As new tariffs ripple across industries, homeowners are bracing for cost increases in everything from appliances to construction materials. What was affordable a year ago may soon come with a hefty markup. That means savvy financial decisions at home are more important than ever. These 18 homeowner strategies can help you stay ahead of the squeeze and protect your bottom line.

1. Lock In Major Renovations Now

If you’ve been putting off that kitchen or bathroom upgrade, it’s time to act fast. Many contractors still honor old pricing structures until their current stock runs out. Once tariff-inflated supplies become the norm, costs will jump significantly. Booking now can save thousands later, says USA Today.

Homeowners who delay could end up spending more for the exact same job. Locking in a contract early allows you to avoid bidding wars or supply shortages. It also gives you first dibs on skilled labor before demand spikes. If you’ve got the budget now, move quickly.

2. Refinance While Interest Rates Are Still Competitive

Higher material prices can create inflationary pressure, which often leads to rising interest rates. Refinancing your mortgage today can help stabilize your housing costs before rates creep up. You may even be able to lower your monthly payment and redirect the savings. That flexibility could be critical in the months ahead.

Even a modest rate reduction adds up over time, notes NerdWallet. It can also free up cash for unexpected home expenses caused by supply chain disruptions. The peace of mind is worth the effort. If you qualify, lock it in now.

3. Start a Home Emergency Fund

With home maintenance and replacement costs climbing, having a cash cushion is non-negotiable. A leaking roof or failing HVAC unit could cost significantly more in a tariff-heavy market. Setting aside funds now means you won’t have to rely on high-interest credit later. Your future self will thank you for the buffer.

Start with a realistic goal — even a few hundred dollars can help, recommends Realtor.com. Build slowly with automatic transfers from your paycheck. Treat it like a utility bill and make it non-negotiable. A dedicated fund brings peace of mind in a volatile economy.

4. Delay Non-Essential Upgrades

Now is not the time to splurge on trendy updates that don’t improve your home’s value. Decorative tile or statement lighting might be appealing, but their cost is likely to rise disproportionately under tariffs. Prioritize what adds utility or energy efficiency first. Aesthetic changes can wait, says Homes & Gardens.

Postponing cosmetic upgrades lets you redirect that money toward more impactful areas. It also gives you time to see how prices settle over the next year. There’s no harm in holding off until costs normalize. Be strategic and patient.

5. Stock Up on Essentials in Bulk

If you know you’ll need lightbulbs, filters, or batteries in the next year, buy them now. Prices on household basics are already creeping up, and bulk purchases can soften the blow. Focus on non-perishable items with consistent usage. Think ahead like you’re prepping for a long trip.

Stocking up now isn’t panic-buying — it’s long-term budgeting. The cost per unit often drops significantly with bulk orders. Even a small supply closet can offer long-term relief. You’ll be glad to have it when prices peak.

6. Rethink Luxury Landscaping

Imported trees, stones, and outdoor materials are already seeing price hikes. Rather than splurging on high-end landscaping, consider native plants and recycled materials. They’re not only cheaper, but also more sustainable and easier to maintain. Your yard doesn’t need to cost a fortune to look good.

Native plants require less watering and fewer chemicals. That saves you money on utility bills and future care. Plus, local nurseries often offer discounts on native species. You’ll get more beauty for your buck.

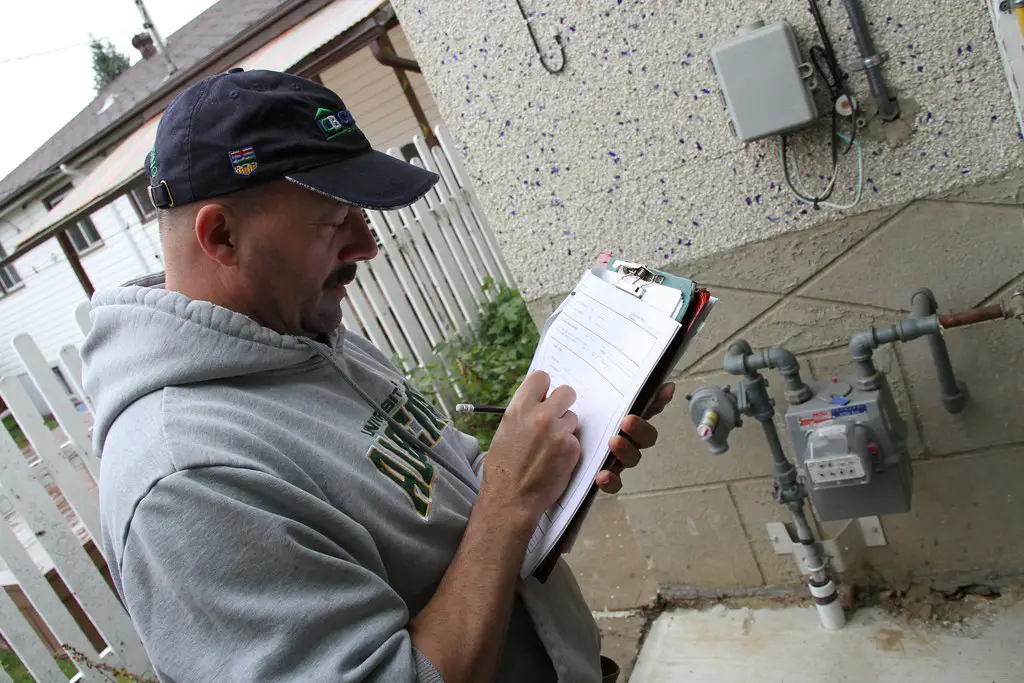

7. Get a Home Energy Audit

Energy efficiency becomes even more valuable when tariffs drive up electricity and fuel prices. A home audit identifies where you’re leaking money — literally. Sealing gaps, upgrading insulation, or changing filters can pay off quickly. Best of all, some improvements are free or low-cost.

Auditors can also recommend which appliances to upgrade first. The goal is to cut costs before your utility bills spike. Many utility companies offer free audits or rebates. Take advantage of them while they’re available.

8. Shop Local for Supplies

With overseas goods subject to higher tariffs, local products may now be the better deal. Visit regional hardware stores, lumber yards, or salvage centers for deals. They often have unique items and are less affected by global pricing shocks. Shopping local supports your economy and your wallet.

Building relationships with local vendors may also lead to future discounts. You’ll get better advice and service from people who know the area. Sometimes, smaller shops even beat big-box prices post-tariff. Don’t assume local means more expensive — do the math.

9. Learn Basic DIY Repairs

Labor costs will rise as materials become scarce, making simple home fixes much more expensive. Learning how to patch drywall, replace a faucet, or paint a room could save you hundreds. YouTube tutorials and local workshops make it easier than ever to gain these skills. Practice now before something breaks.

The more self-sufficient you are, the more control you’ll have over home upkeep. Not every job needs a professional. A few tools and a bit of confidence go a long way. Invest in yourself — the return is real.

10. Review Your Homeowners Insurance

Rising replacement costs mean your current coverage might no longer be enough. If your policy hasn’t been updated recently, it may not reflect today’s construction prices. Talk to your agent about adjusting your limits and adding inflation protection. Better to fix it now than get caught underinsured later.

Even small tweaks can make a big difference in a claim. Check deductibles and consider bundling for savings. Some companies even offer credits for energy-efficient upgrades. Stay protected, not just covered.

11. Cut Back on Subscription-Based Home Services

Recurring costs like lawn care, cleaning, or pest control add up faster than you think. Evaluate what you truly need and what you can manage yourself. Cutting even one monthly bill frees up cash for tariff-related expenses. Flexibility matters more than convenience right now.

A short-term pause doesn’t mean a permanent goodbye. Many services offer seasonal or one-off rates when you need them. Taking a break now helps you recalibrate your budget. Reintroduce services slowly as prices stabilize.

12. Rent Out Unused Space

If you have a basement, guest room, or finished attic, consider monetizing it. Even short-term rentals or workspace leases can generate steady income. With homeownership costs rising, extra cashflow is gold. Plus, you’re maximizing the value of your biggest asset.

You don’t need to host strangers to make it work. Consider renting to friends, traveling nurses, or remote workers. Flexibility and clear rules are key. Let your home work for you, not just cost you.

13. Review Your Tax Deductions

Many homeowners forget about tax advantages linked to energy upgrades or refinancing. If you’ve made improvements or changed your mortgage, you may qualify for breaks. A quick review with a tax professional could uncover hidden savings. Every dollar counts when prices are on the rise.

Keeping good records helps streamline the process. Make notes of upgrades and store receipts digitally. Smart deductions reduce your tax bill and increase cashflow. Don’t leave money on the table.

14. Delay Large Appliance Purchases

Tariffs on imported steel and electronics are hitting big-ticket items hard. If your washer or fridge is still working, try to extend its life. Simple maintenance can often add another year or two of use. Avoid jumping into inflated prices if you don’t have to.

Clean coils, replace filters, and treat your machines well. These habits delay wear and tear. If you must buy, look for refurbished or floor models. Timing matters more than ever.

15. Invest in Smart Home Controls

Smart thermostats, leak detectors, and appliance monitors can prevent costly surprises. These tools give you real-time data to cut energy waste and catch issues early. With prices climbing, prevention is cheaper than repair. Even basic models can yield big returns.

Installation is usually fast and DIY-friendly. Many products qualify for utility rebates or insurance discounts. You’ll get peace of mind and more control over household expenses. It’s tech that pays for itself.

16. Make Use of Community Tool Libraries

Why buy when you can borrow? Tool libraries let you check out everything from power drills to pressure washers. Instead of investing in pricey equipment, borrow what you need for occasional projects. It’s cost-effective and environmentally friendly.

Many towns now offer these services for free or a small fee. You’ll also get advice from experienced users. It keeps clutter down and savings up. Think of it as homeownership with a safety net.

17. Consolidate High-Interest Debt

If you’re carrying balances on credit cards or store loans, now’s the time to consolidate. As costs rise, those monthly payments will squeeze your budget even harder. Look into personal loans or home equity lines of credit for better rates. Paying down debt now improves long-term cashflow.

Start by tackling the highest-interest accounts first. Consider automated payments to stay on track. Every dollar saved in interest is one more for your household. Get ahead of rising expenses while you still can.

18. Watch for Local Incentives

Cities and counties often respond to economic pressure by offering homeowner relief. This could include tax credits, grants for energy upgrades, or reduced permit fees. Staying informed can help you take advantage of programs before they expire. A little paperwork now could save you big.

Check municipal websites and neighborhood associations regularly. Sign up for local newsletters to stay in the loop. These programs are designed to help homeowners navigate tough times. Don’t miss out just because you didn’t know.