1. Florida

Florida remains a retiree favorite with no state income tax, but living costs vary. Coastal cities like Naples and Sarasota are pricier, with annual expenses often exceeding $50,000 for a comfortable lifestyle. More affordable inland areas like Ocala offer a lower cost of living around $40,000 annually.

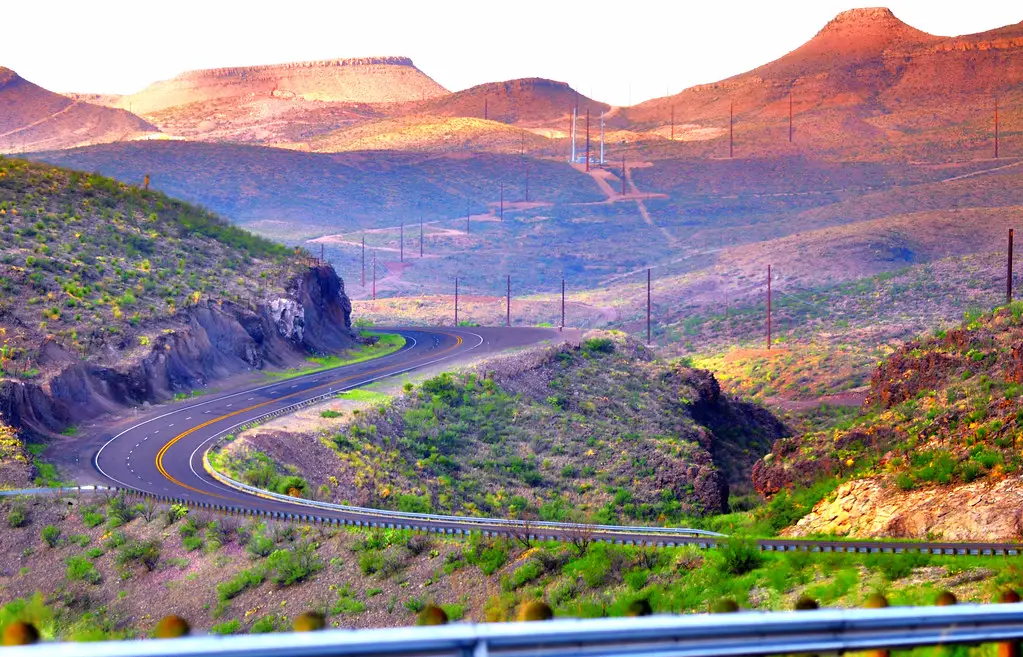

2. Arizona

With warm weather and outdoor activities, Arizona appeals to retirees, but costs can differ significantly by location. Phoenix and Scottsdale tend to be higher, with yearly expenses averaging $50,000-$55,000. Smaller towns like Prescott or Yuma offer affordable living, often under $45,000 per year.

3. Texas

Texas also boasts no state income tax, but housing prices can vary widely. Major metro areas like Austin are expensive, requiring $55,000-$60,000 annually, while smaller towns like Amarillo or Waco can cost $40,000-$45,000. Utilities and healthcare add to overall expenses.

4. North Carolina

North Carolina offers retirees a mix of affordable living and natural beauty. Cities like Asheville cost more, averaging $50,000-$55,000 annually, while smaller towns such as Greenville can offer comfortable living for under $45,000. Taxes are moderate, but healthcare costs are rising.

5. Tennessee

With no state income tax and relatively low property taxes, Tennessee is an affordable choice. Nashville and Chattanooga are more expensive, requiring $50,000 or more yearly, but smaller cities like Knoxville can cost as low as $40,000. Utilities remain reasonable across the state.

6. South Carolina

South Carolina’s charm and mild winters make it popular among retirees. Charleston is on the higher end, with annual expenses exceeding $55,000. More affordable areas like Columbia or Greenville can be managed for $40,000-$45,000 annually.

7. Nevada

Nevada offers retirees no state income tax, but Las Vegas can be expensive, with costs around $55,000 annually. Smaller towns like Reno or Carson City are slightly cheaper, with costs ranging from $45,000-$50,000. Utility costs in the desert climate can add up.

8. Georgia

Georgia combines Southern charm with affordability for retirees. Atlanta and Savannah are pricier, with costs often exceeding $50,000 per year. Smaller towns like Augusta or Macon can offer a comfortable lifestyle for under $40,000 annually.

9. Colorado

Retiring in Colorado offers scenic views but comes with a higher price tag. Denver and Boulder require annual expenses of $60,000 or more, while smaller towns like Grand Junction can cost around $50,000. Taxes and healthcare add to the overall cost.

10. Pennsylvania

With a mix of city and rural living, Pennsylvania caters to diverse retiree needs. Philadelphia is more expensive, with costs exceeding $55,000 annually. Smaller towns like Scranton or Erie offer lower living costs, often under $40,000 per year.

11. Oregon

Oregon offers beautiful landscapes but at a cost, especially in cities like Portland, where annual expenses can exceed $60,000. Smaller towns like Eugene or Bend are slightly cheaper, averaging $50,000-$55,000. High state income taxes and utilities can impact budgets.

12. Alabama

Alabama’s low cost of living makes it an attractive option for retirees. Cities like Birmingham or Huntsville average $40,000-$45,000 annually, while smaller towns can be even cheaper. Affordable housing and moderate taxes are major draws.