1. Naperville, Illinois

Naperville has become one of the most sought-after suburbs in Illinois, but with popularity comes higher costs. Property taxes in this area have seen significant increases due to rising home values and expanded municipal services. Residents are feeling the pinch as the tax burden continues to climb.

2. Westfield, New Jersey

Westfield’s proximity to New York City and its charming downtown have made it a desirable place to live. However, property taxes in this suburb are skyrocketing as home values appreciate and local infrastructure projects demand funding. Homeowners are now paying some of the highest rates in the region.

3. Plano, Texas

While Texas is known for its lack of state income tax, property taxes in suburbs like Plano are climbing steeply. The booming housing market and demand for quality schools have led to increased levies. Families moving to the area should prepare for higher tax bills.

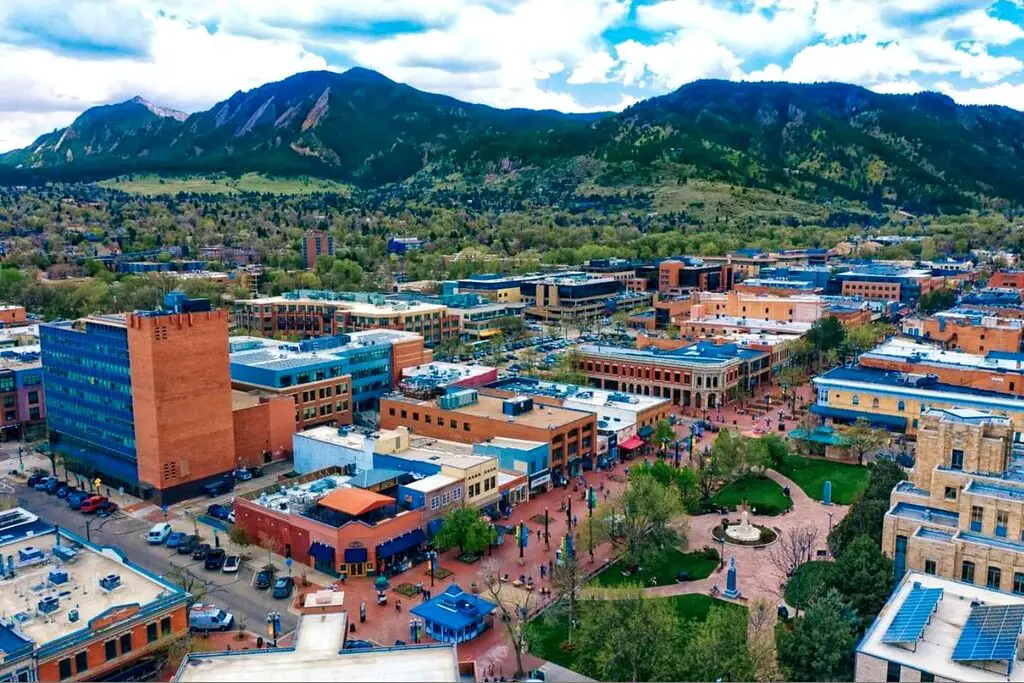

4. Boulder, Colorado

Boulder’s stunning landscapes and thriving economy have caused property values to soar, resulting in skyrocketing property taxes. Local government initiatives to improve public amenities have further contributed to the increases. Residents are grappling with the financial challenges that come with the area’s desirability.

5. Newton, Massachusetts

Newton, known for its top-rated schools and proximity to Boston, is experiencing a dramatic rise in property taxes. The growth in home prices has pushed tax assessments higher, impacting longtime residents. The suburb’s appeal comes with a hefty price tag for homeowners.

6. Scottsdale, Arizona

Scottsdale’s luxury living and year-round sunshine have driven up home values, leading to surging property taxes. Local investments in infrastructure and recreational facilities have also contributed to the tax hikes. Residents are finding it increasingly expensive to maintain their lifestyle in this upscale suburb.

7. Greenwich, Connecticut

Greenwich remains a haven for affluent homeowners, but its rising property taxes are becoming a concern. The town’s emphasis on maintaining high-quality services and public spaces has increased tax bills substantially. Many are questioning whether the benefits outweigh the costs.

8. Bellevue, Washington

Bellevue’s tech-driven economy and proximity to Seattle have made it a hotspot for homebuyers, but property taxes have climbed in tandem. With new developments and growing public service needs, the tax burden has risen sharply. Homeowners are seeing a significant impact on their annual expenses.

9. Evanston, Illinois

Evanston’s mix of urban and suburban charm has led to increased demand for housing, pushing property taxes higher. Investments in schools and public projects are driving the hikes, leaving residents with larger tax bills. The suburb’s appeal now comes with a steep cost of living.

10. Cherry Hill, New Jersey

Cherry Hill has long been a popular choice for families, but rising property taxes are creating challenges for homeowners. Local development and increasing school funding needs have contributed to the hikes. Residents are paying significantly more than they did just a few years ago.

11. San Mateo, California

San Mateo’s location in the heart of Silicon Valley has made it a prime spot for high-income earners, but property taxes have risen accordingly. Skyrocketing home values and growing municipal expenses have pushed tax rates higher. For many, the cost of owning a home in this suburb is becoming prohibitive.

12. Oak Park, Illinois

Oak Park’s historic charm and proximity to Chicago have made it a favorite among homebuyers, but property tax rates are climbing quickly. Funding for public programs and schools has added to the tax burden. Residents are finding it challenging to keep up with the rapid increases.

13. Brookline, Massachusetts

Brookline’s blend of suburban living and urban convenience has led to rising home prices and, in turn, skyrocketing property taxes. The town’s commitment to maintaining high standards for schools and services has driven up costs. Longtime residents are struggling to keep pace with the changes.

14. Palo Alto, California

Palo Alto, synonymous with Silicon Valley affluence, is seeing property taxes soar alongside its already high home values. Infrastructure improvements and public investments have added to the tax burden. Homeowners in this prestigious suburb are paying some of the highest rates in the state.

15. Bethesda, Maryland

Bethesda’s status as a cultural and economic hub near Washington, D.C., has made it highly desirable, but property taxes are on the rise. As home values increase and local government expands services, residents are facing significant tax hikes. The cost of living in this vibrant suburb continues to climb.