1. California

California’s escalating wildfire risks are causing major disruptions in the state’s home insurance market, with premiums skyrocketing as insurers attempt to offset the growing risks. As wildfires become more frequent and intense, some insurance providers have even exited the market, leaving homeowners with fewer options. In fire-prone regions, residents are facing substantial rate hikes or being dropped entirely by their insurers.

The Los Angeles Times reports that even properties that are not directly in high-risk zones are feeling the impact, as insurers adjust their pricing to cover potential future claims. This issue has sparked debates on how best to balance affordable coverage with the reality of increased natural disasters. For more insights into California’s insurance challenges, visit The Los Angeles Times. With the rise in wildfire threats, home insurance premiums in the Golden State show no signs of slowing down.

2. Florida

Florida’s home insurance market has been deeply impacted by frequent hurricanes and the rising threat of sea-level rise. Homeowners are seeing their premiums soar, with some facing increases of up to double the previous rates, as reported by the Sun Sentinel. The state’s vulnerability to severe storms, coupled with insurance companies pulling out due to financial instability, is making it difficult for residents to secure affordable coverage.

Many Florida homeowners now find themselves with limited insurance options, while others are facing exorbitant premiums for basic coverage. Flood damage, particularly in coastal areas, is driving up the cost of policies, and comprehensive flood coverage is becoming increasingly unaffordable. For more details on the situation in Florida, visit The Sun Sentinel. As the risk of hurricanes and flooding intensifies, Florida’s insurance market continues to evolve.

3. Texas

Texas has become one of the most expensive states for home insurance due to the wide array of risks homeowners face, from hailstorms to hurricanes. According to Texas Monthly, the state has seen a sharp increase in premiums as severe weather events become more frequent and intense. Insurance providers are adjusting their rates in response to the increasing damage caused by these extreme weather conditions, leading to higher costs for homeowners.

Additionally, the large size and geographical diversity of Texas create different levels of risk, with some areas seeing significantly higher rates than others. The increased frequency of severe storms in the state is making it harder for residents to find affordable coverage, particularly in areas prone to flooding or hail damage. For further information on insurance rates in Texas, visit Texas Monthly. Homeowners across the state are feeling the financial strain as insurance premiums continue to rise.

4. Louisiana

Louisiana’s home insurance market has been significantly affected by the aftermath of devastating hurricanes, with many insurers raising premiums or ceasing to issue new policies altogether. As NOLA.com explains, the state’s vulnerability to powerful storms and flooding has led to a financial strain on insurance companies, forcing them to adapt by increasing rates. Homeowners in high-risk areas, particularly those near the coast, are experiencing the most severe hikes.

In some cases, property owners are left with little choice but to seek coverage from state-backed insurers, which often come with higher premiums. The combination of climate change and rising risks has created a tough environment for homeowners in Louisiana, who face rising costs and fewer options for reliable coverage. For more details on Louisiana’s insurance challenges, visit NOLA.com. The state’s reliance on both public and private insurers continues to complicate the home insurance landscape.

5. Colorado

Colorado’s increasing wildfire activity has prompted a surge in home insurance premiums across the state. As the Denver Post reports, areas near forests and grasslands are experiencing particularly high rates as insurers factor in the growing risk of wildfires. In some regions, insurance companies have started to demand proof of wildfire mitigation efforts, such as fire-resistant roofing or defensible space around homes, before issuing policies.

Homeowners in these areas are facing steeper premiums, with some residents struggling to find affordable coverage due to the increasing frequency of fires. Colorado’s changing climate and the higher probability of wildfires are influencing insurance policies in the state, making it more difficult for residents to maintain coverage at a reasonable cost. For further insights on this trend, visit The Denver Post. The rising threat of wildfires is undoubtedly reshaping the insurance landscape in Colorado.

6. New York

In coastal areas of New York, the combined risks of storm surges and flooding have led to significant increases in home insurance premiums. According to the New York Insurance Journal, properties in flood-prone zones are especially affected, with premiums for policies that cover flood damage becoming increasingly costly. The state’s vulnerability to hurricanes and heavy rainfalls, which contribute to storm surges, is making it difficult for homeowners to secure affordable coverage.

Flood insurance policies, which are often required by lenders, are seeing premium hikes, while insurers in high-risk areas are reducing coverage options. As the effects of climate change continue to exacerbate flood risks, residents are feeling the financial strain of maintaining adequate protection. For more on New York’s insurance market, visit New York Insurance Journal. As the storm surge risks escalate, the cost of insurance continues to climb.

7. Nevada

Rising temperatures and prolonged droughts are driving up home insurance premiums in Nevada, as the state faces increasing risks of wildfires and extreme heat. The Las Vegas Review-Journal highlights how homes located in fire-prone regions are seeing particularly steep price increases, as insurers adjust their rates to account for the growing threat of wildfires.

With Nevada’s ongoing drought conditions, insurers are taking into consideration the risk of water shortages and the likelihood of fires when calculating premiums. The harsh environmental conditions are making it more difficult for homeowners to secure affordable coverage, as insurance companies become more cautious about issuing policies in high-risk areas. For more information on Nevada’s insurance challenges, visit Las Vegas Review-Journal. As the state grapples with climate-related challenges, home insurance premiums continue to rise.

8. Oregon

Oregon’s increasing wildfire seasons have led to significant hikes in home insurance costs, particularly in rural and forested areas. As noted by OregonLive, residents living in fire-prone regions are seeing their premiums rise sharply due to the growing frequency and severity of wildfires. Insurers are also requiring homeowners to take additional preventive measures, such as creating defensible space around their properties, in order to reduce the risk of fire damage.

Homeowners without wildfire mitigation measures may find it increasingly difficult to secure affordable insurance, as the cost of coverage continues to rise. The economic strain of higher insurance premiums is making it challenging for residents to stay protected against wildfires. For more on Oregon’s insurance market, visit OregonLive. Wildfire risks are increasingly shaping the insurance landscape in Oregon, leading to financial difficulties for residents.

9. Alabama

Alabama’s vulnerability to hurricanes and tornadoes has made it a high-risk state for home insurance, leading to significant premium increases. Coastal areas, in particular, are experiencing sharp hikes, as insurers account for the damage caused by these powerful storms. AL.com explains that the rising cost of coverage is making it harder for homeowners to secure adequate protection, especially in low-lying or high-risk zones. With extreme weather events becoming more frequent, insurers are adopting stricter underwriting guidelines, leaving many homeowners with limited options.

The financial burden of higher premiums is further compounded by the cost of meeting mitigation requirements, such as storm shutters or reinforced roofing. For more details on Alabama’s insurance challenges, visit AL.com. As severe weather risks grow, homeowners in Alabama face mounting costs to stay protected.

10. Mississippi

Coastal Mississippi is grappling with rising home insurance premiums due to the escalating risks of hurricanes and flooding. Homeowners in vulnerable areas are seeing significant rate increases, as insurers factor in the potential for catastrophic storm damage. According to the Mississippi Insurance Journal, some residents are finding it increasingly difficult to maintain coverage, with premiums climbing year after year.

In addition to higher costs, many insurers are tightening their policy terms, limiting coverage for storm-related damages. Coastal properties, particularly those near the Gulf of Mexico, face the steepest increases as rising sea levels exacerbate flooding risks. For more on Mississippi’s insurance market, visit Mississippi Insurance Journal. The challenges in securing affordable coverage highlight the growing impact of climate change on the state’s housing market.

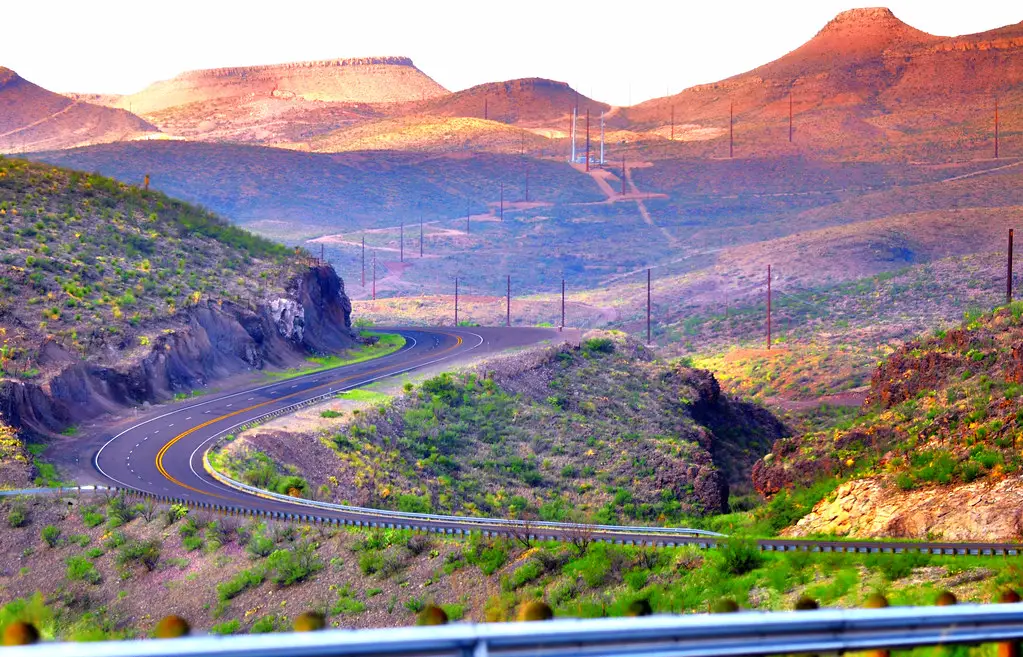

11. Arizona

Arizona’s prolonged droughts and extreme heat are driving up home insurance premiums across the state, creating financial challenges for homeowners. As AZCentral reports, these environmental changes are increasing the risk of wildfires, which insurers consider a significant factor when determining rates. Properties near arid landscapes or wildfire-prone areas face some of the steepest premium hikes, as insurers look to mitigate potential losses.

In addition, the rising costs of water scarcity and infrastructure strain are influencing insurance pricing in Arizona. Homeowners in high-risk zones are also finding that insurers are requiring more stringent mitigation measures, such as fire-resistant materials and defensible landscaping, to maintain coverage. For more on Arizona’s growing insurance challenges, visit AZCentral. The state’s environmental conditions are reshaping the home insurance market, pushing costs higher for residents.

12. South Carolina

South Carolina’s increased hurricane activity is causing a surge in home insurance premiums, particularly for properties in coastal regions. Homeowners in areas like Charleston and Myrtle Beach are facing steep rate hikes as insurers adjust their pricing to account for storm-related risks. The State explains that these increases are driven by the growing frequency and severity of hurricanes, as well as rising sea levels that threaten low-lying communities.

Comprehensive coverage, which includes flood insurance, is becoming especially costly, leaving some homeowners struggling to afford adequate protection. Insurers are also implementing stricter guidelines for homes in high-risk zones, requiring storm shutters and elevated foundations as part of their underwriting criteria. For more insights into South Carolina’s insurance market, visit The State. Rising costs highlight the challenges coastal communities face in maintaining affordable home insurance.

13. Georgia

In Georgia, the combination of hurricanes, tornadoes, and flooding is driving up home insurance premiums, especially in coastal and low-lying areas. The Atlanta Journal-Constitution highlights that unpredictable weather patterns have made it more challenging for insurers to accurately assess risks, leading to higher rates for homeowners. Coastal regions, such as Savannah and Brunswick, are particularly affected by rising premiums, as insurers factor in the growing likelihood of storm damage.

Additionally, inland areas prone to flash flooding are also seeing increases in rates, reflecting the state’s diverse weather risks. Homeowners in high-risk zones may face higher deductibles or limited policy options, further compounding the financial strain. For more on Georgia’s insurance challenges, visit The Atlanta Journal-Constitution. The rising cost of insurance underscores the impact of climate-related risks on Georgia’s housing market.

14. Tennessee

Tennessee is experiencing higher home insurance premiums due to the increasing frequency of severe storms, tornadoes, and flooding. The Tennessean reports that unpredictable weather patterns are making it harder for insurers to assess risks, leading to more cautious underwriting and higher rates. Homeowners in flood-prone areas, particularly along the Tennessee River, are facing some of the steepest increases in premiums.

In addition, insurers are requiring homeowners to take preventive measures, such as installing stormproof windows or elevating HVAC systems, to qualify for coverage. The rising costs are putting financial pressure on residents, especially in areas frequently impacted by extreme weather. For more on Tennessee’s rising premiums, visit The Tennessean. As weather risks continue to grow, homeowners in Tennessee are finding it increasingly difficult to secure affordable and comprehensive coverage.