The real estate world is undergoing a seismic shift, and tech startups are racing to automate everything they can. While some innovations make buying or selling a home easier, others threaten to upend the traditional role of realtors altogether. Many of these companies promise faster transactions, lower fees, and smarter pricing models—but not without controversy. As algorithms take over more of the decision-making, the human touch that once defined the process could become a rare luxury.

1. Opendoor

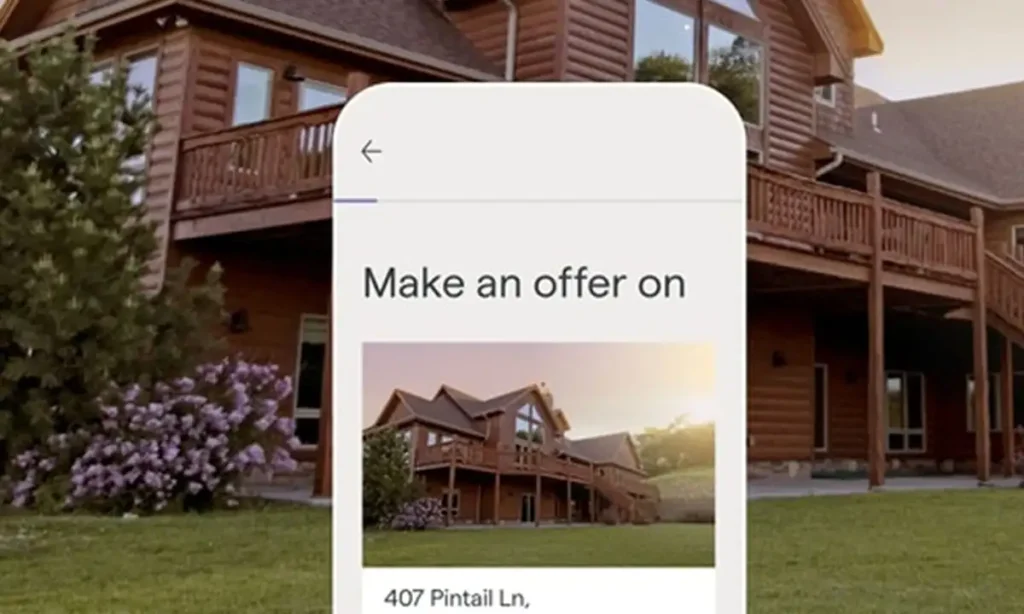

According to TechCrunch, Opendoor uses advanced algorithms to make instant offers on homes without traditional realtor involvement. Sellers input basic details, and the platform generates a price based on market data and predictive analytics. While this can speed up sales dramatically, critics argue it undervalues human expertise and local market knowledge. Homeowners are trading personalized guidance for streamlined convenience.

Opendoor promises simplicity, but it also removes negotiation from the equation. Realtors typically advocate for their clients’ best interests at every step. Without that layer of protection, sellers might leave money on the table. The platform’s success depends heavily on convincing consumers that speed outweighs everything else.

2. RedfinNow

RedfinNow, part of Redfin’s larger real estate ecosystem, uses proprietary algorithms to offer cash purchases on qualifying homes, reports Business Insider. Sellers bypass open houses and agent commissions but often accept lower offers in return for speed. Redfin’s automated valuation models analyze neighborhood trends, home features, and recent sales. The system’s accuracy is impressive but not immune to major market swings.

By eliminating traditional showings and negotiations, RedfinNow appeals to homeowners who prioritize convenience. However, the personal insight of a realtor can reveal hidden value that algorithms might miss. In competitive markets, nuances matter more than numbers. RedfinNow’s model bets that sellers will favor certainty over maximizing profits.

3. Zillow Offers

Zillow Offers, recently phased out but widely studied by CNBC and others, aimed to replace local realtors with a centralized algorithm-driven buying system. Sellers received near-instant offers based on Zillow’s internal pricing models, which sometimes wildly miscalculated home values. Although convenient, the system struggled with rapidly changing markets and unexpected repair costs. Zillow ultimately shuttered the program after significant financial losses.

Zillow Offers showed that even advanced algorithms can misfire badly. Real estate remains a highly local business with countless subtle variables. Realtors’ ability to adapt to real-time conditions proved hard to replicate. The experiment highlighted the limits of pure automation.

4. Knock

Knock’s Home Swap program, covered by HousingWire, uses algorithms to allow homeowners to buy a new property before selling their existing one. It pre-approves clients for new mortgages and guarantees home purchases, effectively streamlining two complex transactions into one. Knock’s system minimizes reliance on local agents by automating timelines and valuations. The startup claims to remove uncertainty, but critics say it creates a “one-size-fits-all” buying experience.

Homeownership journeys are rarely identical. Custom strategies, often crafted by experienced realtors, can make or break a deal. Knock’s model risks oversimplifying decisions that need careful consideration. Nevertheless, the lure of seamless transitions is powerful for many homeowners.

5. Homie

Homie offers flat-fee real estate services powered largely by AI-driven tools. Buyers and sellers can list, tour, and negotiate deals almost entirely through the platform. Realtors are available—but often play a secondary role behind automation. Homie markets itself as an antidote to expensive agent commissions.

The tradeoff is clear: personalized service versus low costs. Homie clients must navigate complex transactions with less hand-holding. For some, that independence feels empowering; for others, it adds stress. Real estate veterans warn that DIY selling can be a costly gamble.

6. Flyhomes

Flyhomes aims to turn buyers into cash buyers by using data and financing automation. Their platform makes rapid offers on behalf of clients, then refinances homes after purchase. Traditional realtors help with showings but operate within Flyhomes’ tightly controlled digital ecosystem. It’s part tech company, part brokerage.

Cash offers are powerful tools in competitive markets. However, reducing a complex emotional process to a few clicks has its downsides. Buyers may overlook risks that a dedicated agent would flag. Flyhomes banks on convenience outweighing caution.

7. Rex Real Estate

Rex Real Estate claims to undercut traditional commissions by relying on machine learning for marketing and matchmaking. Instead of listing homes on the MLS, Rex uses targeted online ads to find buyers. Human agents exist but play a background role. The company paints realtors as unnecessary middlemen.

Critics argue Rex’s model limits exposure and reduces negotiating power. Selling a home quietly through algorithms can backfire in slow markets. A good realtor knows how to create urgency and maximize offers. Rex gambles that sellers will accept less drama—and sometimes less profit.

8. Divvy Homes

Divvy Homes focuses on rent-to-own models powered by predictive analytics. Clients “rent” homes while building equity toward a future purchase, all facilitated by Divvy’s algorithms. Realtors are minimized or replaced by customer service teams. Divvy advertises a faster, more flexible path to ownership.

The model targets buyers who can’t yet qualify for traditional mortgages. While innovative, it introduces new risks around future valuations and maintenance responsibilities. Realtors often provide crucial advice on these issues. Divvy’s success hinges on users understanding—and accepting—those risks.

9. Reali

Reali offers a full-stack app where buyers and sellers complete nearly every step without a traditional agent. Pricing, bidding, and paperwork are algorithm-driven. Licensed real estate professionals are available but remain largely behind the scenes. The company bets that tech-savvy consumers will prefer digital over personal service.

Reali’s model appeals to first-time buyers comfortable with mobile-first experiences. However, major life investments often need human judgment. Experienced agents bring local knowledge that algorithms can miss. Going fully digital could leave critical blind spots.

10. Orchard

Orchard uses predictive analytics to offer “buy before you sell” options similar to Knock. Their model automates valuations and timelines while providing limited agent support. Sellers can upgrade homes and manage listings through a centralized dashboard. Human involvement is streamlined but not eliminated.

Clients appreciate controlling the pace of their move. Still, realtors often coordinate crucial logistics between buyers, sellers, and lenders. Orchard’s automation is impressive—but it can miss the subtleties that experienced agents handle instinctively. The loss of true personal advocacy is a real concern.

11. Ribbon

Ribbon converts buyer offers into cash offers using its financing platform, taking realtors largely out of the financial equation. Their algorithm-driven system evaluates risks and issues fast pre-approvals. Realtors still exist within Ribbon’s ecosystem but act more like transaction coordinators. Speed and certainty are the main selling points.

In hot markets, cash wins—but strategy matters too. A seasoned realtor can negotiate better contingencies or post-closing terms. Algorithms don’t always account for local customs or politics. Ribbon’s model works best when buyers understand what they’re gaining—and giving up.

12. Houwzer

Houwzer offers salaried agents supported by heavy automation to reduce commissions dramatically. Listings, showings, and offers are handled through a streamlined digital platform. Realtors focus narrowly on transactions rather than client relationships. The idea is to maximize efficiency through specialization.

While lower fees are attractive, losing personal rapport can feel transactional. Good agents often build trust that carries across multiple deals. Houwzer’s success depends on buyers and sellers prioritizing savings over service. It’s a model designed for volume, not boutique experiences.

13. Perch

Perch, now operating as Orchard in some markets, focused heavily on automating valuations and financing. Sellers could get instant offers or list homes through minimal-contact digital processes. Realtors played smaller roles than in traditional models, mostly for compliance and paperwork. The platform promised smoother, faster outcomes.

However, faster isn’t always better in complex markets. Pricing too low or missing repair issues can cost sellers dearly. Traditional agents often act as a safety net against costly mistakes. Perch’s streamlined vision proved that automation solves some problems—but not all.