1. Steel (rebar, structural steel, sheet metal)

Steel remains one of the backbone materials for construction — from rebar in concrete to structural beams and metal framing. Global supply-chain disruptions, tariff pressures, and rising manufacturer energy/material costs are pushing steel prices up — and many industry reports suggest volatility will continue. Since steel is so widely used across residential, commercial, and infrastructure projects, even modest price jumps will ripple through many sectors, making it likely to see noticeable increases. If demand recovers post-pandemic and governments push infrastructure, that added demand could further spike steel costs.

Once steel costs rise, nearly every part of a building gets more expensive — concrete reinforcement, roofing, metal doors/windows, even interior framing — which makes planning harder and margins tighter for developers. That’s why I expect steel to be among the first materials to “skyrocket” in price before 2026 ends.

2. Aluminum (cladding, windows, facades, fixtures)

Aluminum has already seen price pressures as tariffs and global trade friction affect metal markets. Because aluminum is often used in windows, cladding, curtain-walls, and facades — especially in mid- to high-end construction — higher aluminum prices will directly inflate costs for those components. If manufacturers pass along higher costs for raw aluminium to fabricators, the end-material prices could rise sharply.

Additionally, since architectural trends in many regions are favoring more glass-and-metal facades, demand for aluminum could increase further — meaning that supply constraints or energy-cost increases could make aluminum significantly more expensive by late 2026.

3. Softwood lumber & wood products (framing, plywood, interior finishing)

Wood has had a crazy ride in the past few years, with sharp spikes and hard drops. While prices have recently stabilized somewhat, global supply-chain uncertainty and import tariff changes (especially on lumber) create fertile ground for another surge. For framing, roofing, subfloors, and interior carpentry, lumber remains essential — and any increase in wood prices disproportionately affects smaller or timber-heavy projects.

Also, climate-driven disasters (storms, fires) can drive sudden demand for restoration materials, which tends to push wood product prices up due to scarcity and urgent rebuilding. That dynamic makes wood a “wait-and-see — but probably going up” material over the next couple years.

4. Concrete & cement (ready-mix concrete, cement, aggregates)

Although heavy and less sensitive to global shipping disruptions than metals, concrete and cement rely on raw materials (like aggregates, clinker, energy for kiln firing) that have been under pressure worldwide. Rising energy costs and transportation bottlenecks can increase production costs, which get passed on. If infrastructure or housing demand rises significantly in light of post-pandemic rebuilding or stimulus packages, demand for concrete could surge — pushing prices up.

Also, shortages or increased cost of aggregates (sand, gravel) or cement components (like clinker, additives) can ripple out, making “cheap and easy” concrete more expensive — and costlier materials tend to slow down construction starts.

5. Gypsum / drywall / plasterboard

Gypsum-based products (drywall, plasterboard, interior wall systems) could see a price increase if energy costs climb or supply bottlenecks emerge. Drywall production depends on gypsum mining, transport, and manufacturing — all of which can be disrupted by rising fuel or freight costs, or regulatory changes. In regions where demand for interior finishing surges, these products may see a sharp uptick in price.

Moreover, if wood prices rise (making timber-framed walls more expensive), some builders may lean on drywall/plasterboard alternatives — increasing demand for gypsum products and potentially creating a supply-driven price spike.

6. Insulation materials (foam, fiberglass, mineral wool, specialty insulations)

Insulation often relies on petrochemical-based materials (foam boards, spray foams, rigid insulation), or energy-intensive manufacturing (for fiberglass or mineral wool). If energy costs or input-material costs (oil, gas, specialized minerals) go up, insulation prices tend to rise. As buildings worldwide face stricter energy-efficiency and climate-compliance regulations, demand for high-performance insulation might soar — driving up demand while supply remains constrained.

Also, if there’s a push for “green building,” demand for specialized eco-friendly insulations (recycled, low-carbon, or high-performance materials) will likely surge — and those already tend to be more expensive than standard insulation, creating double pressure on cost.

7. Copper (wiring, plumbing, electrical conduit, HVAC components)

Copper is widely used for wiring, plumbing, HVAC, and electrical conduits — essential “hidden” materials in almost every building. Global demand (for construction, electronics, electrification projects) plus supply constraints and rising energy/production costs could significantly raise copper prices. As electrification and green-energy initiatives expand (e.g. more wiring, solar systems, efficient HVAC), demand for copper may rise sharply by 2026.

If copper gets more expensive, the costs of electrical systems, plumbing, and HVAC installations could jump — which often represent a substantial part of total building cost, especially in multi-unit or larger projects.

8. Glass & glazing (windows, curtain walls, facades)

Glass — used in windows, doors, curtain walls, facades — depends heavily on energy-intensive manufacturing (melting silica at high temperatures), plus sometimes on imported materials or specialty coatings. If energy prices rise or supply-chain disruptions affect silica, soda ash, or other glass-making ingredients, glass prices could increase. Additionally, architectural trends favoring more glass facades (e.g. in urban apartments, office buildings) may raise demand, contributing to potential price spikes.

Specialty glass (low-emissivity, insulated, laminated, tempered) is even more susceptible: since it requires extra processing, any input-cost increases or supply-chain delays could inflate prices substantially.

9. Bricks, masonry blocks & structural clay products

Bricks and masonry blocks are often locally produced, but they still rely on energy (kilns), clay or shale sourcing, and transport. If energy costs rise or fuel costs for transport increase, that could raise brick/block prices. And if demand increases for renovation and construction — especially in areas where masonry is common — the supply might strain, pushing up costs.

Moreover, environmental regulations (especially in regions moving to reduce emissions) might increase kiln-operating costs or impose stricter firing standards, which could translate into higher manufacturing costs for masonry products.

10. Roofing materials (asphalt shingles, metal roofs, tiles)

Roofing materials — from shingles to metal panels to tiles — can be affected by rising costs of base materials (asphalt, metals, timber) and energy. Asphalt-based shingles rely on petroleum products, so if oil or bitumen prices rise, shingles will cost more. Metal roofing depends on metals like steel or aluminum, which are already under pressure.

Also, after extreme weather events (storms, heavy rains, floods) demand for replacements can spike — creating a “boom demand + constrained supply” situation that often drives prices up quickly.

11. Plumbing fixtures, pipes and fittings (PVC, copper, metal, polymer-based materials)

Pipes, metal fittings, valves, and other plumbing fixtures often depend on metals (copper, steel) or plastics derived from petrochemicals. Price increases in base materials (metals, plastics) or energy can push fixture costs higher. As building codes become more stringent (requiring higher-quality pipes or more durable fixtures), demand for specialized or certified materials may rise, making them more expensive.

If there are disruptions in supply chains for imported fittings (common in many countries), local shortages could further inflate prices. This could especially impact renovation projects or new builds where plumbing is a major cost share.

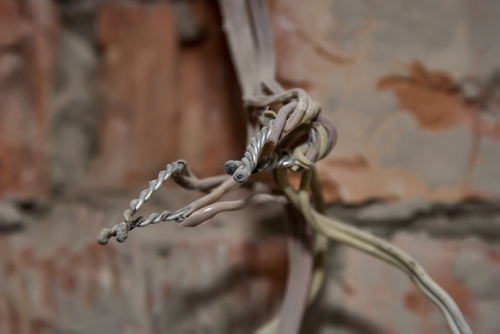

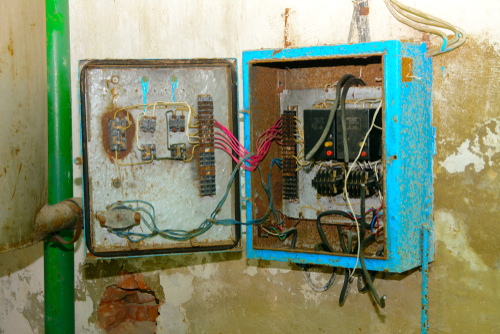

12. Electrical components, switchgear, and wiring accessories

Beyond just raw copper wiring, electrical components — like switchgear, panels, conduits, junction boxes, specialized fixtures — often involve metals, plastics, and electronic components. Because these components are often imported or assembled globally, supply-chain disruptions, tariff increases, or higher component-costs can cause price jumps. As modernization continues (smart buildings, stronger electrical codes), demand for sophisticated electrical gear could rise — putting pressure on availability and prices.

Given that electrical systems are integral to almost every building, rising costs here can add up quickly — often as a hidden but substantial portion of the overall budget.

13. HVAC equipment & mechanical systems (ductwork, units, ventilation, heating)

Heating, ventilation, air-conditioning (HVAC) systems rely on metal, electronics, insulation, and mechanical parts — many of which are sensitive to global commodity and energy prices. Rising cost of metals, copper, plastic parts, refrigerants, and energy for manufacturing can all drive up HVAC equipment costs. As energy-efficiency standards tighten globally and more buildings incorporate modern ventilation/air-conditioning systems, demand for HVAC gear will climb — possibly outpacing supply.

Furthermore, specialized or “green” HVAC systems (heat pumps, high-efficiency units, energy-saving ventilation) may become more sought-after — and since those already tend to be hotter sellers with constrained supply chains, prices could spike even more.

14. Paints, coatings, sealants, adhesives and finishing materials

Finishes and coatings — things like paints, sealants, adhesives, waterproofing membranes — might seem like small line-items, but they use chemicals, resins, solvents, sometimes imported specialty chemicals. As input-chemical costs rise (due to energy, raw-material, or regulatory pressure), manufacturers often pass those increases onto buyers. Demand for renovation, remodeling, and increased focus on durability, sustainability and green building could raise demand for high-quality paints and coatings — putting upward pressure on price.

Additionally, if supply-chain disruptions affect specialized additives or pigments (some of which may come from limited global suppliers), that scarcity could create spikes, especially for premium or eco-friendly finishing materials.

This post 14 Building Materials Expected To Skyrocket in Price Before 2026 Ends was first published on Greenhouse Black.