1. A New Grocery Store Moves In

When a big-name or upscale grocery store pops up, it’s often a sign the neighborhood is changing. Retailers do a lot of research before choosing a location, so their presence suggests the area is attracting higher-income households. Think about stores like Whole Foods or Trader Joe’s, which tend to follow demographic shifts closely. Once they move in, property values and rents nearby usually start creeping up.

Homeowners should pay attention because these stores can be magnets for development. Along with the grocery store, you may see new cafés, gyms, or boutiques opening nearby. That increased convenience comes with higher demand, which tends to push home prices higher. Even if you don’t shop there, the ripple effect is hard to ignore.

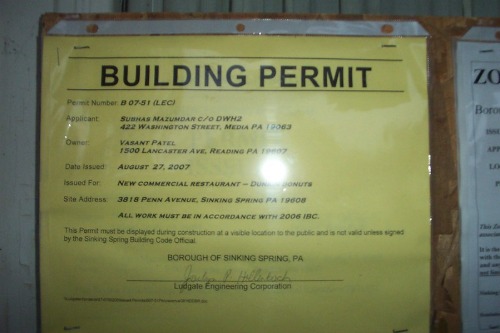

2. Lots of Renovation Permits Being Pulled

If you’re seeing dumpsters in driveways or construction crews regularly in the neighborhood, it usually means people are investing heavily in their homes. Local governments often publish permit activity, which can show a spike in renovations or additions. This suggests homeowners or investors expect property values to rise and want to maximize returns. It can also be a sign that buyers with more money are moving in.

For longtime homeowners, this activity signals that the cost of living may increase. Higher property values often lead to higher property taxes, even if you’re not personally renovating. Plus, neighborhoods in transition can bring new rules or stricter code enforcement. It’s an early clue that the financial landscape may shift.

3. A New School or Rezoning Announcement

When a neighborhood lands a new school, or when existing school boundaries change, it can reshape the market quickly. Families often prioritize access to better-rated schools, and demand follows the zoning map. This kind of demand pushes prices up in areas included in favorable districts. If you notice announcements from your school board, it’s worth paying attention.

Even if you don’t have kids, the impact will touch your wallet. Stronger school ratings usually translate into higher property taxes to support expanded services. At the same time, it creates more competition for homes within those boundaries. That can make buying and staying in the area more expensive.

4. Trendy Restaurants and Coffee Shops Appear

Local dining options can be a good indicator of change. When small, independent restaurants and stylish coffee shops open, they’re often testing areas that are becoming hotspots. These businesses rely on steady traffic from residents with disposable income. Their arrival usually hints that the area is on developers’ radars.

For homeowners, this is both a perk and a warning. While it’s nice to have a latte spot within walking distance, it’s also a sign that costs will rise. Higher demand for housing follows lifestyle amenities. Over time, your tax bill and insurance costs may climb along with the buzz.

5. Public Transit Expansions or New Stations

A new bus line or train stop can change the character of a neighborhood overnight. Transit improvements make commuting easier, which draws more people into the area. That increased accessibility tends to push property values up quickly. Developers often target these neighborhoods for apartments and mixed-use projects.

If you own a home nearby, expect change. Property taxes and assessments usually follow once the area becomes more desirable. On top of that, more people moving in can bring new rules or fees, like parking restrictions. It’s one of the clearest signals that costs will rise.

6. Parks and Green Spaces Get Upgrades

When the city invests in revitalizing parks or creating new trails, it makes the area more attractive. Families and outdoor enthusiasts gravitate toward neighborhoods with better recreational amenities. Over time, this leads to higher property demand and, in turn, higher costs. A well-maintained park is often a first step in larger redevelopment plans.

For homeowners, this can feel like a mixed blessing. You get nicer amenities nearby, but also higher appraisals and taxes. Sometimes, it sparks stricter HOA rules to “keep up appearances.” Watching where municipal dollars are being spent can give you an early warning of these shifts.

7. More Short-Term Rentals on Your Street

An uptick in Airbnbs or other short-term rentals often signals that your neighborhood is becoming more desirable for out-of-towners. Investors usually target places with rising popularity, knowing they can charge higher nightly rates. That activity can indirectly raise housing demand and property values. Over time, it also changes the community’s feel.

For existing homeowners, this can be a sign of costs edging up. More rentals often mean more scrutiny from local governments, which may introduce new taxes or fees. Insurance premiums can also rise in neighborhoods with heavy rental activity. While it brings foot traffic and money into the area, it can make living there pricier.

8. Major Employers Announce Moves Nearby

If a big company is setting up shop close to your neighborhood, it usually means an influx of new jobs. Those jobs attract new residents, many of whom are willing to pay more for housing near work. This increased demand can raise both rents and home values. A single employer shift can alter the whole housing market.

Homeowners should watch local business news carefully. Even announcements that seem far off can signal rising costs in the near future. Property taxes and assessments often jump once demand for housing increases. It’s one of the clearest external signs of what’s ahead.

9. Boutique Gyms and Fitness Studios Arrive

Fitness chains tend to set up where residents can afford premium memberships. Whether it’s a spin studio, yoga center, or a climbing gym, these businesses often mark an upswing in neighborhood affluence. Their arrival usually suggests that more costly services and businesses will follow. That translates to higher costs of living for locals.

For homeowners, it’s an early sign to prepare for shifts in your budget. The neighborhood may become trendier, which drives up property values. It can also bring in younger, wealthier demographics who compete in the housing market. Fitness may be good for health, but it can make your wallet feel the strain.

10. Increased Code Enforcement or HOA Activity

When cities or neighborhood associations suddenly start cracking down on maintenance, it’s usually tied to rising property values. Leaders want the area to “look better” to match its changing reputation. That can mean stricter rules on landscaping, exterior paint, or even parking. While this can raise curb appeal, it also raises homeowner costs.

Homeowners should note these changes quickly. New rules might mean unexpected expenses for compliance. Plus, higher community standards usually point to an incoming wave of redevelopment. It’s rarely just about appearances—it’s about positioning the neighborhood for higher values.

11. Higher-End Housing Developments Breaking Ground

When you see luxury condos, townhomes, or large new builds under construction, it’s a direct signal of change. Builders put money into areas where they see potential for higher returns. These developments attract buyers with larger budgets, shifting the neighborhood’s profile. They often serve as a turning point for overall costs.

For existing homeowners, these projects usually mean higher property values and taxes. The arrival of wealthier residents often spurs more upscale businesses to move in. Over time, this transforms the cost structure for the whole community. Watching construction projects is a practical way to gauge what’s ahead.

12. Local Taxes or Assessments Rise

A bump in property tax rates, school levies, or special assessments is more than just paperwork. It often reflects increasing demand in the area. Local governments raise taxes to cover infrastructure, schools, or amenities, especially when growth is happening. This can hit homeowners’ wallets directly.

While rising taxes are frustrating, they’re also a clue. They signal that your area is gaining attention and investment. Often, higher taxes coincide with more services and development nearby. Unfortunately, they rarely go down once they’ve gone up.

13. New Zoning Changes or Development Plans

City councils and planning commissions often release updates about zoning or redevelopment plans. When land use shifts from industrial or low-density to mixed-use or residential, it’s a sign of growth ahead. These changes open the door for more housing and commercial projects. That activity usually drives up nearby home prices.

Homeowners should monitor public notices and planning board agendas. Even if construction isn’t visible yet, policy changes are the first step. Over time, they almost always mean higher living costs and more pressure on existing residents. It’s an early-warning system many people overlook.

14. More Media Coverage of the Neighborhood

When you start seeing your neighborhood highlighted in “best places to live” lists or lifestyle blogs, take note. Media buzz often precedes rising demand, as more people become curious about moving there. This type of attention attracts both buyers and investors. Once the spotlight hits, the local market usually accelerates.

For homeowners, this can feel exciting but also costly. Increased attention leads to higher property values, which translates into higher taxes. It can also mean more competition for services and amenities. While the neighborhood’s reputation grows, so do the costs of keeping up with it.

This post 14 Neighborhood Clues That Signal Rising Costs for Homeowners was first published on Greenhouse Black.