If your monthly expenses feel like they’re always creeping higher, you’re not alone—but you’re also not powerless. Small, sustainable shifts in how you live can quietly chip away at your bills without much effort. From how you cook to how you wash your clothes, little decisions add up to big savings over time. The key is to focus on consistency and efficiency, rather than drastic lifestyle overhauls.

1. Line Dry Your Clothes

According to the U.S. Department of Energy, dryers are among the top energy-consuming appliances in most homes. Opting to air-dry your laundry—either outside or on an indoor drying rack—can noticeably lower your electricity bill. It also extends the life of your clothes, saving you money on replacements. While it takes more time, the long-term payoff is worth it.

It’s a great solution for warm months, especially if you live in a sunny area. Even partial drying on a line before tossing clothes into the dryer can make a difference. Plus, you skip the wear-and-tear caused by high heat. A simple clothesline or foldable rack is a small investment that can start paying you back right away.

2. Use a Programmable Thermostat

As noted by Energy Star, using a programmable thermostat can save homeowners up to $180 a year on heating and cooling. These devices let you automatically adjust the temperature based on when you’re home or asleep. By minimizing energy use during off-peak hours, you avoid heating or cooling an empty house. It’s a hands-off way to slash utility bills month after month.

You can set different temperatures for weekdays and weekends, or even specific times of day. Some smart thermostats also learn your habits and adjust accordingly. That extra level of automation helps you save without sacrificing comfort. Over time, the device pays for itself—and then some.

3. Cook at Home More Often

According to Forbes, cooking at home can save you over $200 per month compared to dining out or ordering takeout. Preparing meals in your kitchen is one of the most effective ways to control both spending and portion sizes. Planning your meals ahead of time and grocery shopping accordingly reduces impulse buys. Even simple meals like pasta or stir-fry can help you avoid overpriced convenience food.

Start small by designating a few “cook-in” nights each week. Use leftovers creatively to reduce waste and maximize what you already have. You don’t need to be a gourmet chef—just a bit of prep can go a long way. Over time, it becomes a habit that keeps both your wallet and waistline in better shape.

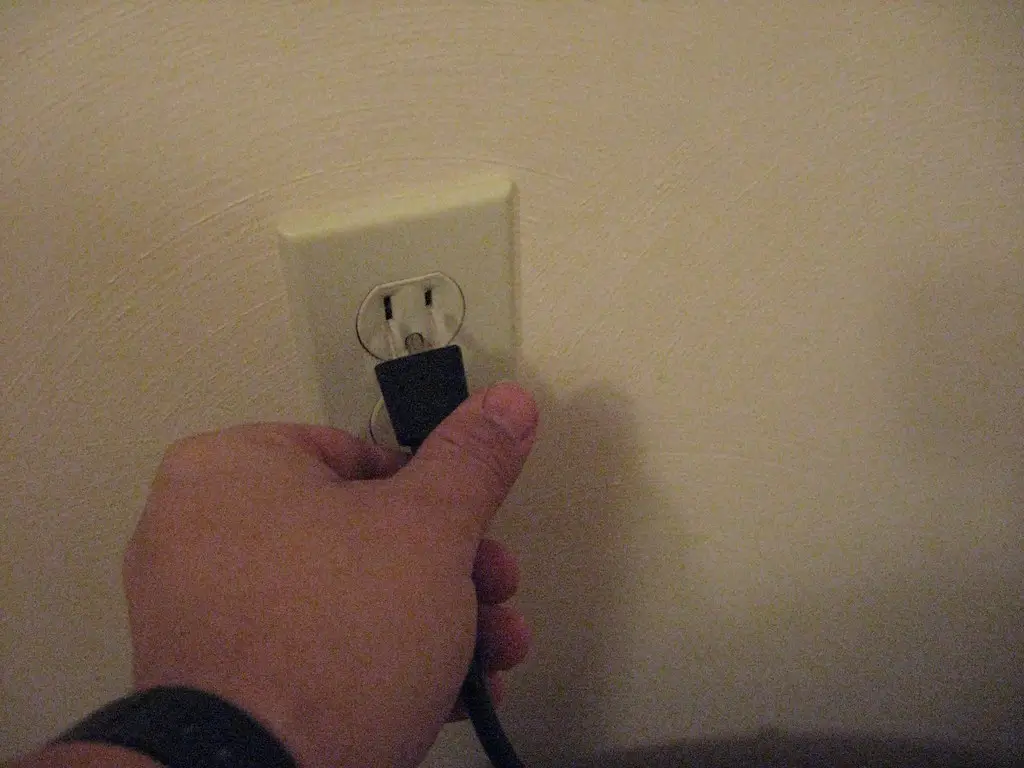

4. Unplug Idle Electronics

Good Housekeeping reports that electronics left plugged in—even when turned off—can account for up to 10% of your energy bill. Known as “phantom load” or “vampire power,” this hidden consumption adds up over time. Unplugging devices or using smart power strips can eliminate this waste. It’s one of the easiest changes you can make with virtually no downside.

Think TVs, coffee makers, chargers, and game consoles. If you’re not using them, they don’t need to be drawing power. Setting up a routine where you unplug or switch off unused items can quickly become second nature. Over the course of a year, the savings quietly pile up.

5. Switch to LED Bulbs

LED light bulbs use at least 75% less energy than traditional incandescent bulbs. They also last significantly longer, which means fewer replacements and more long-term savings. While they may cost more upfront, the investment pays for itself quickly. You’ll notice a smaller electricity bill without changing your lighting habits at all.

They’re available in every size and color tone you could want, making the transition seamless. Many utility companies even offer rebates or free kits to encourage the switch. If you haven’t already, start by replacing your most-used lights. Once you make the swap, you’ll wonder why you waited so long.

6. Use Reusable Water Bottles

Bottled water is a small daily expense that adds up fast. Switching to a reusable bottle and a water filter can save hundreds per year. Plus, it’s more environmentally friendly and often more convenient. One-time purchases like a quality water bottle and a basic filter can lead to long-term savings.

You also avoid the hassle of hauling bottled water from the store. With filtered tap water, you always have a clean, cold drink ready to go. Keep a bottle in your car, bag, or at work to cut the temptation of buying drinks. It’s a small shift that quickly pays off.

7. Cancel Unused Subscriptions

Many people pay for digital subscriptions they’ve forgotten they even signed up for. Streaming services, apps, fitness platforms, and meal kits can all quietly drain your bank account. Reviewing your bank statements once a month helps you spot and cancel the ones you don’t use. Over time, trimming the fat saves real money.

You can also consider rotating subscriptions—keep only one or two active at a time and pause the rest. Some services even allow you to freeze your account without losing your history. Apps like Truebill or Rocket Money can help manage this for you. Keeping a lean subscription list is one of the smartest financial habits around.

8. Grocery Shop with a List

Impulse purchases can quickly blow up your grocery bill. Creating a list and sticking to it helps you avoid overspending and wasted food. Plan your meals in advance and shop with purpose. You’ll spend less time wandering the aisles and more time getting what you actually need.

A detailed list also cuts down on repeat trips, which can lead to more unnecessary buys. Try organizing it by category—produce, dairy, pantry, etc.—for a smoother experience. Over time, this becomes a routine that saves time and money. It’s low effort, high reward.

9. Wash Clothes in Cold Water

Washing clothes in cold water uses significantly less energy than hot or warm cycles. Modern detergents are formulated to work just as well in lower temps. Not only do you save on utilities, but your clothes also last longer. Fabrics shrink and fade less, which means fewer replacements.

Unless you’re dealing with oily stains or heavily soiled items, cold water usually does the job. Some washing machines even default to cold now for efficiency. Making this switch costs you nothing but pays you back every month. It’s one of the easiest lifestyle upgrades out there.

10. Automate Bill Payments

Late fees are a completely avoidable expense. Setting up autopay ensures you never miss a due date, keeping your credit score and finances in check. Many companies also offer small discounts for using automatic payments. It’s a quick setup that offers long-term benefits.

You can still review statements each month to catch errors—just without the pressure of remembering every due date. Autopay also simplifies your monthly routine. Less stress, more savings. That’s a win-win.

11. Use a Slow Cooker

A slow cooker allows you to make large, budget-friendly meals with minimal effort. Ingredients like beans, root vegetables, and cheaper cuts of meat become delicious when cooked low and slow. Batch-cooking also reduces your reliance on takeout and frozen meals. You can prep in the morning and enjoy a ready-to-eat dinner by evening.

One-pot meals also mean fewer dishes to wash, saving on both water and time. Leftovers can stretch into lunches or even another dinner. It’s a great tool for busy households looking to save money without sacrificing quality. Plus, it makes your home smell amazing.

12. Carpool or Combine Errands

Driving less can save you a surprising amount of money on gas, maintenance, and even insurance. Coordinating carpools for work or school reduces wear and tear on your vehicle. Planning your errands in one trip instead of many also keeps you out of traffic and out of the gas station. It’s about making your time and fuel work harder for you.

Apps and community boards make organizing carpools easier than ever. You’ll also enjoy more time to yourself when you’re not constantly behind the wheel. Over the course of a month, this habit can free up both cash and hours. Smart planning makes a big difference.

13. DIY Basic Home Repairs

Learning to fix minor things around the house—like leaky faucets or squeaky doors—can prevent bigger, costlier problems. YouTube is full of tutorials for basic repairs that don’t require special tools. Avoiding service fees or emergency calls saves a bundle. With a few tools and a little confidence, you’re good to go.

Start with something simple, like replacing a light fixture or unclogging a drain. As your skills grow, so will your savings. You also gain a sense of independence and ownership. It’s empowering, cost-effective, and genuinely useful.

14. Borrow Instead of Buy

From power tools to party supplies, borrowing items you rarely use makes far more sense than purchasing. Neighbors, friends, or even local libraries often have what you need. This strategy avoids clutter and stretches your dollars. Plus, you’re building a network of shared resources.

Apps and online groups make lending and borrowing easier than ever. Nextdoor, Facebook Marketplace, and community bulletin boards are all great starting points. You help each other out—and spend far less doing it. Smart homeowners know when to borrow, not buy.

15. Lower the Temp on Your Water Heater

Most water heaters are set higher than necessary by default—often at 140°F. Lowering the temp to 120°F can reduce water heating costs by up to 10%. The water is still hot enough for showers and cleaning, but you’ll save on energy every day. It’s a change you’ll barely notice—except in your utility bill.

You can adjust the thermostat on most units with a simple turn of a dial. For added savings, insulate the heater and surrounding pipes. These small tweaks add up over time. Your water stays hot, and your wallet stays happier.