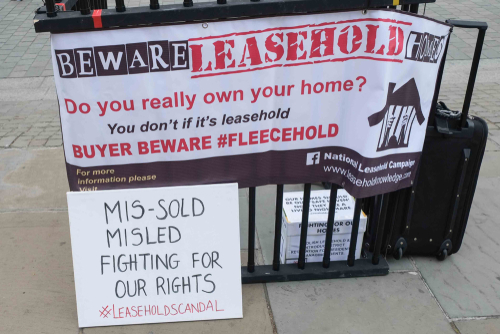

1. Choosing a co-op or leasehold without understanding the structure

Co-ops and leaseholds often come with lower purchase prices. The ownership structure is fundamentally different from standard real estate. Approval processes, resale rules, and financing options are more limited. That affects how easily you can exit.

Co-op boards can reject buyers, slowing or killing a sale. Leaseholds lose value as the lease term shortens. Many lenders won’t finance these properties at all. Lower entry cost can mean fewer paths later.

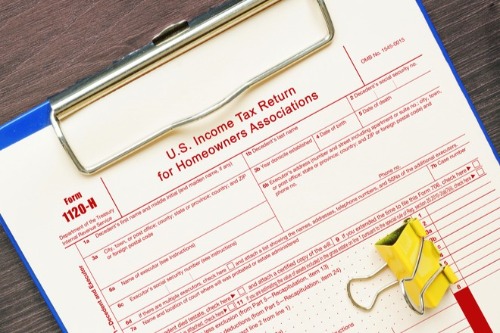

2. Choosing a home with a restrictive HOA

HOAs can be great at first because they promise order and shared responsibility. The restrictions, however, can be far more limiting than people expect. Rules may control rentals, pets, parking, exterior changes, and even who can live with you. Those limits directly affect how you can adapt the home later.

If you ever want to rent the property, many HOAs cap rentals or ban them entirely. Running a small business from home or adding solar panels can also be prohibited. HOA fees and special assessments are ongoing costs you cannot opt out of. Once you buy in, your future choices are governed by a board you don’t control.

3. Buying in a flood zone or high-risk climate area

Waterfront views and warm climates are understandably appealing. The tradeoff is long-term exposure to flooding, hurricanes, wildfires, or extreme heat. Insurance requirements and deductibles in these areas are higher and can change suddenly. That unpredictability affects affordability and resale.

Some insurers pull out of high-risk markets, leaving fewer and pricier options. Mortgage lenders may require specific coverage that limits who can buy from you later. Local governments can also impose new building or elevation rules over time. What feels like a lifestyle upgrade can quietly shrink future flexibility.

4. Assuming school districts will stay the same

Many buyers choose a home largely for the current school district. District boundaries, however, are not permanent. Redistricting, school closures, or policy changes happen more often than people realize. When they do, the home’s value proposition can change overnight.

If the schools shift, you may feel forced to move sooner than planned. Private school tuition is an expensive backup many families didn’t budget for. Buyers down the line may not value the location the same way you did. A decision made for today’s schools can limit tomorrow’s choices.

5. Purchasing a highly customized or unconventional home

Unique layouts and bold design choices can feel exciting and personal. The issue is that most buyers prefer something close to neutral. Odd floor plans, missing closets, or hyper-specific features shrink the buyer pool. Fewer interested buyers means less leverage later.

You may need to remodel just to sell, which costs time and money. Some changes, like removing bedrooms or combining units, are hard to reverse. Appraisals can also come in lower for unconventional properties. Personal taste today can become a resale constraint tomorrow.

6. Buying a home that depends on one long commute

A long commute often feels manageable at first, especially for a dream house. Life changes, and jobs do too. If work locations shift or remote options disappear, that distance becomes a liability. Transportation costs and time add up quickly.

Homes far from job centers are more sensitive to fuel prices and economic shifts. Selling can be harder if fewer buyers are willing to make that commute. You may feel stuck in a job just to keep the house workable. A location choice can quietly lock in career decisions.

7. Ignoring zoning and land-use restrictions

Many buyers assume they can add on or repurpose space later. Zoning laws don’t always allow that. Restrictions can limit additions, accessory dwelling units, or home businesses. What you see at purchase may be all you ever get.

These rules are enforced by municipalities, not suggestions. Variances are uncertain, time-consuming, and not guaranteed. If your needs change, your property may not be able to change with you. Zoning can quietly cap your future options.

8. Buying at the very top of your budget

It feels empowering to get approved for the max and use all of it. The problem is that housing costs rarely stay flat after closing. Property taxes, insurance, utilities, and maintenance almost always rise. When your payment already stretches you, those increases remove flexibility fast.

Being house-rich and cash-poor limits job changes, sabbaticals, and even family planning. It also makes refinancing or selling under pressure more likely if the market shifts. Lenders base future borrowing power on your debt-to-income ratio, not your intentions. Starting maxed out narrows your options for years.

9. Skipping a realistic maintenance assessment

It’s easy to underestimate how much upkeep a home really needs. Deferred maintenance compounds over time. Roofs, HVAC systems, plumbing, and foundations are expensive to fix. Ignoring them reduces future choices.

Large repair costs can prevent you from moving or refinancing when you want. Buyers often demand discounts or walk away from poorly maintained homes. Insurance companies may refuse coverage for neglected systems. Maintenance decisions today affect mobility later.

10. Overlooking property tax volatility

Many buyers focus on the mortgage payment and forget taxes can change. Reassessments, local levies, and rising home values can push taxes up. Some areas reassess aggressively after a sale. That can blow up a carefully planned budget.

Higher taxes reduce affordability for you and future buyers. They also impact debt-to-income calculations for new loans. Moving becomes harder when monthly costs creep up. Taxes are a long-term constraint, not a fixed number.

11. Buying with the assumption you’ll “just rent it out later”

Renting later sounds like a safe backup plan. Not all homes work well as rentals. Location, layout, HOA rules, and local laws all matter. Many owners discover this too late.

Some cities impose strict rental licensing or short-term rental bans. Cash flow may not cover expenses once vacancies and repairs are real. Lenders and insurers treat rentals differently than primary homes. A weak rental option can trap you in a property you outgrow.

This post Housing Decisions That Reduce Options Later was first published on Greenhouse Black.