Most homeowners think they know their neighborhood better than anyone—but real estate investors often have a completely different, behind-the-scenes perspective. Armed with data, experience, and long-term strategy, these pros pick up on trends and warning signs the average resident might never notice. From shifting school zones to zoning loopholes, investors are tracking subtle shifts that can affect home values for years to come. If you’ve ever wondered what they’re seeing that you’re not, this list may surprise you.

1. School Districts Can Shift—And That Changes Everything

One of the first things investors analyze is school district boundaries, because a highly rated school zone can significantly raise a property’s value. According to Zillow, homes in top-rated school districts often sell for up to 49% more than comparable homes outside those zones. But district lines can—and do—change, and investors pay close attention to proposed rezoning plans. They know a redrawn boundary can boost or tank property values overnight.

Homeowners may not notice until it’s too late, especially if they don’t have kids in school. Investors, on the other hand, often monitor local school board meetings and planning commission agendas. A change that shifts a neighborhood from a top school to a struggling one? That’s a huge red flag for long-term value.

2. Infrastructure Projects Signal Price Jumps

While most residents groan at construction, investors often see dollar signs. As Forbes has noted, infrastructure upgrades—like new highways, light rail lines, or even major utility projects—can spark real estate booms. These projects usually improve access, reduce congestion, or boost an area’s desirability. Investors track city council budgets and public works announcements for clues.

For homeowners, the noise and detours may be annoying, but investors know it’s temporary. They’re already calculating how improved roads or transit access could attract new buyers and raise rents. They’re often one step ahead, buying before the work is even halfway done. By the time you notice your commute has improved, they’ve already flipped a house.

3. Zoning Changes Are Goldmines

Investors know that zoning laws dictate a neighborhood’s future. According to The Wall Street Journal, savvy investors often pounce when single-family zones are upzoned to allow for multi-family or mixed-use development. These changes open the door to denser housing or even small businesses—massively increasing what a property is worth. But most homeowners don’t track their city’s zoning code or proposed updates.

Investors, though, are glued to city planning meetings and public notices. A quiet zoning change can unlock the ability to build duplexes, add accessory dwelling units (ADUs), or open a short-term rental. That’s serious profit potential—especially in areas facing housing shortages. By the time neighbors find out, the investor has already broken ground.

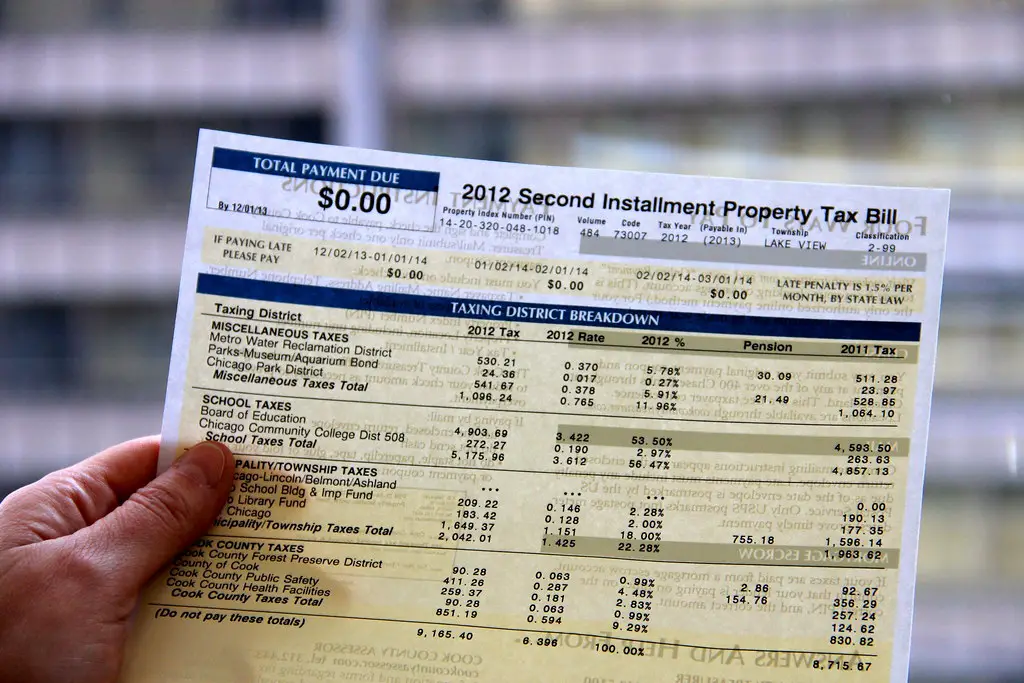

4. Property Tax Assessments Predict Who’s About to Sell

While most people only glance at their property tax bills, investors study assessment patterns like a roadmap. As noted by Realtor.com, rising tax assessments can signal economic shifts, gentrification, or upcoming turnover—especially among long-term owners. Investors often target these homeowners, knowing that many may feel pressure to sell before taxes rise further. It’s a quiet predictor of neighborhood change.

An elderly homeowner with a suddenly high tax burden might be ready to move. A cluster of higher assessments in one block could mean the area is “heating up” for investment. Investors are tracking trends, not just one-off spikes. It’s strategic—because timing a purchase just before a neighborhood turns over can lead to major returns.

5. HOA Minutes Reveal Brewing Trouble

Most people never read their homeowners’ association (HOA) minutes—until there’s a fine or a lawsuit. But investors often request these documents before buying, and for good reason. They reveal everything from budget shortfalls to neighbor disputes and major repair projects. If there’s dysfunction, investors may steer clear—or use it to negotiate a lower price.

They also use this intel to gauge how strict or flexible the HOA is. If rules are lax, it might be ideal for renting or flipping. If the board is overly aggressive, it could scare off future buyers. Investors treat HOA documents like a crystal ball for property value stability.

6. Parking Availability Can Make or Break Value

You might not think twice about where you park, but real estate investors definitely do. In urban neighborhoods, off-street parking—or even just easy curbside access—can add tens of thousands to a home’s value. Investors often drive the block at different times of day to gauge the reality. Is it a nightmare at night? That’s a red flag.

They also look for garages that could be converted into rentals or ADUs. And if city permits make that easy? Even better. They see parking not just as convenience, but as cash flow potential.

7. Local Ordinances Can Kill a Rental Plan

Many homeowners are shocked to learn their town has rules about how many unrelated people can live in one house, or how long a short-term rental can operate. Investors already know—and they read the fine print. They check for occupancy limits, permit caps, and rental moratoriums. What you think of as a perfect AirBnB location might be totally off-limits legally.

It’s not just about legality—it’s about profit margins. Investors don’t want fines, neighbor complaints, or forced shutdowns. They choose areas where regulations are stable or short-term rentals are encouraged. If your neighborhood has confusing or evolving rules, they’ll either avoid it—or plan accordingly.

8. Crime Data Tells a Deeper Story

You might think your neighborhood feels safe, but investors don’t rely on vibes. They dig into detailed crime maps, looking at trends over time—not just raw numbers. A slight uptick in car break-ins or package thefts might be a passing trend to you, but to them, it signals instability. They also check what type of crime is increasing and how local police are responding.

Investors also watch how crime rates correlate with price changes. In some cases, increased patrols or neighborhood watches can reverse a dip in value. In others, it’s the start of a decline. They aren’t guessing—they’re using hard data to predict what comes next.

9. Nearby Vacant Land Means Development Is Coming

Empty lots or neglected commercial buildings don’t scare investors—they intrigue them. That land could soon become a shopping center, apartment complex, or transit hub. Investors dig into who owns the lot, what it’s zoned for, and whether any permits have been pulled. For them, the “ugly” part of your neighborhood is often the most valuable.

Even if construction hasn’t started, rumors and filings often surface months before a project is public. Investors keep close ties with developers, architects, and real estate agents for early info. They buy nearby while prices are low and sell high once the new project breaks ground. It’s a long game—and most homeowners aren’t even in the loop.

10. Rent Growth Can Reveal a Coming Price Surge

Rents often rise before home values do, making them an early indicator of a hot market. Investors track rental listings, median price shifts, and how long units sit vacant. If rents are climbing fast but home prices are lagging, that’s a prime buying window. Homeowners might not notice—especially if they’re not renting out their property.

It’s all about leverage: higher rent potential can support higher mortgage payments and boost investor ROI. It also signals demand from young professionals, remote workers, or new residents. The sooner they move in, the more equity they build. It’s a clear sign a neighborhood is on the rise.

11. Businesses Moving In (or Out) Tell the Real Story

Investors watch local businesses like tea leaves. A new Trader Joe’s or Starbucks opening nearby? That’s often a sign of rising income levels and buyer demand. On the flip side, when anchor stores or long-time favorites close, it can hint at declining foot traffic or shifting demographics.

They also track what kinds of businesses are arriving. Are there coworking spaces and boutique gyms? Or are payday lenders and storage facilities taking over? The answers tell investors everything about where the neighborhood is headed.

12. Owner-Occupancy Rates Matter More Than You Think

The percentage of people who actually live in the homes they own tells investors a lot. High owner-occupancy usually means more neighborhood pride, better upkeep, and fewer tenant turnover issues. Investors love stable communities—but they also know when a neighborhood is tipping toward absentee landlords. That could spell trouble for long-term value.

They use public records and census data to see who’s really living there. A sudden drop in owner-occupancy? That’s often a sign of economic pressure or investor saturation. Either way, they adjust their plans accordingly.

13. The Condition of Neighboring Homes Affects Your Bottom Line

Curb appeal isn’t just about your own house—your neighbors’ properties matter too. Investors drive around and take notes on roof condition, landscaping, and paint quality. If half the homes nearby look neglected, they know it’ll drag down appraisals and scare off future buyers. It’s not personal—it’s math.

They’re also watching for signs of illegal rentals or unpermitted renovations. One bad property can ripple out and affect everyone’s value. While most homeowners are just trying to get by, investors are calculating the long-term implications. And sometimes, they’ll pass on a house just because the one next door looks like trouble.