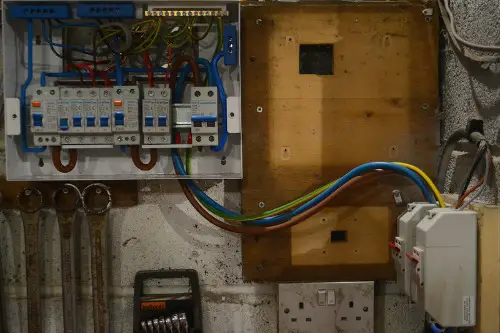

1. Rewiring a Room Without a Permit

One homeowner decided to replace all the old wiring in a bedroom after watching a few online tutorials. Unfortunately, they used undersized wire for the outlets, which overheated behind the walls. The fire department later confirmed the blaze started in a junction box that had no protective cover. Because the electrical work wasn’t permitted or inspected, the insurance company refused to cover the damages.

This is a common clause in home insurance policies: if a fire is caused by unlicensed electrical work, you may be on your own. Insurers see it as an avoidable risk that should have been handled by a certified electrician. Even if you think you did it “by the book,” the lack of a permit can sink your claim. The homeowner ended up paying for both the repairs and the cost of replacing all their furniture.

2. Installing a Wood Stove Without Clearance

A family in a rural area thought a wood stove would save them money on heating bills. They installed it themselves, but didn’t leave enough clearance between the stove and the wall paneling. Over time, the heat dried out the wall, and one night, it caught fire. The blaze spread to the ceiling before firefighters could stop it.

Their insurance company pointed to the stove’s installation manual, which clearly listed minimum clearance distances. Because the stove wasn’t installed according to manufacturer specifications, the fire damage wasn’t covered. This kind of denial happens more often than people think with heating appliances. Even “small” deviations from the rules can be a big deal when an adjuster comes to inspect.

3. Overloading Extension Cords During a Renovation

While remodeling their kitchen, a couple plugged multiple power tools into a single heavy-duty extension cord. It worked fine for a while, until the cord overheated under a pile of sawdust and scraps. A small spark ignited the debris, and the fire moved quickly through the unfinished cabinets. The kitchen was destroyed before the fire department arrived.

Insurers often deny these claims by citing “improper use of electrical equipment.” Extension cords are meant for temporary use, not as permanent outlets. Overloading them is a known fire hazard, and it’s explicitly warned against in most product manuals. The couple was left with not just the bill for the new kitchen, but also a steep cleanup cost from smoke damage.

4. Using the Wrong Finish on a Woodworking Project

One DIYer refinished their dining table using an oil-based stain, then left the rags in a pile in the garage. Spontaneous combustion kicked in when the oils oxidized, and the rags caught fire overnight. By morning, the garage — and part of the house — was gone. The homeowner admitted they had no idea oily rags could self-ignite.

Insurance adjusters quickly ruled the cause as negligence. Most policies have exclusions for “failure to follow product safety instructions,” and the stain can clearly warned to store rags in a sealed metal container. Even though it was an honest mistake, the claim was denied. The cost to rebuild the garage and repair smoke damage topped $50,000.

5. Improper Chimney Cleaning for a DIY Fireplace Upgrade

A homeowner decided to revive an old fireplace by installing a new mantel and cleaning the chimney themselves. They skipped hiring a sweep and used a shop vacuum to remove only the visible soot. Unfortunately, creosote deeper in the flue ignited during their first fire of the season. Flames raced up the chimney and into the attic.

When the insurance inspector found the chimney hadn’t been professionally cleaned or inspected, the claim stalled. Policies often require maintenance to be documented for fire-prone systems like fireplaces. Without receipts or proof, insurers can argue that poor upkeep caused the loss. In this case, they did exactly that, leaving the homeowner with a costly rebuild.

6. DIY Roofing with a Propane Torch

Trying to save money, one homeowner tackled a flat roof repair using roll roofing and a propane torch. They accidentally left the flame too close to the roof insulation while melting the seams. It smoldered for hours before erupting into flames. By the time anyone noticed, the fire had spread to two other rooms.

Insurance companies see open-flame roof work by unlicensed individuals as high-risk and often deny claims outright. It’s considered a “hazardous activity” that voids coverage in some policies. Even professional roofers need special insurance to do torch-down jobs. Doing it yourself without training makes it even harder to get a payout.

7. Homemade Space Heater Modifications

A crafty homeowner decided to “improve” a portable space heater by rewiring the fan and adding a more powerful heating element. It worked — for about two weeks. Then the device overheated, melted the internal wiring, and caught the carpet on fire. The resulting blaze gutted the living room.

Because the fire originated from a modified appliance, the insurer cited “unauthorized alterations” and denied the claim. Many policies exclude fires caused by equipment that has been altered from its factory specifications. In the eyes of the insurer, this wasn’t a manufacturer’s defect but a self-made hazard. The family had to replace all their belongings out of pocket.

8. Attic Insulation Installed Over Recessed Lights

A homeowner installed new insulation in the attic to cut energy bills. They didn’t realize that certain recessed light fixtures need clearance to avoid overheating. The insulation trapped heat around the lights, eventually causing one fixture to ignite. The fire burned a hole through the ceiling into the master bedroom.

An insurance inspection revealed the problem within minutes. The recessed lights were clearly labeled “non-IC rated,” meaning they needed space around them. This type of installation error is a classic reason for denial because it violates both building codes and manufacturer guidelines. The homeowner’s attempt to save on heating costs ended up costing far more in repairs.

9. Unvented Dryer Duct During Basement Remodel

While remodeling their basement, one couple rerouted their dryer vent to blow directly into the room for “extra warmth.” Lint built up on nearby studs and insulation, and within months, the heat from the dryer ignited it. The resulting blaze spread through the basement ceiling and into the first floor. The family escaped, but the house was heavily damaged.

Insurance investigators had no trouble identifying the cause. Building codes — and dryer manuals — require vents to lead outside specifically to prevent fires. Since the setup was not only unapproved but also created a known hazard, the claim was denied. The couple’s “heat hack” ended up costing them their home.

10. Improvised Candle Holders in a Blackout

During a winter storm, a homeowner used empty wine bottles to hold tall candles for light. The bottles tipped over on a cluttered table, igniting papers and curtains. The fire spread quickly, forcing the family to flee. By the time firefighters arrived, half the living room was gone.

While it sounds like bad luck, the insurer labeled it “avoidable negligence.” Using unstable candle holders in an unsafe location falls under policy exclusions for reckless behavior. Even in emergencies, homeowners are expected to use caution and follow fire safety basics. The denial left the homeowner responsible for thousands in repairs.

11. Spray Foam Insulation Near a Hot Water Heater

A DIY enthusiast decided to insulate the basement walls using spray foam. Unfortunately, they sprayed it right up to the hot water heater’s exhaust vent. The foam melted and caught fire when the heater kicked on. It burned silently for a while before spreading to the joists above.

Investigators quickly determined the installation violated clearance requirements. Spray foam manufacturers and building codes specify minimum distances from heat sources. Ignoring those rules meant the fire was considered a result of improper installation, not a sudden accident. The insurance company refused to pay for the damage.

12. Unattended Paint-Stripping with a Heat Gun

One homeowner used a heat gun to strip old paint from window frames. They left it running on a stand while they answered a phone call. The hot air ignited dried paint dust in the sill, and the fire quickly moved into the wall cavity. Neighbors saw smoke and called 911.

Because the tool was left unattended, the insurer had a straightforward path to denial. Many policies exclude coverage for fires caused by unattended equipment in active use. Even a few minutes away can be considered negligence in an adjuster’s eyes. The repair costs ended up being far more than the original renovation budget.

This post 12 DIY Projects That Led to House Fires — And Insurance Denials was first published on Greenhouse Black.