With property taxes on the rise and square footage often used as the basis for assessments, homeowners across the country are getting creative—some might even say extreme. From sawing off staircases to turning garages into loopholes, Americans are finding unusual ways to cut down their home size without sacrificing their lifestyle. These methods range from thrifty to downright bizarre, but they all share one goal: staying ahead of the taxman. Here are 14 strange ways people are shrinking their homes in the name of tax savings.

1. Removing Second Floors

In rural pockets of the Midwest, some homeowners have literally taken off the second story of their homes. The Money Pit reported on families who chose to deconstruct their upper levels to reduce assessed value. By turning their homes into sprawling ranch-style structures, they maintain livable square footage while eliminating taxable vertical space. It’s a drastic move, but it can lead to big tax breaks.

The process involves more than just demolition—it’s a complete restructuring of how space is used. Homeowners repurpose attics or expand basements to reclaim the lost function. In many towns, this tactic lowers the property’s perceived value on tax rolls. It’s an extreme version of downsizing that plays by the local rules.

2. Building Underground Additions

To avoid increasing visible square footage, some homeowners are digging—literally. Houzz highlighted several interesting ways to add rooms underground, invisible to property assessors. These spaces often go uncounted in official tax calculations, especially in areas where basements are considered non-livable. It’s a clever workaround that’s gaining traction in states with harsh winters.

These underground rooms become offices, playrooms, or even hidden guest suites. With good insulation and lighting, they’re surprisingly comfortable. Plus, they escape the scrutiny of drone inspections or drive-by assessors. When taxes are tied to what’s seen, going subterranean pays off.

3. Converting Main Homes Into Multiple Micro Units

Instead of owning one big home, some Americans are legally converting them into a cluster of micro-units. The Seattle Times has written about homeowners who split their houses into four or five self-contained spaces, each under local tax thresholds. They then live in one and rent out the others—often all while paying less in taxes than before. It’s a paperwork-heavy strategy, but one that pays off with the right permits.

Each micro-unit often falls under lower square footage limits, giving the owner more flexibility. Plus, cities with ADU-friendly laws make the process easier. While zoning regulations can be a hurdle, savvy homeowners work within the system. The result is a home that earns income while costing less to own.

4. Turning Living Space Into Storage

In tax-heavy zones like New Jersey, some owners are transforming formal living areas into designated storage rooms. American Property Tax Counsel explains how certain counties assess storage space at a lower tax rate than living space. By removing HVAC systems, outlets, and even drywall, a room’s designation can legally change. It’s a strange but strategic downgrade.

These rooms often still serve practical purposes—seasonal storage, hobby stations, or oversized closets. But on paper, they don’t count the same way. Local tax codes don’t always keep up with how people use space. So if your “storage” room just happens to have a recliner and a TV, that’s your business.

5. Replacing Rooms With Movable Structures

Instead of building permanent additions, homeowners are increasingly opting for yurt-style structures or tiny homes on wheels. These setups can be parked on the property without affecting the home’s tax-assessed square footage. Because they’re technically not attached, they skirt the building codes that increase taxes. They also offer a flexible way to expand living space.

These units often house guests or serve as home offices. Some owners even move into them full-time, using the main house as a shared family asset. As long as the structure stays mobile, it typically avoids triggering new assessments. It’s a minimalist solution with a major upside.

6. Carving Out Hallways and Closets

One of the more surprising trends involves taking out closets and interior hallways to reduce living square footage. Some counties don’t count certain transitional spaces if they don’t meet minimum dimensions. By shrinking or removing them altogether, homeowners reduce their taxable space without affecting main living areas. It’s a subtle change with real benefits.

These modifications often go unnoticed by visitors. But on paper, the difference can knock a property into a lower tax bracket. Every square foot matters when taxes are calculated by the inch. And in this case, less really is more.

7. Moving Bathrooms Outdoors

In southern states with mild climates, some homeowners are removing half baths or even full bathrooms and relocating them to backyard structures. By moving plumbing off the main house, they decrease the home’s official square footage. The new outdoor setups are often built like spa retreats, with composting toilets and solar showers. They’re stylish—and tax-savvy.

Of course, these setups aren’t for everyone. But for those willing to embrace outdoor living, it’s a functional and fun alternative. And the lower property tax bill is an extra reward. For some, it’s worth the weather gamble.

8. Floating Stairs Instead of Enclosed Ones

Enclosed staircases are often counted as part of a home’s usable space. So some homeowners are replacing them with open, floating stairs to make that space technically “non-habitable.” While not every jurisdiction agrees on the definitions, enough do to make this strategy worthwhile. It’s modern, minimalist, and just a little rebellious.

Floating stairs create the illusion of openness while giving back a few precious square feet. They also add an architectural flair that can increase resale appeal. Tax-wise, every inch reclaimed adds up. For clever homeowners, it’s a stylish path to savings.

9. Swapping Garages for Carports

Garages are often taxed as finished structures, while carports may not be. Homeowners looking to cut assessments are removing garage doors and walls, leaving behind semi-enclosed parking spaces. It reduces square footage and, in some cases, changes zoning classifications. Plus, carports can be cheaper to maintain.

While it may lower curb appeal slightly, the tax savings can be significant. For those in high-assessment zones, it’s a tradeoff worth making. And with creative design, some carports still look sleek. It’s all about outsmarting the form without losing the function.

10. Decommissioning Finished Basements

Finished basements are often taxed as full living spaces. To reduce their tax load, some homeowners are ripping out carpet, removing drywall, and even uninstalling lighting. They then classify the space as “unfinished,” cutting its contribution to overall square footage. It’s a backward form of remodeling—but with forward-thinking financial goals.

These basements still serve as rec rooms or storage, just without the bells and whistles. It’s an odd tactic, but it works in many tax districts. When assessors come knocking, a bare basement is a financial blessing. And homeowners can always “refinish” again later—unofficially.

11. Using Sliding Walls to Redefine Rooms

Sliding walls let residents change how space is counted on demand. During assessments, a large room with a partition may count as one space rather than two. Some homeowners even design layouts that hide beds, desks, or appliances to make rooms appear smaller or less functional. The tax implications depend on local rules—but often favor the minimalist design.

These changes are subtle but effective. A one-bedroom loft that can “disappear” into an open concept space may dodge thousands in annual taxes. It’s not just a design choice—it’s a financial strategy. Flexibility, in this case, means savings.

12. Hiding Square Footage With False Ceilings

False ceilings can mask loft spaces or hide areas that would otherwise be counted. Homeowners install dropped ceilings that obscure upper nooks or sleeping lofts from view. While technically present, the space above isn’t always visible to inspectors—or included in tax assessments. It’s like cloaking square footage in plain sight.

These ceilings often double as acoustic enhancements or lighting features. But their true function is financial. By keeping the space under the radar, owners pay less over time. It’s another way design meets strategy.

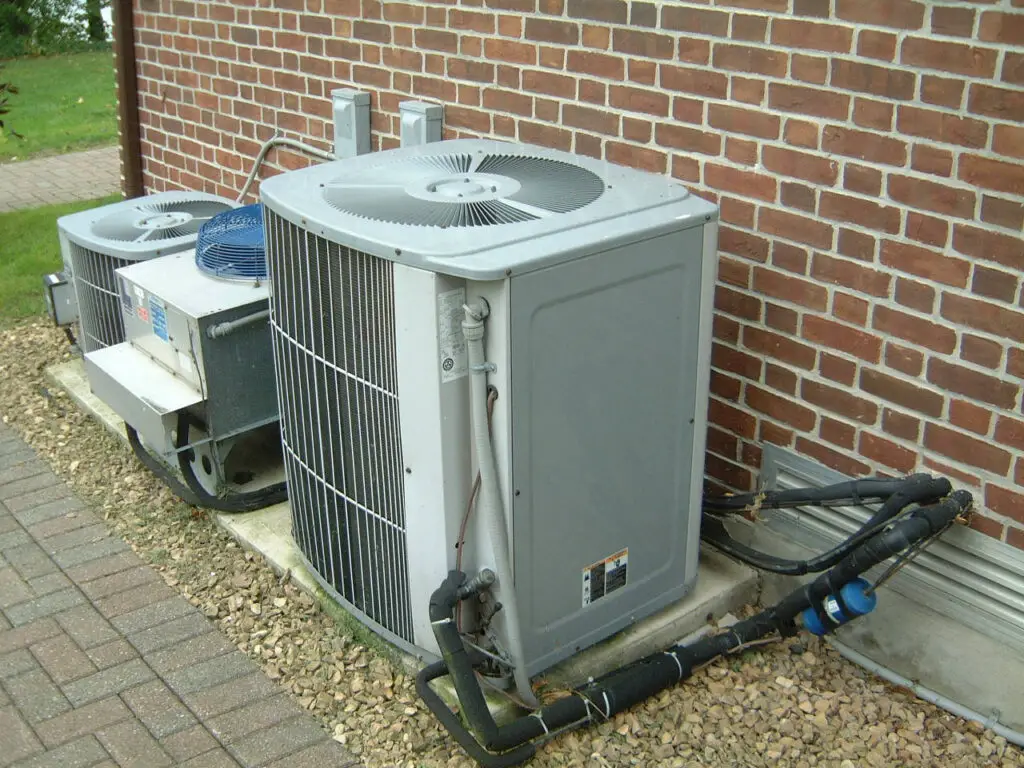

13. Removing Central HVAC

In some areas, homes without central HVAC are assessed at lower values. That’s prompted some homeowners to uninstall or downgrade their heating and cooling systems. Instead, they use wall units, space heaters, or ductless mini-splits that don’t register the same way on tax assessments. It’s not always comfortable—but it’s effective.

Going without central air might sound drastic, but for the right person, it’s a worthy tradeoff. Utility bills drop, and so do taxes. Comfort is a little more customizable. And in mild climates, it may not be much of a sacrifice at all.

14. Splitting Properties Into Separate Parcels

In multi-acre lots, some owners are dividing land to isolate their main home onto a smaller, less-taxed parcel. They reclassify the rest as agricultural, conservation, or undeveloped. This drastically reduces the home’s total assessed value. It also opens up land for other uses—like gardens, animals, or even RV parking.

The legal work can be complex, but the payoff is big. With careful planning, a once-tax-heavy estate becomes a lean, low-cost homestead. It’s a paperwork game—but one that pays in real dollars. For those who can navigate it, the savings are serious.