1. McAllen, Texas

McAllen often shows up in “affordable Texas living” lists because housing and groceries are genuinely cheaper than the national average. What gets less attention is that the Rio Grande Valley has historically high healthcare utilization and fewer competitive hospital systems. Many residents rely on emergency care due to gaps in primary coverage, which pushes costs upward fast. A single ER visit can erase months of savings from cheaper rent.

On top of that, Texas has one of the highest uninsured rates in the country, and McAllen reflects that reality. When insurance is missing or skimpy, negotiated discounts disappear and list prices take over. Specialty care often requires traveling within a limited network of providers. The result is a low-cost city that becomes financially punishing the moment serious medical care is needed.

2. Miami, Florida

Miami’s appeal is obvious: no state income tax, warm weather, and a lifestyle that feels accessible compared to coastal California or New York. Healthcare, however, is where the math breaks down quickly. South Florida has high insurance premiums and a large population cycling in and out of coverage. Hospitals frequently charge private-pay patients some of the highest rates in the region.

Miami also has a heavy concentration of for-profit medical systems and specialty clinics. That structure tends to favor higher billing, especially for diagnostics and outpatient procedures. Emergency room visits are common for routine issues, driving surprise bills. The city feels affordable until healthcare turns a modest budget upside down.

3. Orlando, Florida

Orlando markets itself as affordable sunshine with steady job growth tied to tourism and logistics. The problem is that healthcare infrastructure hasn’t kept pace with population growth. Fewer hospital systems dominate the region, limiting price competition. Insurance premiums and deductibles in Central Florida are often higher than newcomers expect.

Tourism-heavy economies also mean more contract and hourly workers with uneven benefits. That leads many residents to delay care until it becomes urgent and expensive. Specialist appointments can take months, pushing people toward ER care. What starts as “manageable living costs” can quickly become unmanageable medical debt.

4. Tampa, Florida

Tampa is often pitched as a calmer, cheaper alternative to Miami. Housing is still relatively affordable, but healthcare costs tell a different story. The metro area is dominated by a small number of large hospital systems. Less competition generally translates into higher negotiated rates with insurers.

Tampa also has an aging population, which increases demand for specialty and hospital-based care. That demand strains capacity and inflates costs for everyone. Even insured residents report high out-of-pocket expenses for routine procedures. The city’s affordability pitch weakens fast when medical needs increase.

5. Las Vegas, Nevada

Las Vegas regularly makes “low cost, no income tax” lists, especially for people fleeing California. Healthcare is where the savings often vanish. Southern Nevada has a limited number of hospital systems serving a rapidly growing population. That imbalance leads to long waits and higher prices.

The city also struggles with provider shortages in primary care and certain specialties. Many residents end up using emergency departments as a default option. For-profit hospital ownership is common, which tends to push charges upward. Medical bills in Las Vegas often shock newcomers who expected desert bargains across the board.

6. Phoenix, Arizona

Phoenix has long been marketed as affordable sprawl with endless housing supply. While housing was cheap for years, healthcare costs have stayed stubbornly high. Rapid population growth has strained hospitals and specialists. Insurance premiums in the region reflect that pressure.

Arizona also has a significant retiree population, increasing demand for complex care. That demand raises prices even for younger, healthier residents. Surprise billing and facility fees are common complaints. Phoenix living feels affordable until healthcare enters the equation.

7. Albuquerque, New Mexico

Albuquerque is often highlighted as a budget-friendly Southwestern city with culture and scenery. Healthcare access is one of its weakest points. The city has a limited number of major hospitals serving much of the state. That concentration reduces competition and drives up costs.

New Mexico also faces provider shortages, especially in specialized care. Residents frequently travel out of state for certain treatments, adding indirect expenses. Delays in care often lead to more severe and costly interventions. Low housing costs don’t protect against high medical bills here.

8. New Orleans, Louisiana

New Orleans is famous for culture and relatively low housing costs compared to other major cities. Its healthcare system has been under strain for years. Hospital closures and consolidation have left fewer options for residents. That lack of choice shows up in higher bills and limited access.

Louisiana consistently ranks among states with poorer health outcomes, increasing overall medical spending. Many residents rely on hospital-based care rather than preventive services. Insurance coverage gaps are common. The city’s charm doesn’t extend to affordable medical treatment.

9. Baton Rouge, Louisiana

Baton Rouge often gets attention as a cheaper alternative to New Orleans. The healthcare situation is similar but with fewer high-level options. A small number of hospital systems dominate the region. That dominance limits price competition and patient leverage.

Residents often travel to New Orleans or Houston for advanced care. Those trips add lodging, transportation, and time costs. Insurance networks may not fully cover out-of-area treatment. The result is a city that saves you on rent but not on health.

10. Birmingham, Alabama

Birmingham is frequently marketed as one of the South’s most affordable mid-sized cities. Healthcare is anchored by a major academic medical center that dominates the market. While quality is high, prices often are too. When one system controls specialty care, costs tend to follow.

Alabama also has high rates of chronic illness, increasing healthcare utilization. That demand pushes up insurance premiums and out-of-pocket expenses. Routine care can quickly escalate into expensive hospital visits. Birmingham’s affordability depends heavily on staying healthy.

11. Jackson, Mississippi

Jackson consistently appears on lists of low-cost U.S. cities due to cheap housing. Healthcare access is a persistent challenge. Hospital closures and financial instability have reduced options for residents. Fewer providers generally mean higher prices.

Mississippi has some of the nation’s worst health indicators, which increases system-wide costs. Many residents delay care due to access issues. By the time treatment happens, it’s often expensive. Jackson’s low cost of living doesn’t shield residents from medical financial stress.

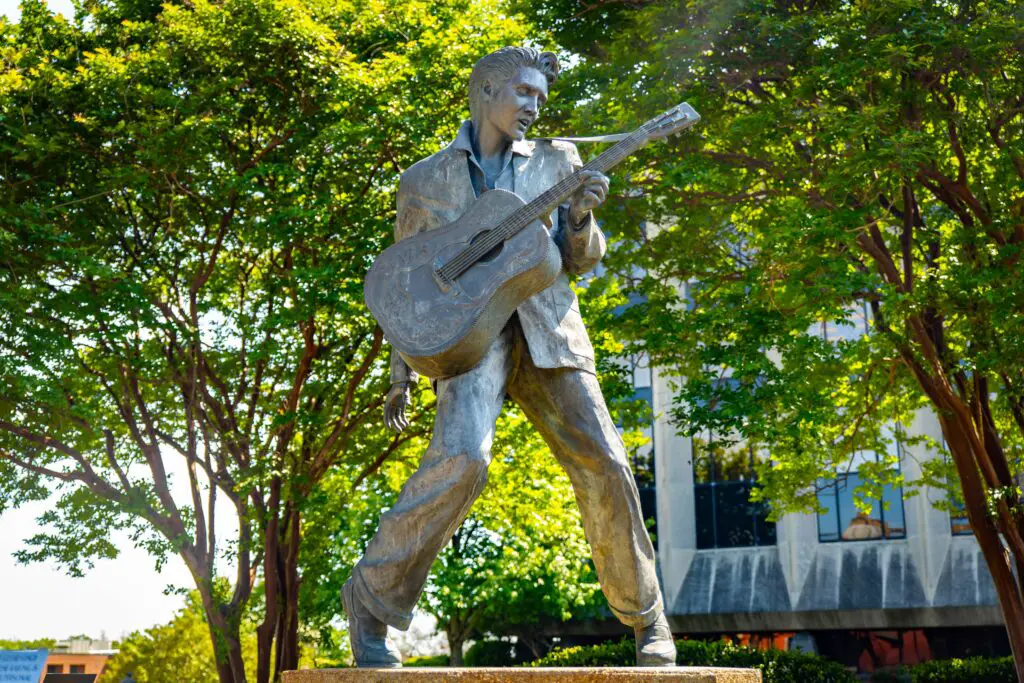

12. Memphis, Tennessee

Memphis markets itself as affordable with no state income tax. Healthcare costs tell a more complicated story. The city has high rates of poverty and chronic illness. That combination drives heavy reliance on hospital systems.

While Memphis has respected medical institutions, demand is intense. Emergency departments are frequently overcrowded. Insurance coverage gaps remain common. Medical bills can quickly overwhelm the savings from cheaper housing.

13. Oklahoma City, Oklahoma

Oklahoma City often flies under the radar as a budget-friendly metro. Healthcare costs are less visible but significant. Hospital consolidation has reduced competition in the region. That consolidation often leads to higher prices for insured patients.

Oklahoma also has high rates of preventable chronic disease. This increases utilization of costly services. Rural patients funnel into Oklahoma City hospitals, adding strain. The city’s affordability pitch weakens when healthcare enters the budget.

14. Little Rock, Arkansas

Little Rock is frequently cited as one of the most affordable state capitals. Healthcare access is concentrated in a small number of systems. That concentration limits consumer choice and price negotiation. Specialized care options are especially narrow.

Arkansas struggles with provider shortages outside urban areas. Little Rock absorbs much of that demand. Patients often face long waits and high facility fees. Low rent doesn’t offset high medical expenses.

15. Boise, Idaho

Boise’s reputation as a low-cost gem lingers even as housing prices rise. Healthcare costs have quietly climbed alongside population growth. The region has limited hospital capacity relative to demand. That mismatch drives up prices and wait times.

Specialty care options are fewer than newcomers expect. Many residents travel to other states for complex treatment. Insurance networks may not fully cover that care. Boise’s affordability narrative often ignores the true cost of staying healthy.

This post 15 Cities That Market “Low Cost Living” — Until Medical Bills Arrive was first published on Greenhouse Black.