1. Areas Prone to Natural Disasters

Locations that are prone to natural disasters such as hurricanes, floods, or earthquakes often experience fluctuating property values. According to The New York Times, areas in the path of frequent natural disasters, like coastal cities in Florida, can see home values drop after a major event. This is due to the costly damage that can occur and the increased risk of future disasters, which can make potential buyers wary.

In addition, properties in these regions often face higher insurance premiums, making them less attractive to buyers. The risk of flooding, wildfires, and hurricanes also affects long-term property investments, as homes may not appreciate as much as in safer areas. If you own property in a disaster-prone region, it’s important to factor in these risks when considering your home’s value.

2. Cities with Declining Job Markets

A city’s job market plays a huge role in determining its real estate value. According to Forbes, cities with shrinking job opportunities can experience a decline in home values as residents are forced to relocate in search of work. When large employers leave or industries decline, local economies suffer, leading to lower demand for housing. As a result, homeowners may struggle to sell their properties, and prices could drop.

Furthermore, job market declines can lead to a decrease in the overall population, contributing to urban blight and neighborhood deterioration. When fewer people are looking for homes, property values stagnate or fall, making it difficult to secure a profitable sale. If your property is located in a city experiencing job market challenges, it may be worth monitoring local economic conditions closely.

3. Regions with High Crime Rates

High crime rates can significantly impact the value of homes in an area. The National Association of Realtors notes that neighborhoods with higher crime are often considered less desirable, leading to lower property demand. Homebuyers typically look for safe environments for their families, and a higher risk of crime can cause them to avoid purchasing in those areas.

As crime rates rise, property values can fall due to concerns over safety, leading to less interest from potential buyers. Homeowners in these areas may find that their properties take longer to sell, or that they must lower the asking price to attract buyers. If your property is located in a high-crime area, you may face challenges when it comes to maintaining or increasing your home’s value.

4. Areas with Poor School Districts

The quality of local schools can have a significant impact on property values, especially for families with children. According to U.S. News & World Report, homes located in areas with low-rated school districts often see lower property values due to reduced demand. Families tend to prioritize access to good schools, which can drive up the value of homes in well-performing districts.

Poor school districts, on the other hand, can drive potential buyers away, causing home values to stagnate or decline. Properties in these areas may be harder to sell or may require price reductions to attract interest. If you live in an area with a poorly rated school district, this could be a contributing factor to the value of your home.

5. Regions with Poor Infrastructure Development

Infrastructure plays a crucial role in maintaining and boosting home values. Areas with outdated or underdeveloped infrastructure may face declining property values. This can include regions with inadequate public transportation systems, poorly maintained roads, or insufficient access to essential services. Areas that lack modern infrastructure may see slower economic growth, which can directly affect the desirability of the region.

Additionally, areas with poor infrastructure development may struggle to attract new businesses or residents, leading to stagnation in the real estate market. Without investments in infrastructure improvements, these areas may see home values drop over time, as they fail to compete with more developed regions. If your property is located in an area with poor infrastructure, it’s important to be aware of these potential long-term risks.

6. Areas with High Levels of Pollution

Environmental pollution can lead to long-term decreases in property values, particularly in urban areas with poor air or water quality. Research shows that properties located near factories or industrial zones often see lower home values due to the negative impact of pollution on health and quality of life. Homes in polluted areas can be less desirable, leading to reduced demand and lower sale prices.

In addition, environmental issues such as poor air quality or contaminated water sources can discourage new residents from moving to these areas. As a result, properties in polluted regions can experience a steady decline in value over time. If your property is located near industrial zones or areas with high pollution levels, the potential for home value depreciation could be a concern.

7. Gentrifying Neighborhoods

Gentrification can lead to both positive and negative effects on property values. Areas undergoing gentrification may initially see home values rise due to the influx of new businesses and higher-income residents. However, gentrification can also lead to displacement, with longtime residents being pushed out by rising property taxes and increased rent prices. This can create volatility in the housing market.

In some cases, gentrifying neighborhoods may experience a drop in home values once the initial wave of improvements fades or becomes unsustainable. Homeowners may find that their properties become less valuable if gentrification causes social tensions or economic instability. If your property is in a gentrifying neighborhood, it’s important to carefully assess the long-term implications for your home’s value.

8. Areas with Overbuilding

Overbuilding in certain regions can lead to an oversupply of homes, which can cause property values to decrease. When there are more homes available than there is demand, prices typically drop as sellers compete to attract buyers. This is particularly concerning in markets where new housing developments outpace population growth or demand for homes.

In areas experiencing overbuilding, home values may stagnate or decline as the market becomes saturated. Homeowners may find it harder to sell their properties, and prices could fall due to the excess supply. If your area is undergoing extensive new development, it could have an impact on your home’s future value.

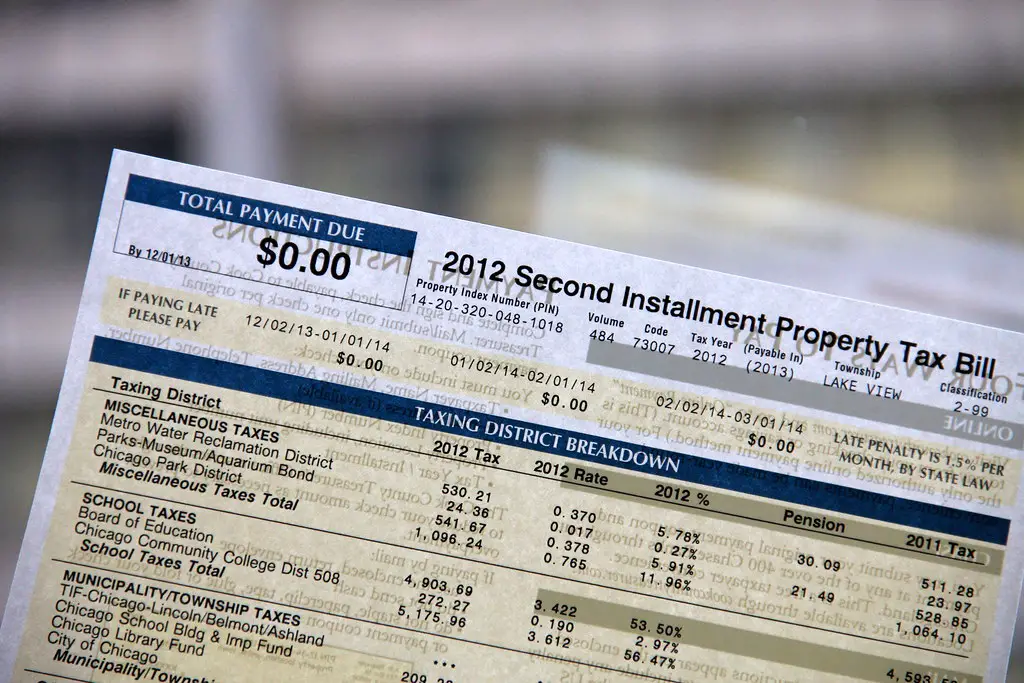

9. Regions with High Property Taxes

High property taxes can make homeownership expensive, which may discourage potential buyers. Areas with high property taxes often experience slower home value growth as homeowners struggle with the financial burden of taxes. Rising property taxes can drive people to relocate to more affordable regions, leading to a decrease in demand for homes in high-tax areas.

In addition, high property taxes can result in reduced disposable income for residents, making it more difficult for them to invest in home improvements or other factors that might increase a property’s value. If your property is in an area with high taxes, this could affect the long-term appreciation of your home.

10. Flood-Prone Areas

Living in a flood-prone area can significantly impact your home’s value. Homes located in flood zones may experience a drop in value due to the high risk of flood damage. Properties in these areas often face higher insurance premiums, making them less attractive to potential buyers.

Flood-prone areas can also become difficult to sell due to concerns about the cost and frequency of flood damage. Homes in these regions may require frequent repairs and may not see the same level of appreciation as homes in safer areas. If your property is located in a flood-prone zone, it’s important to consider these factors when evaluating your home’s value.

11. Remote or Isolated Locations

Properties located in remote or isolated areas may struggle to maintain their value over time. Homes in rural or isolated locations often face lower demand due to their distance from urban centers and amenities. Without access to essential services like schools, hospitals, or shopping, these homes can become less desirable to potential buyers.

In addition, properties in remote areas may have limited resale potential, as fewer buyers are interested in living in secluded locations. Over time, the lack of demand can lead to stagnating or declining property values. If your property is in a remote location, it may be more vulnerable to value fluctuations.

12. Declining Tourist Destinations

Tourism can significantly impact property values, particularly in areas that rely on visitors for economic stability. Declining tourism can lead to a drop in property demand, as businesses close and the local economy suffers. Areas that once thrived as tourist destinations may see home values fall as fewer people are attracted to the region.

In addition, the lack of investment and infrastructure improvements in declining tourist areas can contribute to property value decreases. If your property is located in a region where tourism is on the decline, it’s important to stay informed about economic shifts and local developments that could affect the market.

13. High Vacancy Rates

High vacancy rates in an area can indicate a lack of demand for housing, which can directly impact property values. Areas with high vacancy rates often struggle with neighborhood decline, as empty homes can lead to increased crime and maintenance issues. High vacancy rates are a red flag for real estate investors and homebuyers alike.

When vacancy rates rise, it often signals that there is insufficient demand for properties, leading to a reduction in home values. If your property is located in an area with high vacancy rates, it may take longer to sell, and you may need to lower your asking price to attract potential buyers.

14. Areas with Unstable Political or Economic Conditions

Political instability and economic uncertainty can have a significant effect on property values. Areas with unstable political environments or struggling local economies often see a decrease in property demand. Buyers tend to avoid regions where political unrest or economic instability may threaten their investments, leading to declining home values.

If your property is located in an area experiencing political or economic turmoil, you may face challenges in maintaining or increasing your home’s value. These conditions can create uncertainty in the housing market, making it more difficult to sell properties at desirable prices.

15. Areas Dependent on a Single Industry

Communities that rely heavily on one industry, such as coal towns in West Virginia or oil-dependent regions in North Dakota, often see sharp declines in home values when those industries face downturns. When large employers shut down or demand for a product falls, workers are forced to relocate, leaving behind vacant homes. As populations shrink, local economies weaken and housing demand plummets. This makes real estate in single-industry regions particularly vulnerable to sudden value losses.

Even if the broader economy improves, recovery in these areas can be slow without diversification. Communities built around a single employer or sector often lack the infrastructure or investment to bounce back quickly. Homeowners may find it difficult to sell their properties or maintain equity as the housing market struggles to recover. If your property is located in a single-industry area, your home’s long-term value could be at risk.

16. Areas with Aging Housing Stock

Neighborhoods with older housing stock, like parts of Buffalo, New York, or Cleveland, Ohio, can struggle with declining property values. Homes built decades ago often require significant repairs, from new roofs to plumbing and electrical updates. When large numbers of properties in a neighborhood show visible signs of aging, the area can lose appeal to potential buyers. This lowers overall demand and puts downward pressure on home prices.

At the same time, newer developments in nearby suburbs can attract buyers seeking modern amenities, leaving older neighborhoods behind. Without reinvestment or renovation efforts, these communities risk long-term stagnation in property values. Buyers often prefer move-in-ready homes, which makes selling older properties more difficult. If your home is located in an area with aging housing stock, its value may not appreciate as quickly as homes elsewhere.

17. Suburbs Experiencing Population Decline

Some suburban areas, such as parts of Detroit’s outskirts or older communities outside St. Louis, have experienced long-term population decline. As younger generations move toward urban centers or faster-growing regions, these suburbs are left with shrinking demand for housing. Fewer buyers mean longer selling times and potentially lower sale prices. Over time, this lack of demand can drag down property values significantly.

Declining populations can also hurt local services like schools, businesses, and healthcare facilities. As amenities close or deteriorate, neighborhoods become less attractive to potential buyers. With fewer resources and declining infrastructure, property values often remain flat or fall. If you own a home in a suburb facing population decline, you may find it harder to maintain or increase your home’s worth.

18. Areas Hit Hard by Foreclosures

Regions that suffered heavily during the housing crisis, like parts of Las Vegas, Nevada, or Stockton, California, can struggle for years with lingering foreclosure effects. High foreclosure rates often leave behind abandoned or poorly maintained properties, which can depress neighborhood values. Even after markets recover, the reputation of these areas can make buyers hesitant. This stigma can lead to slower appreciation compared to other markets.

Additionally, foreclosures often drive down comparable sales in a neighborhood, setting lower price expectations for future buyers. A high number of distressed properties can overwhelm housing supply, further pushing down values. Homeowners in these areas may need to wait longer to see significant equity growth. If your property is in a foreclosure-prone region, its value may not rebound as quickly as expected.

19. Areas with Declining Retail Centers

Communities where retail hubs have closed, like parts of Akron, Ohio, or Rockford, Illinois, often experience falling home values. When major malls and shopping centers shut down, they leave behind large vacant spaces that reduce neighborhood appeal. The decline of local retail also signals economic weakness, which can scare off potential buyers. These shifts can drag down the desirability of nearby housing markets.

As retail centers close, residents may need to travel farther for shopping and daily needs, making the area less convenient. Empty retail buildings can also attract vandalism or crime, creating a negative image for the community. Buyers often avoid neighborhoods where commercial decline is visible, further reducing demand. If your home is near a declining retail center, its long-term value could suffer.

20. Areas Facing Climate Change Risks

Climate change is creating new risks for property owners in places like Miami, Florida, and New Orleans, Louisiana. Rising sea levels and stronger hurricanes are increasing the vulnerability of coastal homes. These risks not only drive up insurance costs but also reduce long-term buyer interest in flood-prone regions. Over time, the perception of danger can depress home values significantly.

Even inland areas aren’t immune, as hotter summers and drought conditions affect states like Arizona and California. Limited water resources and extreme heat can make some regions less attractive to potential buyers. As environmental challenges grow, buyers may favor areas seen as safer or more resilient. If your property is in a climate-risk zone, you may face challenges in preserving or increasing its value.

21. Areas with Poor Public Transportation

Cities and suburbs lacking strong transit systems, like parts of Atlanta, Georgia, or Houston, Texas, can see slower home value growth. Buyers often value easy access to public transportation for commuting and convenience. Without it, areas may be seen as less desirable, especially among younger professionals who prefer not to rely on cars. This can lead to weaker demand and lower property appreciation.

Poor transportation infrastructure can also affect long-term economic growth, limiting job opportunities and deterring new residents. As congestion worsens, living in these areas may become more frustrating for homeowners. Properties in poorly connected regions often struggle to keep pace with values in more accessible neighborhoods. If your home is in a location without reliable public transit, its value could lag behind more connected areas.

22. Small Towns Losing Young Residents

Many small towns in the Midwest and Northeast, such as Youngstown, Ohio, or Elmira, New York, face ongoing challenges as young residents leave for bigger cities. This outmigration leads to aging populations and declining demand for housing. With fewer buyers in the market, property values can stagnate or fall. The lack of economic opportunity often discourages new families from moving in, further compounding the issue.

As populations shrink, local services such as schools, restaurants, and healthcare facilities may close or scale back. This creates a cycle of decline that makes the town even less attractive to potential buyers. Without new investment or opportunities, property values in these areas often struggle to recover. If you own a home in a small town losing its younger population, your property could be at risk of long-term value loss.

This post If You Own Property in These 22 Areas, Your Home Value Could Be in Trouble was first published on Greenhouse Black.