1. Property Taxes

Property taxes are one of the most significant ongoing costs of homeownership, but they often come as an unwelcome surprise. Homeowners may not fully account for how much these taxes will increase each year, especially as property values rise. In many areas, property taxes are assessed based on the value of your home, so as home prices increase, so does your tax bill.

According to Zillow, property taxes can vary widely depending on the location, with some states having significantly higher taxes than others. It’s important to research property tax rates in the area before purchasing a home, as these costs can add up to thousands of dollars annually. Buyers should also factor in the possibility of tax reassessments, which can raise your property tax bills unexpectedly.

2. Homeowners Insurance

Homeowners insurance is essential for protecting your property, but the cost of insurance premiums can vary depending on several factors, including the location of your home, the value of the property, and the coverage you choose. In some cases, homeowners may not budget adequately for insurance premiums, which can add up to a significant annual cost.

As reported by The Balance, premiums can rise due to natural disasters in your area or changes in local building codes. Additional coverage for specific risks, such as flood or earthquake insurance, can further increase your premium. Homeowners should shop around for quotes and carefully assess their insurance needs to avoid overpaying for unnecessary coverage.

3. Home Maintenance and Repairs

While buying a home is an exciting milestone, it comes with the ongoing responsibility of maintaining and repairing the property. From roof repairs to plumbing issues, these costs can add up quickly and often come at the most inconvenient times. Many homeowners don’t anticipate the high cost of upkeep, especially in older homes where repairs tend to be more frequent and expensive.

According to HouseLogic, experts recommend budgeting 1% to 4% of your home’s value each year for maintenance and repairs. For example, if your home is worth $250,000, you should expect to spend between $2,500 and $10,000 annually on upkeep. Setting aside an emergency fund for repairs and conducting regular home inspections can help mitigate these hidden costs.

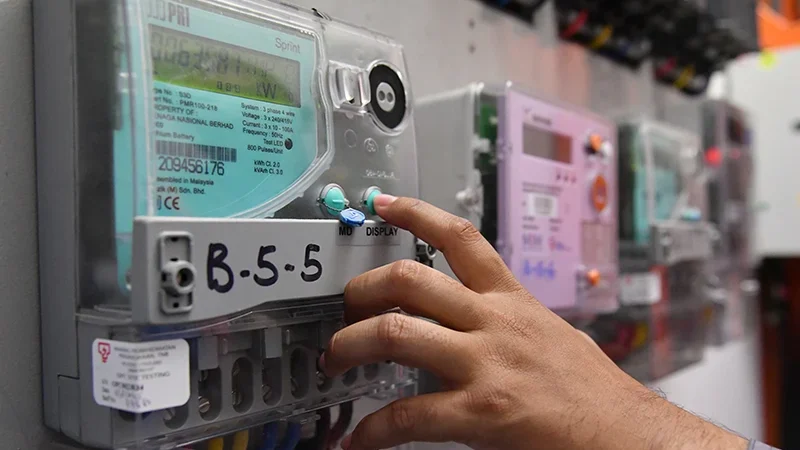

4. Utilities

When renting, utility costs are often included in the rent or at least capped, but as a homeowner, you’ll be responsible for the full cost of utilities, including water, electricity, gas, trash removal, and even sewage. These costs can fluctuate significantly depending on the size of your home, your location, and your usage patterns. Many new homeowners are shocked by how much utilities can add to their monthly expenses.

As noted by Energy Star, the average American household spends over $2,000 annually on energy bills. Factors such as heating and cooling systems, insulation, and the number of electrical appliances in your home can all affect your utility costs. To reduce these expenses, homeowners should consider energy-efficient appliances, better insulation, and mindful energy usage.

5. Landscaping and Lawn Care

Landscaping is an often-overlooked cost of homeownership. Whether you’re maintaining a lawn or installing more elaborate garden features, these expenses can add up. Lawn care services, tree trimming, and garden maintenance can cost hundreds to thousands of dollars each year, depending on the size of your yard and the complexity of your landscaping.

According to HomeAdvisor, the national average for landscaping services is around $300 to $500 annually, with larger projects or ongoing care requiring more substantial investment. If you prefer to tackle landscaping yourself, tools, seeds, fertilizers, and water usage can still result in high costs. Homeowners should be prepared for regular maintenance and budget accordingly, especially if they plan to add significant landscaping features to their yard.

6. Pest Control

Many homeowners don’t realize the ongoing costs associated with pest control. While it’s common to hire a pest control company when you first notice a problem, regular maintenance to keep pests at bay can add up. Whether it’s termites, rodents, or ants, pest control services are an ongoing expense that can increase depending on the severity of the problem and the size of your home.

As reported by Orkin, pest control can cost between $300 and $1,000 per year depending on your area and the services you require. Regular inspections, treatments, and preventative measures can help, but many homeowners overlook the ongoing costs of keeping their property pest-free. Setting aside a portion of your home maintenance budget for pest control can help manage this hidden cost.

7. HOA Fees

Homeowners associations (HOAs) are common in many neighborhoods, and while they help maintain the community and offer amenities, they come with fees. These fees can range from a small monthly charge to hundreds of dollars per month, depending on the location and the services provided. Many homeowners don’t account for HOA fees when purchasing a home, leading to financial strain once they move in.

According to The Balance, HOA fees typically cover services like lawn care, trash removal, street cleaning, and sometimes even amenities like swimming pools or fitness centers. However, these fees can increase over time, especially if the HOA needs to fund improvements or cover rising maintenance costs. Homebuyers should thoroughly review the HOA’s fee structure and budget accordingly to avoid surprises.

8. Closing Costs

Many first-time homebuyers underestimate the significant closing costs involved in purchasing a property. These costs, which can include loan origination fees, title insurance, and inspection fees, can add up to 2% to 5% of the home’s purchase price. For example, on a $300,000 home, closing costs could range from $6,000 to $15,000.

As noted by Bankrate, while some closing costs can be negotiated, others are non-negotiable, and they must be paid upfront. It’s essential for buyers to budget for these expenses and understand what’s included in the closing cost estimate to avoid any last-minute surprises.

9. Homeowners Association Special Assessments

In addition to regular HOA fees, some homeowners are blindsided by special assessments. These are one-time charges that are imposed by the HOA to cover large-scale projects or unexpected costs, such as repairs to common areas, infrastructure improvements, or emergency maintenance. Special assessments can range from a few hundred dollars to thousands of dollars, depending on the scope of the project.

According to Nolo, homeowners associations are allowed to impose these assessments without a vote from homeowners in many cases, which can leave residents facing unexpected costs. Homebuyers should inquire about the likelihood of special assessments when considering a property, as they can significantly impact your financial plans.

10. Upgrades and Renovations

Once you own a home, you may realize that certain features need updating or improving. Whether it’s upgrading outdated appliances, remodeling a bathroom, or finishing a basement, home upgrades and renovations can quickly become expensive. While these improvements can increase the value of your home, they also represent a significant investment, often requiring financing, permits, and contractors.

According to HomeAdvisor, the national average cost of home renovations is about $20,000. Larger projects like kitchen renovations or room additions can cost significantly more. Homeowners should budget for potential renovations when purchasing a home, especially if they plan to update the property over time.

11. Appliance Replacements

While appliances like refrigerators, dishwashers, and water heaters are essential to modern living, they don’t last forever. Over the course of owning a home, you will likely need to replace these appliances at least once. High-end appliances can cost thousands of dollars to replace, and many homeowners don’t anticipate these costs when budgeting for homeownership.

As noted by Consumer Reports, appliance replacements can range from a few hundred dollars for small appliances to several thousand dollars for larger ones like refrigerators or HVAC systems. Homeowners should consider setting aside an appliance replacement fund to cover these costs as part of their long-term homeownership plan.

12. Utility Upgrades and Infrastructure Repair

Utility systems like plumbing, electrical, and HVAC can fail unexpectedly, especially in older homes. The costs to repair or replace these systems can be significant, often running into thousands of dollars. While basic home inspections can identify issues before purchasing, there may still be hidden problems that arise after you move in.

According to The Home Depot, replacing old pipes, updating electrical systems, or installing a new HVAC unit can cost anywhere from $1,000 to $5,000 or more. Setting aside a portion of your home maintenance fund for unexpected infrastructure repairs can help alleviate financial stress when these issues inevitably arise.