1. Trampolines

Trampolines might look like harmless backyard fun, but insurers see them as a big red flag. They’re considered an “attractive nuisance,” meaning they’re likely to draw kids and accidents. Broken bones and head injuries from trampoline mishaps are common, which means liability risk shoots up. Because of that, some insurance companies may even refuse coverage if you own one.

What’s tricky is that most homeowners don’t realize they need to disclose it. If someone gets hurt, your policy might not cover the medical bills or lawsuits. Even if it’s fenced in or has a safety net, many insurers still count it as a risk. So that “just for fun” purchase can quietly lower the value of your coverage.

2. Wood-Burning Stoves

A wood-burning stove gives off cozy cabin vibes, but insurers often associate them with fire hazards. Poor installation, creosote buildup, and improper ventilation can all lead to fires. Even if you use it safely, the potential danger is enough to make companies cautious. As a result, your premiums may rise or your home’s insurable value may drop.

Many people don’t mention it when they install one, thinking it’s like any other appliance. The truth is, some insurers require a professional inspection before they’ll even cover you. If that inspection isn’t done, you could find yourself underinsured in the event of a claim. It’s one of those home upgrades that feels charming but has hidden costs.

3. Certain Dog Breeds

Dog lovers hate to hear this, but some breeds can hurt your insurance standing. Insurers keep lists of “high-risk” breeds, which often include pit bulls, Rottweilers, and Dobermans. Even the gentlest family pet from one of these breeds can make your policy more expensive. That’s because bite claims can be costly, and lawsuits add up quickly.

The frustrating part is that many homeowners don’t even know their pup is on a restricted list. You might assume your dog is safe because it’s never shown aggression. Unfortunately, insurers only look at statistics, not individual personalities. This means your furry friend could quietly reduce your coverage value.

4. Swimming Pools

Pools are another “attractive nuisance” that insurers watch closely. The risk of drowning, especially for children, makes them one of the top liability concerns. Even if you have safety gates and covers, companies still see them as risky. Higher premiums or exclusions are often the result.

Homeowners sometimes think a pool boosts property value, but it doesn’t always translate the same way with insurance. The added liability can offset the home’s perceived worth. Some insurers may even require extra liability coverage if you have one. Without it, your policy may not fully protect you.

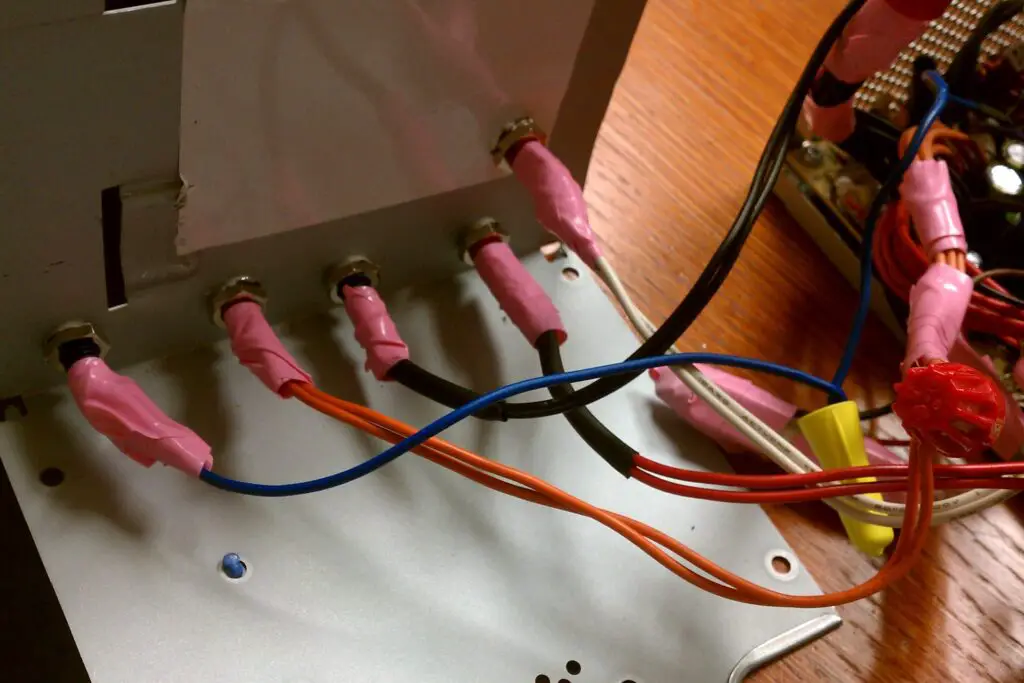

5. Outdated Electrical Wiring

If your home still runs on knob-and-tube wiring or aluminum circuits, insurers get nervous. These older systems are far more prone to overheating and sparking fires. Even if you haven’t had issues, the age alone makes them a hazard. That can lower your insurable value or make coverage hard to get.

Many homeowners aren’t even aware of what type of wiring they have. If your house is older, it’s worth checking with an electrician. Updating the system could save you from higher premiums and reduced coverage. Leaving it as-is could quietly chip away at your insurance protection.

6. Home-Based Businesses

Running a business from your spare bedroom might seem harmless, but insurers view it differently. If clients visit your home or you store business inventory, it adds liability. Standard homeowners insurance usually doesn’t cover business-related claims. That means your overall protection looks weaker to insurers.

Many people forget to tell their provider when they start a side hustle. If something happens—like a client slipping in your driveway—you may not be covered. Even equipment like computers or stock might not be insured under your regular policy. Without a rider or separate business policy, your home’s value in the eyes of insurers goes down.

7. Treehouses

A treehouse might be the ultimate childhood dream, but insurers see it as a lawsuit waiting to happen. Kids climbing up and falling down is the most obvious risk. Even sturdily built ones come with liability issues. Some companies will outright refuse to cover a home with one on the property.

What catches people off guard is that insurers don’t care if it’s used daily or just once a year. The simple presence of a treehouse increases risk. If a neighborhood kid gets hurt on it, you could be on the hook for medical bills. It’s a hidden factor that chips away at your policy’s value.

8. Old Roofs

A roof past its prime is one of the most common reasons insurance value drops. Once it’s over 20 years old, many companies consider it a liability. Leaks and storm damage claims are far more likely with aging shingles. That’s why insurers may reduce coverage or exclude roof-related damage.

Homeowners often assume as long as it’s not leaking, it’s fine. But insurers focus on the potential for future issues. Even if your roof is still standing strong, its age alone can lower your home’s insurable worth. Replacing it can restore value, but leaving it untouched can hurt your policy.

9. Oil Tanks

Buried or aging oil tanks are another red flag. They can corrode and leak, causing serious environmental damage. Cleanup costs are huge, and insurers don’t want that responsibility. As a result, they may limit or refuse coverage.

Many homeowners don’t realize the presence of an old tank can even impact selling the home. Buyers often shy away because of potential liability. Some insurers will require you to remove or replace it before issuing coverage. It’s a hidden factor that lowers your insurance value quietly but significantly.

10. Space Heaters

Portable space heaters may seem like a cheap heating solution, but insurers see danger. They’re a leading cause of house fires, especially when left unattended. Even modern ones with safety features don’t completely erase the risk. Having them around too often can raise your risk profile.

Most people don’t think twice about plugging one in during winter. But if a fire starts because of a heater, your claim could face extra scrutiny. Insurers know how common these accidents are, so they factor it in. Over time, reliance on them can erode your coverage value.

11. Aggressive Landscaping Features

Believe it or not, certain landscaping features can hurt your insurance standing. Think ponds, fountains, or even big retaining walls. They can lead to accidents, injuries, or water-related damage. Insurers see them as hazards rather than home upgrades.

Homeowners often install these to boost curb appeal or property value. But the risk of someone slipping, falling, or flooding changes the equation. Even decorative ponds are seen as drowning hazards. It’s a subtle way your yard can lower your policy’s value.

12. DIY Renovations

Weekend projects are fun until insurers find out. Unpermitted or poorly done renovations can make them nervous. Electrical, plumbing, or structural changes are especially risky. If they weren’t inspected, insurers assume a higher chance of failure.

What homeowners miss is that unpermitted work can void parts of a policy. A bathroom remodel gone wrong might not be covered at all. Even if it looks fine, insurers won’t take your word for it. This reduces your home’s insurable value without you realizing it.

13. Old Plumbing Systems

Galvanized steel or polybutylene pipes are red flags for many insurers. They’re prone to corrosion, leaks, and even bursts. Water damage claims are among the most expensive for companies to handle. That’s why old plumbing systems can quietly lower your coverage.

Most homeowners don’t realize how big of a deal pipes are to insurance. If you’ve never had a leak, you might think it’s fine. But insurers focus on the likelihood of future problems. Updating your plumbing can restore value, but leaving it untouched reduces your home’s insurance worth.

This post 13 Household Items That Lower Your Insurance Value Without You Knowing was first published on Greenhouse Black.