1. Bigger Houses, Smaller Returns

It feels like a natural step up to move into a bigger house once you can afford it. More space, more status, more comfort—at least that’s the pitch. But larger homes come with higher property taxes, insurance premiums, utility bills, and maintenance costs. Those ongoing expenses rarely increase the home’s resale value dollar-for-dollar.

Historically, housing appreciates primarily based on location and market conditions, not square footage alone. A 4,000-square-foot house in a stagnant area can underperform a modest home in a high-demand neighborhood. Meanwhile, the owner absorbs years of elevated costs. The “upgrade” often increases lifestyle overhead more than long-term net worth.

2. New Cars and Instant Depreciation

Driving a new car off the lot feels like a reward for hard work. The smell, the shine, the untouched odometer—it all signals progress. But new vehicles typically lose significant value in their first year, often around 20% or more. That depreciation happens regardless of how well you care for it.

Used cars, especially those a few years old, have already absorbed that initial drop. Mechanically, many modern vehicles last well past 150,000 miles with proper maintenance. Paying a premium for “brand new” often buys status rather than durability. Financially, the upgrade transfers wealth from you to the dealership faster than you might expect.

3. Constantly Replacing Technology

It’s tempting to swap out your phone or laptop every year. Marketing cycles are designed to make last year’s model feel obsolete. Yet performance improvements between annual releases are often incremental rather than revolutionary. For many users, the functional difference is barely noticeable.

Meanwhile, electronics depreciate rapidly and resale values drop as new models launch. Perfectly functional devices end up replaced long before they’re unusable. Stretching upgrade cycles from one year to three can dramatically lower total ownership costs. In many cases, the “upgrade” mainly refreshes aesthetics rather than productivity.

4. Renovations That Overpersonalize

Home renovations are often framed as investments. Open kitchens and updated bathrooms can indeed boost resale value. But highly customized features—like niche luxury finishes or unusual layouts—don’t always recoup their cost. Buyers rarely pay full price for someone else’s tastes.

Data from real estate markets consistently show that most remodeling projects return less than 100% of their cost at resale. High-end kitchen remodels, in particular, often recoup only a portion of what was spent. If you renovate purely for enjoyment, that’s valid. But calling every upgrade an “investment” stretches the math.

5. Premium Subscriptions That Multiply

Upgrading from basic to premium plans feels small in isolation. Five extra dollars here, ten dollars there—it doesn’t seem dramatic. But stacked across streaming services, software tools, music platforms, and delivery memberships, the total compounds quickly. Monthly expenses become permanent financial fixtures.

Companies rely on subscription models because recurring revenue is predictable and profitable. Consumers, however, often forget to reassess whether they still use the added features. The upgrade that once felt exciting quietly becomes background overhead. Over time, these invisible commitments erode discretionary income.

6. Bigger Weddings, Longer Bills

Many couples feel pressure to “upgrade” their wedding to match social expectations. Larger guest lists, premium venues, and elaborate décor can double or triple the budget. In the United States, average wedding costs regularly reach tens of thousands of dollars. That spending often happens before a couple builds long-term savings.

Research consistently shows that higher wedding spending does not correlate with stronger marriages. The financial stress from large upfront costs can even strain newlyweds. A memorable celebration doesn’t require maximal spending. In purely financial terms, upgrading the event often subtracts from future flexibility.

7. Lifestyle Inflation After Raises

A raise feels like progress, and it is. But many people immediately upgrade apartments, cars, wardrobes, and vacations to match their higher income. Economists call this “lifestyle inflation,” and it can neutralize the wealth-building power of earnings growth. Savings rates often stay flat even as income rises.

If fixed expenses grow in lockstep with salary, financial independence moves further away. The extra income that could have compounded through investing gets redirected into consumption. Over time, this pattern can delay major goals like home ownership or retirement. The upgrade feels proportional, but the opportunity cost is substantial.

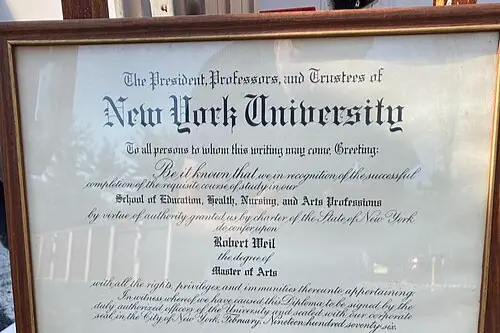

8. Expensive Degrees Without ROI

Education can be one of the best investments a person makes. However, not all degrees yield the same financial return. Tuition costs have risen significantly over the past few decades, increasing the burden of student loans. Some graduate programs leave students with high debt relative to expected income.

When additional credentials do not materially increase earning potential, the “upgrade” may not pay for itself. This is especially true in fields where experience outweighs additional academic qualifications. Debt repayments can last for decades and limit other financial decisions. The key question isn’t prestige, but return on investment.

9. Upsizing Daily Habits

Upgrading small daily choices adds up faster than most people realize. Choosing premium coffee, ride-share over public transit, or frequent restaurant meals may feel minor. Yet these recurring costs can total thousands of dollars annually. The spending becomes routine and unquestioned.

Behavioral finance research shows that small, repeated expenses often escape scrutiny because they don’t feel dramatic. But over years, those habits can equal the cost of a vacation or sizable investment contribution. There’s nothing wrong with enjoyment. The issue is assuming small upgrades are financially neutral when they’re not.

10. Chasing Luxury Brands

Luxury goods promise higher quality and longer life. Sometimes that’s true, particularly with well-made items crafted from durable materials. But price premiums often reflect branding, marketing, and perceived status. The functional difference between mid-tier and luxury can be narrower than the price gap suggests.

Consumer research consistently finds diminishing returns at the high end of pricing tiers. Paying double doesn’t usually mean receiving double the performance. If the motivation is social signaling, the financial return is effectively zero. The upgrade might elevate image, but not intrinsic value.

11. Scaling Businesses Too Quickly

In business, upgrading can mean expanding rapidly—more staff, bigger offices, new markets. Growth sounds inherently positive. Yet scaling increases fixed costs and operational complexity. If revenue projections fall short, those new expenses remain.

Many startups fail not because demand is absent, but because overhead outpaces cash flow. Premature expansion strains capital and can dilute focus. Sustainable growth often requires measured, incremental increases. An upgrade in size without stability underneath can quietly destroy enterprise value.

This post Why “Upgrading” Often Destroys Worth was first published on Greenhouse Black.