1. Infrastructure money is finally getting spent

When a place has been written off for years, big infrastructure projects are usually the last thing to arrive. If you start seeing long-delayed road repairs, bridge work, or utility upgrades actually breaking ground, that is a meaningful shift. Much of this is tied to federal and state funding that takes years to move from approval to construction. Construction starting now often reflects decisions made when leaders believed the area was worth reinvesting in.

These projects matter because they lower costs and risks for everything that comes next. Reliable roads, water systems, and power grids make it easier for employers, developers, and residents to commit long term. Infrastructure spending also creates local jobs that circulate money immediately through the community. By the time the orange cones show up, a rebound is often already quietly underway.

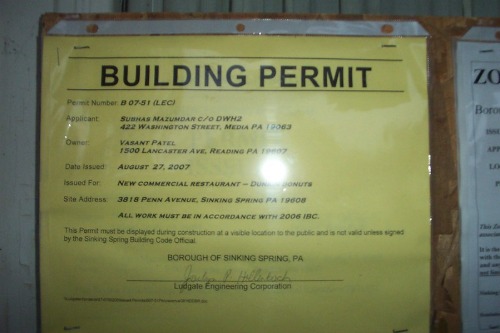

2. Building permits stop falling and start creeping up

Housing markets tend to sense change before most people do. If building permits and renovation applications stop declining and begin inching upward, that is rarely random. Developers are cautious by nature and usually avoid areas they believe will keep losing value. An uptick suggests they see future demand, not just cheap land.

This is especially telling when the permits are for modest projects, not luxury outliers. Small apartment buildings, duplexes, and rehabs point to realistic expectations about who will live there. Local governments also tend to streamline approvals only when they want growth to resume. Together, these shifts hint that the housing market is repositioning rather than collapsing.

3. Population loss slows, then quietly reverses

Rapid population decline gets headlines, but stabilization rarely does. When census estimates or school enrollment numbers stop falling year over year, that is a subtle but important signal. It often means the people most able to leave already have. What remains is a population choosing to stay and invest locally.

Early population rebounds are usually driven by younger adults and immigrants. They are more willing to trade risk for affordability and opportunity. Even small inflows can support restaurants, rentals, and neighborhood retail. Once those basics stabilize, larger demographic shifts often follow.

4. Small businesses start opening without heavy subsidies

When a declining area wants to look healthy, officials often lure businesses with grants and tax breaks. A more interesting signal is when small businesses open without much fanfare or incentive. Think barbershops, coffee spots, childcare centers, and repair services. These owners are betting their own money on consistent local demand.

Small businesses operate close to the ground and feel changes early. They rely on foot traffic, repeat customers, and word of mouth. If several open within a short period, it suggests confidence is spreading informally. That kind of organic growth is harder to fake and easier to sustain.

5. Crime trends improve in specific, measurable ways

Crime statistics are complicated, but patterns still matter. A rebound often begins with declines in the most disruptive everyday crimes, like auto theft or burglary. These improvements tend to show up before overall crime rates dramatically fall. They reflect better policing strategies and stronger community engagement.

Residents notice these changes long before national data catches up. Feeling safer running errands or parking overnight changes behavior quickly. More people outside means more eyes on the street and stronger informal control. That feedback loop can accelerate recovery faster than policy alone.

6. Remote workers quietly move in

Remote work has reshuffled the American map in uneven ways. Declining areas with low housing costs and decent amenities are increasingly attractive to remote workers. These moves rarely show up in splashy announcements. They show up in home purchases, coworking spaces, and weekday coffee shop crowds.

Remote workers bring outside income into the local economy. They are less tied to local job markets, which reduces economic volatility. Over time, they can support better services and new businesses. Their presence often signals that quality of life is improving enough to compete nationally.

7. Schools and training programs get new investment

Education funding decisions are forward-looking by nature. When school districts renovate buildings or expand career and technical programs, they are planning for stable enrollment. Community colleges and trade schools often lead this shift. They respond directly to local employer demand.

Workforce training suggests employers expect to hire locally. That expectation rarely exists in places seen as terminally declining. Improved education options also make it easier for families to stay or move in. Over time, this builds a more resilient local labor market.

8. Zoning rules start to loosen

Zoning reform is usually reactive, not proactive. Cities loosen rules when pressure builds for more housing or mixed use development. Allowing accessory dwelling units or denser projects signals renewed demand. It also suggests political leadership is adapting to growth rather than fighting it.

Developers pay close attention to these changes. Flexible zoning lowers risk and increases project feasibility. It can unlock infill development in long neglected neighborhoods. That kind of incremental density often accompanies early rebounds.

9. Healthcare access expands instead of contracts

Hospitals and clinics are brutally data driven. If a healthcare system expands services or opens a new facility in a struggling area, it sees sustainable demand. This may include urgent care centers, mental health services, or specialty clinics. These investments are hard to reverse once made.

Better healthcare access improves quality of life almost immediately. It also makes the area more attractive to employers and older residents. Healthcare jobs tend to be stable and locally anchored. Their growth often anchors broader neighborhood recovery.

10. Arts, culture, and nightlife return at a small scale

Large cultural projects get attention, but small ones matter more early on. Pop up galleries, live music nights, and independent theaters often reappear first. These ventures depend on disposable income and a sense of safety. Their return suggests both are improving.

Cultural activity changes how people talk about a place. It draws visitors from nearby areas who had written it off. That external attention can attract further investment. Reputation shifts often lag reality, but culture helps close the gap.

11. Climate resilience projects move from planning to action

Many declining areas are also vulnerable to climate risks. When resilience projects like flood control, heat mitigation, or grid hardening begin construction, priorities have shifted. These projects are expensive and require long term commitment. They indicate confidence the area will still matter decades from now.

Resilience lowers insurance costs and future disaster losses. That makes private investment more viable. It also reassures residents considering whether to stay. Few places invest in protection unless they expect a future worth protecting.

12. Local optimism becomes cautious but practical

The final signal is harder to quantify but easy to feel. Residents stop saying things will magically get better and start talking about specific improvements. They mention a new employer, a safer street, or a reopened store. This kind of grounded optimism spreads slowly but sticks.

People make long term decisions based on shared expectations. When enough residents believe staying makes sense, decline loses momentum. Investment follows belief as much as data. By the time optimism sounds boring, a rebound is often real.

This post 12 Signals a “Declining” Area Is About to Rebound was first published on Greenhouse Black.