1. Obvious Deferred Maintenance

If an appraiser walks up to a house and sees peeling paint, sagging gutters, or a cracked driveway, that’s an immediate red flag. These signs suggest that the home hasn’t been consistently cared for, which can hint at deeper issues. Even small things, like missing caulk around windows or a broken fence post, create the impression of neglect. Appraisers know buyers will use those flaws to negotiate a lower price, so they factor it in.

Deferred maintenance also signals potential repair costs that buyers may not want to shoulder. An appraiser’s job is to estimate what someone would realistically pay for the property today, not in its “perfect” condition. If repairs are needed, value will dip. That’s why staying on top of maintenance pays off when it’s time to sell.

2. Roof in Poor Condition

The roof is one of the first big-ticket items appraisers assess, and a failing one can slash value quickly. Missing shingles, water stains on ceilings, or obvious sagging are dead giveaways. A compromised roof isn’t just cosmetic—it raises questions about leaks, insulation, and structural safety. Buyers know they’ll need to budget thousands for replacement, and appraisers reflect that in the valuation.

A healthy roof also ties directly to a home’s insurability and mortgage approval. If the roof is too far gone, lenders may balk at financing altogether. That makes the property less marketable, which drags down value. In other words, the roof is one corner of the home you can’t ignore.

3. Outdated Electrical or Plumbing

Appraisers pay attention to the bones of the home, and outdated systems are a major red flag. Old knob-and-tube wiring, limited electrical panels, or corroded plumbing scream “expensive upgrade ahead.” Beyond cost, there are safety issues that make older systems a liability. Buyers typically shy away unless the price reflects the need for modernization.

Modern systems, on the other hand, add reassurance that the home is safe and functional. Appraisers know buyers value peace of mind, and functioning infrastructure delivers that. If updates haven’t been made, appraisers adjust the value to account for buyer hesitation. It’s one of those hidden elements that quietly makes or breaks a home’s appeal.

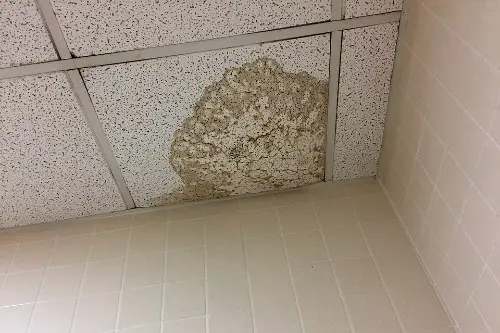

4. Signs of Water Damage or Mold

Water stains on ceilings or musty odors are red flags that appraisers don’t ignore. These usually signal a roof leak, basement seepage, or plumbing problem. Mold in particular raises concerns about health and remediation costs. Even if the issue seems minor, appraisers assume buyers will be cautious.

Water damage also suggests ongoing maintenance problems. A single stain could point to larger unseen issues inside walls or foundations. Because the true extent can be costly to uncover and fix, appraisers build that risk into the valuation. A fresh coat of paint won’t fool them—they’re trained to look deeper.

5. Foundation Cracks

Cracks in walls, sloping floors, or sticking doors often hint at foundation issues, and appraisers pay close attention. Structural stability is the bedrock of a home’s value—literally. Repairing foundations can run into tens of thousands of dollars, so appraisers don’t take chances. If they see signs of instability, value takes a hit.

Even small cracks can be alarming when paired with uneven floors or visible settling. Appraisers aren’t structural engineers, but they know enough to recognize potential risk. Buyers may demand inspections or back out entirely, which weakens marketability. That uncertainty lowers the appraised value to reflect the added burden.

6. Outdated or Neglected HVAC Systems

Heating, ventilation, and air conditioning are big-ticket items, and appraisers check their condition. An ancient furnace or noisy AC unit signals upcoming costs for a buyer. Comfort and energy efficiency matter, and outdated systems raise red flags about both. No one wants to buy a home only to replace its HVAC right away.

Modern, well-maintained systems, on the other hand, can help a home stand out. They make the property more appealing and reduce the likelihood of lender concerns. If systems are outdated or failing, appraisers adjust value accordingly. It’s a case where a little preventive maintenance can go a long way.

7. Evidence of Pests

Signs of termites, rodents, or carpenter ants can tank an appraisal fast. Appraisers know that pests don’t just cause surface-level damage; they can compromise wood structures, insulation, and wiring. A single termite trail can raise alarms about hidden destruction. Even if an infestation has been treated, the stigma lingers.

Pests also raise health and safety concerns, which makes buyers wary. An appraiser sees the potential for additional inspections and costly treatments, and they lower value to reflect that. It’s not just the immediate issue—it’s the question of trust in the home’s condition. That shadow hangs over the appraisal report.

8. Out-of-Sync Renovations

Not all upgrades boost value—some actually hurt. If a home has mismatched flooring, a low-quality addition, or oddly placed upgrades, appraisers notice. Inconsistency makes a home feel disjointed and lowers its overall appeal. Buyers may perceive the property as poorly thought out or cheapened by the work.

Quality and cohesion matter as much as modernization. A luxury kitchen in an otherwise outdated home looks out of place. Appraisers reflect that mismatch in the valuation, because buyers won’t pay a premium for half-finished or awkward updates. Uniformity creates value; disjointed changes subtract from it.

9. Poor Curb Appeal

First impressions matter, and appraisers factor them into overall value. Overgrown landscaping, cluttered yards, or damaged siding make a home less inviting. If the outside looks neglected, it raises questions about the inside. Buyers often decide within seconds whether a property feels worth the price.

Curb appeal isn’t just aesthetic—it reflects maintenance and pride of ownership. An unkempt exterior makes appraisers adjust downward, because it narrows the pool of interested buyers. Fresh paint, trimmed hedges, and a clean entryway send a different message. It shows the home is cared for and desirable.

10. Location Drawbacks

Appraisers can’t change geography, but they weigh it heavily. Homes near noisy highways, busy train tracks, or industrial sites often lose value. Environmental concerns, like being in a floodplain, also ding the appraisal. Even if the home itself is pristine, location can limit desirability.

Buyers don’t just buy a house; they buy its surroundings. If the neighborhood is declining or crime rates are high, appraisers reflect that in their assessment. Value is tied to market demand, and location directly influences demand. That’s why even a gorgeous home in a problematic spot struggles to appraise well.

11. Excessive Personalization

A house that screams the current owner’s taste can be a turnoff. Bright paint colors, unusual fixtures, or overly customized spaces make it harder for buyers to envision themselves living there. Appraisers know personalization narrows appeal and adjust accordingly. A neutral, versatile home generally earns higher marks.

Over-the-top features can actually shrink the buyer pool. For example, converting a bedroom into a home theater may appeal to some but alienates many. Appraisers consider how adaptable the home is to average buyers. The more niche the design, the lower the valuation tends to go.

12. Inaccurate Square Footage or Layout Issues

Appraisers double-check measurements and floor plans, and discrepancies hurt. If the listed square footage doesn’t match reality, that’s a major red flag. Awkward layouts, like walking through a bedroom to reach another room, also diminish usability. Buyers notice these flaws, and appraisers adjust value downward.

Functionality drives marketability, and a choppy or cramped layout makes a home less livable. Even if the square footage is accurate, wasted space brings value down. Appraisers aim to reflect what buyers are realistically willing to pay. A home that feels off-balance won’t command top dollar.

This post 12 Red Flags That Make Appraisers Instantly Lower Home Value was first published on Greenhouse Black.