problem if it affects drywall, wiring, or insulation. Use these veneers only where they’re meant to go—and make sure you’re not covering up something that needs ventilation or fireproofing. The risk isn’t worth the shortcut.

13. DIY Decking Materials Not Rated for Load

Building your own deck can save thousands, but using untreated wood or non-rated fasteners can lead to structural failure. If someone gets hurt or the deck collapses, your insurer may argue the materials were inadequate or improperly installed. That opens the door for claim denials or liability issues.

It’s not just about looks or even initial sturdiness—decks are weight-bearing structures, and every part needs to meet code. That includes beams, supports, fasteners, and surface boards. Before you start building, make sure everything you’re using has the right structural ratings. Your insurance coverage may depend on it.