In real estate, the most tempting offers often hide the biggest headaches. A home listed at a shocking discount or a financing deal that seems too generous rarely tells the whole story. Buyers who rush into these opportunities without careful review can find themselves stuck with unexpected costs or legal traps. Understanding the fine print can mean the difference between a dream home and a financial nightmare.

1. Zero-Down Mortgages

According to Bankrate, zero-down mortgage offers sound great but often come with higher interest rates and expensive mortgage insurance. Lenders offset the risk of no down payment by charging more over time. Buyers may also find stricter qualification requirements buried in the terms. The savings up front can quickly vanish under long-term costs.

Zero-down programs also expose buyers to greater financial risk if property values drop. A small market correction can leave owners underwater. Selling or refinancing becomes difficult. These hidden pitfalls often surprise first-time buyers.

2. Rent-to-Own Deals

As reported by The New York Times, rent-to-own arrangements can saddle tenants with inflated prices and complex contracts. Monthly payments are often higher than market rent, with little protection if the buyer cannot eventually purchase. Many contracts contain non-refundable fees and strict penalties for minor late payments. Tenants often invest years into a property they never actually own.

These deals often favor sellers heavily. Buyers must scrutinize option clauses, repair responsibilities, and financing contingencies. Legal advice is crucial before signing. Without it, buyers risk losing thousands with nothing to show for it.

3. Pre-Foreclosure Listings

Zillow notes that pre-foreclosure homes often involve complicated legal and financial entanglements. The current owner may still occupy the property, making the sale process slow and unpredictable. Hidden liens, unpaid taxes, or title issues can create massive headaches. Buyers attracted by the price rarely realize the risks involved.

Purchasing pre-foreclosures can require months of legal navigation. Buyers may also have to handle evictions themselves. Title insurance becomes even more critical in these cases. Few bargains are as simple as they first appear.

4. “Investor Specials”

According to Realtor.com, properties advertised as “investor specials” often suffer from severe hidden damage. Cosmetic issues might disguise major structural, plumbing, or electrical problems. Disclosure standards vary widely, leaving buyers with few legal remedies. What looks like a fixer-upper can quickly turn into a money pit.

Sellers of “as-is” homes rarely negotiate repairs. Inspection clauses must be reviewed carefully. Many investors budget for worst-case repairs before bidding. Optimism can be financially fatal.

5. Home Warranty Promises

Some sellers entice buyers with free home warranties that appear to cover everything. In reality, warranty contracts often exclude major systems like roofs or foundations. Fine print limits payouts and requires buyers to use approved vendors. Filing claims can be slow, frustrating, and expensive.

Warranties give buyers a false sense of security. Reading exclusions and service fee policies is critical. Not all warranties are created equal. Empty promises can mask serious home flaws.

6. Builder Incentives

New construction projects often advertise flashy incentives like cash rebates or “free” upgrades. However, these offers frequently tie buyers to preferred lenders with higher fees or rates. Fine print can also shift promised incentives after contract signing. Buyers need to calculate total costs, not just up-front bonuses.

Builders often recoup giveaways through hidden surcharges. Standard pricing might inflate to cover “free” additions. Customization options can carry steep markups. Incentive deals should be viewed with healthy skepticism.

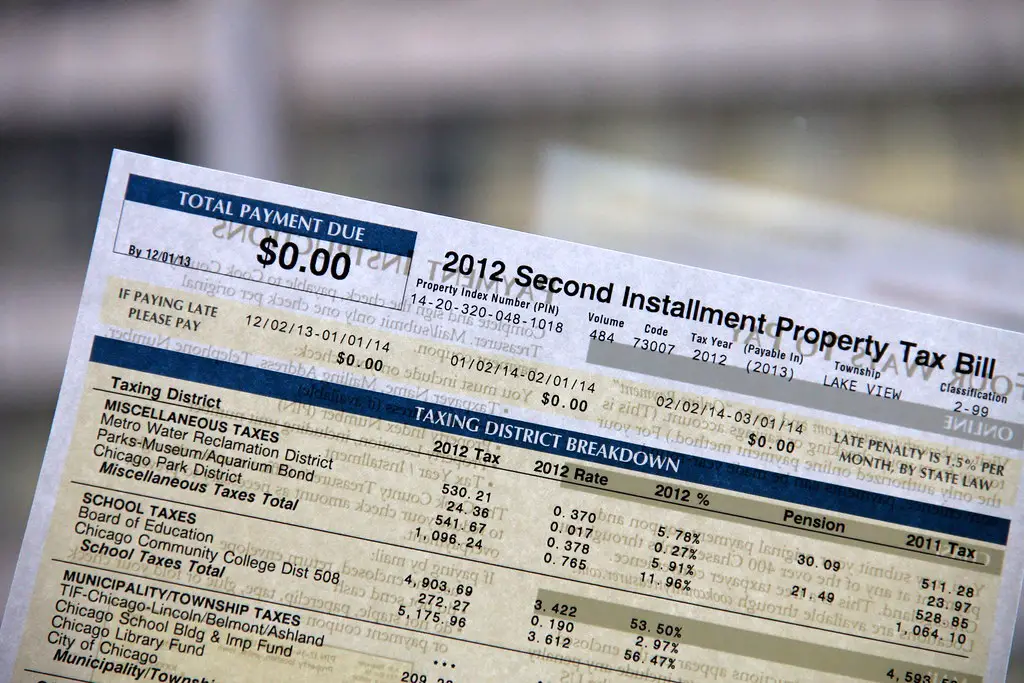

7. Extremely Low Property Taxes

When a listing boasts incredibly low property taxes, it’s often a temporary situation. Many new developments use special tax districts or abatements that expire after a few years. Homeowners can be hit with sudden tax increases without much warning. Fine print disclosures rarely highlight these future jumps.

Budgeting based only on current taxes is risky. Buyers must verify long-term tax projections. Consulting the local assessor’s office can prevent surprises. Temporary savings rarely last forever.

8. Ultra-Low HOA Fees

Low homeowners association (HOA) fees may signal underfunded reserves and deferred maintenance. While saving on monthly dues sounds appealing, future special assessments can cost tens of thousands. Fine print rarely discloses financial health openly. Buyers should review recent meeting minutes and budgets carefully.

Deferred repairs can create serious safety and aesthetic issues. Lawsuits against the HOA can also inflate costs. Cheap dues often lead to expensive consequences later. Transparency is key before committing.

9. “Off-Market” Deals

Agents sometimes hype “off-market” deals as exclusive bargains, but off-market properties often come with higher negotiation hurdles. Sellers may be testing the waters, not fully committed to selling. Appraisals and inspections might be tougher to arrange. Buyers attracted to the idea of exclusivity often miss these practical barriers.

Lack of market exposure can also mean overpaying. Competitive pricing pressure is absent. Due diligence must be even more thorough. Off-market does not automatically equal undervalued.

10. Leaseback Offers

Sellers offering leaseback arrangements want to stay in the home temporarily after closing. While this can create rental income for buyers, fine print often shields sellers from damages or default consequences. Disputes over security deposits, repairs, and move-out timelines can arise. Leasebacks can delay true occupancy by months.

Investors should require detailed contracts outlining terms. Inspections before and after the leaseback period are wise. Casual agreements create serious risks. Always assume problems could arise.

11. Ultra-Short Closing Windows

A seller pushing for a lightning-fast close may signal hidden problems. Inspection waivers and appraisal shortcuts become common under these deadlines. Buyers sacrificing due diligence to meet an unrealistic schedule can miss costly defects. Fine print often shifts risk entirely onto the buyer.

Speed benefits sellers, not buyers. Rushed deals rarely favor careful decision-making. Extending timelines often uncovers hidden flaws. Patience protects your investment.

12. “As-Is” Bank-Owned Properties

Banks selling foreclosed homes often disclaim all responsibility for property condition. Fine print limits buyer protections to an extreme degree. Hidden mold, foundation issues, or unpermitted construction might only appear after purchase. Cheap price tags hide expensive rehabilitation costs.

Inspections are crucial but not foolproof. Banks often refuse to negotiate repairs or credits. Legal recourse after closing is almost nonexistent. Buyers must go in fully prepared.

13. Financing “Bonuses”

Some real estate deals offer “bonuses” for using in-house lenders, but these perks can come with strings attached. Interest rates may be higher, or closing costs inflated behind the scenes. Buyers focusing only on visible perks lose sight of overall cost. Fine print can erase initial savings.

Comparing multiple lenders always reveals hidden costs. Loyalty incentives rarely beat competitive shopping. Even small rate differences matter long-term. Smart buyers prioritize total loan value over flashy bonuses.