1. Star Wars Action Figures (Prequel Era)

The Star Wars prequels sparked renewed interest in action figures around 1999–2005. Early buyers assumed these would become as valuable as original trilogy collectibles. However, the prequel figures were mass-produced and lacked the historical allure of earlier releases. Many collectors who invested heavily found that resale prices barely covered the original cost.

The lesson is that nostalgia alone doesn’t guarantee value. The market distinguishes between cultural significance and mere novelty. Those who rushed to buy every character ended up with a lot of unsellable stock. Scarcity combined with historical importance is what truly drives collectible prices.

2. Beanie Babies

Remember the Beanie Baby craze of the 1990s? People were convinced that these tiny stuffed animals would be the collectibles of a lifetime. Early buyers invested thousands in limited editions, expecting the values to skyrocket. Unfortunately, the market became oversaturated, and demand plummeted, leaving many investors stuck with bags of unsellable plush toys.

Those who bought “rare” Beanie Babies too soon saw their anticipated windfalls evaporate. Unlike other collectibles, the value of Beanie Babies relied heavily on hype rather than tangible rarity. By the early 2000s, most had lost nearly all of their resale value. The lesson? Timing is everything, and hype can be a dangerous investment guide.

3. Pokémon Cards (Early 2000s)

During the Pokémon card boom, some investors bought first editions in massive quantities. They assumed these cards would continue rising in value indefinitely. However, the market became flooded with reprints and counterfeit cards, which diminished the scarcity of many supposedly rare cards. Many buyers ended up holding collections worth a fraction of their initial investment.

Collectors who held on without researching market trends were particularly hard hit. The cards themselves weren’t the problem—it was the overestimation of long-term demand. Nostalgia only sustains value if there’s real scarcity. A few cards eventually became valuable, but early investors generally paid the price for jumping in too soon.

4. Comic Books (Specifically Modern Age Issues)

Some investors bet big on comic books from the 1990s and early 2000s, thinking modern issues would mirror the skyrocketing value of Golden and Silver Age comics. They bought in bulk, hoping for massive returns. Instead, many of these comics were overproduced and never reached the iconic status they anticipated. Today, most of these Modern Age issues remain inexpensive on the secondary market.

Even attempts to preserve them in mint condition couldn’t overcome the market glut. The value simply wasn’t intrinsic to the material, and rarity was artificially inflated. Those who waited decades for dramatic appreciation often felt burned. It’s a reminder that not all collectibles are timeless—some are just trends.

5. Magic: The Gathering Cards (Non-Legendary Editions)

Magic: The Gathering became a magnet for investors when the game first exploded in popularity. Some bought non-legendary or common cards expecting them to grow into high-value assets. The reality? Supply far outstripped demand for anything outside of key first-edition or promo cards. Many collections stagnated, generating little to no return.

Casual hype doesn’t equate to collectible value. While certain rare cards did appreciate significantly, most bulk purchases failed. Investors learned that understanding which cards actually matter is crucial. A rookie mistake was assuming all early prints were automatically rare.

6. Vintage Video Game Consoles (Second-Generation Hype)

When the early 2000s nostalgia wave hit, investors snapped up second-generation consoles like the Atari 2600 and NES clones. Many expected these items to become gold mines. But the consoles were relatively common, and emulation and digital availability undercut their collectible value. As a result, most early investors found limited returns.

Rarity matters more than nostalgia in the gaming world. Condition and completeness help, but mass-produced items rarely yield huge profits. Waiting too long to gauge sustained collector interest can lead to disappointment. A rush to buy first editions is rarely a winning strategy.

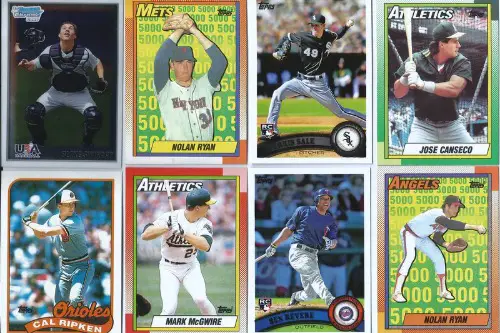

7. Sports Trading Cards (2000s Baseball)

Baseball cards saw a resurgence in the early 2000s, driven by the success of star rookies and online marketplaces. Many investors bought large lots expecting a boom. Instead, the market collapsed under oversupply, and digital tracking of statistics made actual cards less relevant. Consequently, the value of many purchased sets dropped dramatically.

Those who didn’t specialize in rookie cards or Hall of Fame prospects suffered the most. The lesson: only a tiny percentage of cards maintain lasting value. Bulk buying hoping for market-wide appreciation rarely works. Collectors learned to identify true scarcity rather than chasing hype.

8. Funko Pop! Figures

Funko Pop! figures became a cultural phenomenon in the 2010s. Some investors stocked up on exclusive and limited editions thinking they would become the next Beanie Babies. The reality? Many exclusives were overproduced, and the resale market quickly became oversaturated. As a result, values of certain figures didn’t meet expectations.

Even rare figures weren’t guaranteed hits. Popularity can be fleeting, and trends often shift before collectors can capitalize. Many investors realized that storing thousands of Pop! figures didn’t equal financial security. Timing, demand, and rarity are far more nuanced than they initially assumed.

9. Limited Edition Sneakers

Hype-driven sneakers, particularly from brands like Nike and Adidas, attracted early investors in the 2010s. They bought limited releases expecting instant appreciation. Over time, production numbers increased, and secondary market prices fluctuated wildly. Some sneakers that once sold for thousands now fetch only a fraction of that amount.

The market for limited edition sneakers is highly volatile. Brand popularity and celebrity endorsements don’t always translate into long-term value. Many investors learned that predicting which models become iconic is a gamble. Trend-based markets rarely reward impatience.

10. Antique Furniture (Faux Vintage)

Some investors bought “vintage” furniture pieces hoping they would skyrocket in value. The catch? Many pieces were mass-produced reproductions rather than true antiques. When buyers discovered the truth, resale value plummeted. The early investment quickly turned into a costly mistake.

Authenticity is everything in antique collecting. Visual appeal alone doesn’t guarantee an appreciating asset. Investors learned the hard way that documentation and provenance are non-negotiable. Misjudging this can turn a seemingly valuable item into a liability.

11. Movie Memorabilia (Modern Releases)

Movie props and merchandise from recent films seemed like an easy win. Fans bought limited-edition items hoping they’d be coveted in a few years. However, mass production and lack of historical significance meant most pieces didn’t appreciate. Collectors were left with items that had sentimental but little financial value.

The collectible market favors the classics. Contemporary memorabilia may peak briefly but rarely sustains long-term interest. Scarcity and cultural impact are what drive lasting value. Early investors without that insight often faced disappointment.

12. NFT Art (Early Crypto Hype)

The NFT boom promised a digital collectible revolution. Many rushed to buy digital art early, thinking prices would keep climbing. The market quickly became oversaturated, and hype-driven valuations collapsed. Early investors often ended up with NFTs worth far less than their purchase price.

NFTs illustrated that novelty isn’t the same as long-term value. Digital scarcity can be artificial and fleeting. Only pieces tied to genuine demand and enduring appeal retained some resale potential. Timing and market insight proved essential, yet often overlooked.

13. Limited Edition Coins (Modern Mint Runs)

Some investors jumped on limited edition coin releases from government mints in the 2000s and 2010s. They expected these to become rare treasures. Unfortunately, mints often produce higher-than-expected quantities, diluting perceived rarity. The market value of these coins often fell short of initial expectations.

Rarity and demand must align for true appreciation. Collectors realized that not all “limited editions” are genuinely limited. Timing the purchase and sale is critical. Without it, these coins are more decorative than lucrative.

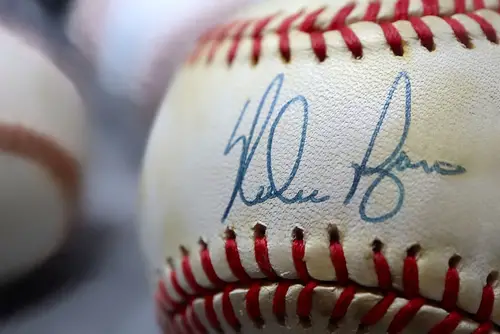

14. Celebrity-Owned Items

Items owned or signed by celebrities often sell for a premium, prompting early investment. However, authenticity issues or shifts in popularity can tank values quickly. What once seemed like a surefire investment can become a costly mistake. Buyers often overpaid for the name rather than the tangible rarity.

Celebrity collectibles are a gamble on both fame and authenticity. Popularity can fade, and provenance is often hard to verify. Investors learned to separate hype from genuine historical or cultural significance. Many early buyers paid the price for jumping in too soon.

This post 14 Collectibles That Backfired on Investors Who Bought Too Soon was first published on Greenhouse Black.