1. HOA fee increases

HOA dues often start reasonable and then creep up as communities age. Maintenance reserves, insurance, and vendor contracts all get more expensive over time. A $20 monthly increase doesn’t feel dramatic in isolation. Multiply that by years of ownership and it becomes a real budget line.

This cost matters because HOA increases are largely out of your control. Special assessments can arrive when reserves fall short. Older buildings are especially prone to these spikes. Reading meeting minutes can provide early warning.

2. Property tax adjustments

Property taxes rarely jump all at once, but reassessments and millage changes nudge them upward over time. If you pay through escrow, the increase can feel invisible because it’s bundled into your monthly payment. The surprise comes when the lender recalculates and adds a catch-up amount for a prior shortfall. That’s how a “small” annual hike turns into a noticeable monthly bump.

This cost earns a spot because it’s both predictable and easy to underestimate. Local governments regularly adjust rates to fund schools, roads, and services. Even a few hundred dollars more per year compounds over a decade of ownership. Checking assessment notices and appealing when appropriate can soften the blow.

3. Homeowners insurance premium creep

Homeowners insurance premiums tend to rise quietly as rebuilding costs and regional risks increase. Many insurers apply modest annual increases that don’t trigger a shopping-around reflex. You might not notice until renewal paperwork shows a higher total than last year. Over time, those incremental increases add up.

This belongs on the list because insurance is mandatory for most mortgages. Inflation in labor and materials directly affects replacement-cost coverage. Climate-related claims have also pushed premiums higher in many states. Reviewing coverage limits and deductibles annually can keep costs aligned with reality.

4. Routine maintenance supplies

Small maintenance purchases rarely make headlines in a budget. Things like caulk, furnace filters, and lightbulbs feel trivial at checkout. Homeownership requires buying them again and again. Over a year, the receipts stack up.

This item earns inclusion because neglecting it costs more later. Regular replacements prevent larger repairs. Skipping them can void warranties or reduce efficiency. Tracking these expenses shows their true weight.

5. HVAC service plans

Annual HVAC tune-ups seem optional until you skip one. Many homeowners enroll in service plans for peace of mind. The monthly or yearly fee feels manageable. Over time, it becomes a recurring obligation.

This cost is specific because heating and cooling systems are expensive to replace. Service plans can reduce breakdown risk. However, they add hundreds over several years. Comparing plan costs to pay-as-you-go service is worthwhile.

6. Water and sewer rate increases

Water and sewer bills rarely stay flat. Municipalities raise rates to fund infrastructure repairs. The increases are often a few dollars at a time. They compound quietly on monthly bills.

This belongs here because usage doesn’t have to change for costs to rise. Aging pipes and treatment plants drive expenses. Drought conditions can also push rates higher. Monitoring usage helps, but rate hikes still land.

7. Trash and recycling fees

Trash service is easy to ignore because it’s routine. Some cities bill separately from taxes. Fees increase as landfill and fuel costs rise. The annual total is higher than expected.

This cost is included because it’s unavoidable. Optional add-ons like yard waste pickup raise the bill. Private haulers may adjust prices with little notice. Reviewing service levels can trim excess.

8. Pest control

Preventive pest control feels discretionary at first. Many homeowners sign up after one bad experience. Quarterly treatments seem affordable individually. Over years, they become a steady expense.

This makes the list because prevention is often cheaper than repairs. Termites, rodents, and ants cause real damage. Skipping service can mean higher future costs. Evaluating necessity by region matters.

9. Energy “vampire” electricity use

Electronics draw power even when not in use. Chargers, routers, and smart devices sip electricity constantly. Each one uses little energy on its own. Together, they raise utility bills.

This cost is specific because it’s hidden in plain sight. Older devices are often less efficient. Power strips can reduce standby draw. Small changes add up over time.

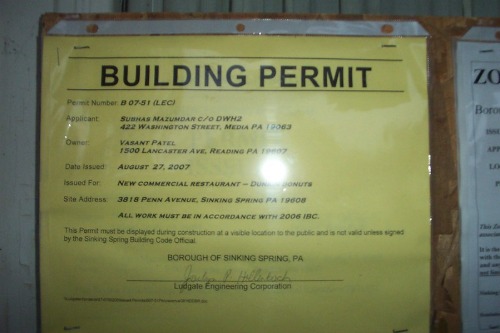

10. Permits and inspection fees

Minor home projects often require permits. Fees for electrical, plumbing, or fence work add up. Each permit seems inexpensive. Multiple projects multiply the cost.

This belongs here because skipping permits can be costly. Fines or resale issues may follow. Municipal fees vary widely by location. Budgeting for them avoids surprises.

11. Landscaping and yard upkeep

Yard care costs sneak in season by season. Mulch, fertilizer, and seed are recurring purchases. Equipment maintenance adds another layer. The yearly total is larger than expected.

This makes the list because curb appeal affects home value. Neglect leads to pricier fixes later. Even DIY yards aren’t free. Planning seasonal expenses keeps it manageable.

This post House Costs That Seem Minor Until They Stack Up was first published on Greenhouse Black.