Tax laws are constantly evolving, and changes at the federal, state, and local levels can impact the cost of everyday goods and services. Staying informed about these potential shifts can help consumers budget and plan accordingly. From online purchases to sugary drinks, several common items are on the horizon for altered tax treatment. Understanding these upcoming changes can provide a clearer picture of future spending.

1. Online Purchases

The taxation of online purchases has been a shifting landscape for years. The Supreme Court’s 2018 ruling in South Dakota v. Wayfair paved the way for states to require online retailers to collect sales tax even if they don’t have a physical presence in the state. As a result, many consumers have already seen an increase in the tax applied to their online orders. This trend is likely to continue as more states adapt their laws and as marketplaces become more sophisticated in their tax collection processes.

The convenience of online shopping comes with the increasing likelihood of sales tax being applied at checkout, regardless of the seller’s location. This levels the playing field between brick-and-mortar stores and online retailers, but it also means that the final cost of online purchases may rise for consumers who were previously exempt from paying sales tax on these transactions.

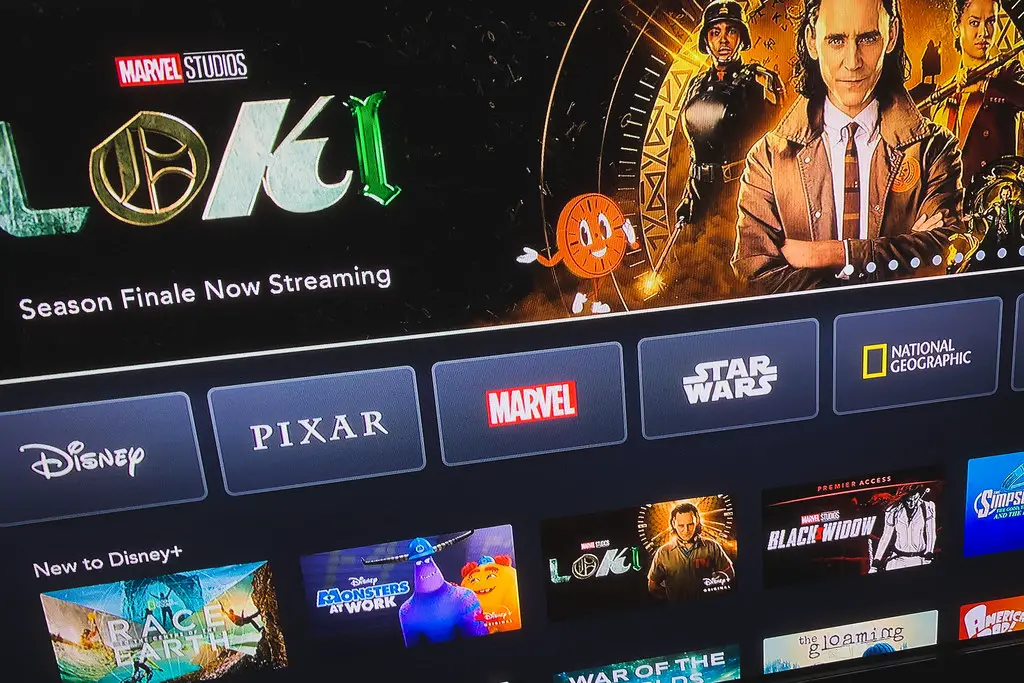

2. Digital Services

Many states are now considering or implementing taxes on digital services such as streaming subscriptions, cloud storage, and online gaming. The argument is that these services are increasingly becoming a significant part of the economy and should be subject to taxation similar to traditional goods and services. According to a report by the Tax Foundation, the specifics of these taxes, including the rate and the types of services covered, vary significantly by state and are subject to ongoing legislative debate. This evolving landscape means consumers may soon see changes in the cost of their online entertainment and data storage.

As digital consumption continues its rapid growth, taxes on these services could become a substantial source of revenue for states seeking to modernize their tax codes. For consumers, this would likely translate to an increase in the monthly expenses associated with popular streaming platforms, cloud storage solutions, and other digital subscriptions they rely on. The implementation timelines and the precise scope of these digital service taxes will be crucial factors for consumers to monitor in the coming years as more states consider this revenue stream.

3. Sugary Drinks

Taxes on sugary drinks, often referred to as “soda taxes,” have been implemented in several cities and states with the aim of discouraging consumption and raising revenue for health-related initiatives. These taxes typically add a per-ounce fee to beverages with added sugar. As reported by the Centers for Disease Control and Prevention (CDC), there is ongoing discussion and potential for more jurisdictions to adopt similar taxes in the future as public health concerns about excessive sugar intake persist across the nation. This trend could lead to higher prices for common beverages.

If more areas decide to implement sugary drink taxes, consumers in those regions will undoubtedly experience an increase in the price of sodas, sweetened teas, and various other sugary beverages they purchase regularly. The ultimate effectiveness of these taxes in altering consumption patterns among the population and their overall impact on state and local revenue streams remain subjects of continuous study and public debate. Consumers in areas considering such taxes should be aware of potential future increases in their beverage costs.

4. Vaping Products

The taxation of vaping products, including e-cigarettes and e-liquids, is another area that is experiencing rapid evolution across the United States. Many states have already implemented or are actively considering excise taxes on these products, often establishing rates that mirror those applied to traditional tobacco products. According to the Campaign for Tobacco-Free Kids, the primary rationales behind these taxes include addressing public health concerns, particularly the alarming rise in youth vaping, and generating dedicated revenue for public health programs and initiatives. This suggests a likely increase in the cost of vaping.

As the regulatory landscape surrounding vaping continues to develop and adapt to new trends and health findings, it is highly probable that taxes on these products will become even more widespread and potentially see further increases in the coming years. This will directly affect the financial burden on consumers who currently use vaping products as part of their lifestyle. The specific tax rates and the structural frameworks governing these taxes can still vary considerably from one jurisdiction to another.

5. Cannabis Products

With the increasing legalization of cannabis for medical and recreational use in various states, the taxation of cannabis products is becoming a significant issue. Tax structures vary widely, including sales taxes, excise taxes based on weight or potency, and cultivation taxes. As more states legalize cannabis, the tax landscape will continue to evolve, potentially impacting prices for consumers.

The way cannabis is taxed can have a significant effect on the legal market, influencing prices and competitiveness with the illicit market. Tax revenues from cannabis sales are often earmarked for specific purposes, such as education or public safety.

6. Single-Use Plastics

In an effort to reduce plastic waste, some jurisdictions are considering or implementing taxes or fees on single-use plastic items like bags, straws, and food containers. These measures aim to incentivize the use of reusable alternatives. While not strictly a tax in all cases, these fees function similarly by increasing the cost to consumers.

If these types of charges become more widespread, consumers will likely need to pay a small fee for single-use plastic items or bring their own reusable alternatives to avoid the cost. The goal is to encourage a shift towards more sustainable practices.

7. Ride-Sharing and Delivery Services

Some cities and states are exploring or implementing taxes and fees on ride-sharing services like Uber and Lyft, as well as food and grocery delivery services. These fees are often intended to help fund transportation infrastructure or address other local needs. As these services become more integral to daily life, their taxation is likely to be a continued topic of discussion.

Increased taxes or fees on these services would likely translate to slightly higher costs for consumers using ride-sharing or delivery apps. The specific amounts and how they are applied can vary depending on the location.

8. Real Estate Transactions

While not an everyday purchase in the same way as groceries, changes to taxes associated with real estate transactions, such as transfer taxes, can have a significant financial impact. Some jurisdictions are considering adjustments to these taxes, which are typically levied when a property is sold. These changes can affect both buyers and sellers.

Fluctuations in real estate transfer taxes can influence the overall cost of buying or selling a home. These taxes are often used to fund local government services.

9. Hotel and Short-Term Rentals

Taxes on hotel stays are common, and some areas are now extending similar taxes to short-term rentals booked through platforms like Airbnb and VRBO. This levels the playing field between traditional lodging and these newer forms of accommodation and provides additional revenue for local governments, often earmarked for tourism-related initiatives.

As short-term rentals become more popular, these taxes will likely become more widespread, adding to the overall cost of vacation rentals for consumers.

10. Parking

Some cities are considering or increasing taxes on parking, both at public and private lots. This can be part of broader transportation or congestion management strategies. Higher parking taxes would directly impact the cost for individuals who drive and park in these areas.

Increased parking taxes could incentivize the use of public transportation or other modes of travel. The revenue generated can be used for transportation infrastructure improvements.

11. Entertainment Tickets

Taxes on entertainment tickets, such as for concerts, sporting events, and movie theaters, can fluctuate. Local governments may adjust these taxes as a way to generate revenue or to support cultural institutions. Changes to these taxes would affect the final price consumers pay for these events.

Increases in entertainment ticket taxes can make leisure activities slightly more expensive for consumers. The revenue often supports local arts and entertainment venues.

12. Bag Fees

Similar to taxes on single-use plastic bags, some areas implement mandatory fees for paper bags provided at checkout. These fees are designed to encourage the use of reusable bags and reduce overall waste. While not always a tax, the effect on consumers’ spending is similar.

Consumers in areas with bag fees will need to either bring their own reusable bags or pay a small fee for paper bags at stores.

13. Carbon Emissions

While not yet widespread for everyday consumer items in the United States, there is ongoing discussion about carbon taxes or fees on goods and services based on their carbon footprint. Such policies aim to incentivize more sustainable consumption and production. If implemented, these taxes could indirectly affect the price of many everyday items.

The implementation of carbon-related taxes would likely lead to price adjustments across various sectors, potentially making goods with higher carbon footprints more expensive.

14. Prepared Foods

The taxation of prepared foods can vary by state and locality, with some areas taxing them at a different rate than groceries. There may be future adjustments to these tax classifications, potentially impacting the cost of restaurant meals, takeout, and prepared items from grocery stores.

Changes in how prepared foods are taxed can affect consumer spending on dining out and convenience meals. The specific definitions of “prepared foods” and the applicable tax rates can vary.