1. Vintage Movie Posters From the 1930s–1940s

Original movie posters from Hollywood’s Golden Age become investments due to low survival rates. They were printed cheaply and meant to be discarded. Posters for films like King Kong or Casablanca are especially rare. Condition and originality are crucial.

Paper conservation standards allow condition assessment. Title popularity creates lasting demand. Auction histories provide price benchmarks. These factors together support long-term value.

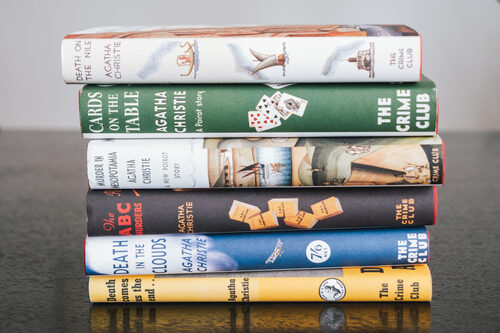

2. First-Edition Books With Original Dust Jackets

A true first-edition book with its original dust jacket often crosses into investment territory because so few survived intact. Dust jackets were meant to be discarded, so their presence dramatically affects value. A first printing of The Great Gatsby is a classic example, where the jacket can represent over 90 percent of the book’s worth. The object becomes investable because scarcity is tied to survival, not just age.

Collectors can fact-check this through publisher records and established bibliographies. The dust jacket’s artwork, price clipping, and typography are closely studied. Condition standards are well documented and widely accepted. That shared understanding makes pricing stable enough for investment.

3. Ming Dynasty Blue-and-White Porcelain Jars

Certain Ming dynasty porcelain jars become investments because of their craftsmanship and documented kiln origins. Blue-and-white ware from the Xuande or Chenghua periods is especially prized. These objects reflect technical mastery that was difficult to replicate later. Their survival rate is low due to fragility and centuries of use.

Scholars and museums have extensively studied these wares. Stylistic elements and clay composition help verify authenticity. Comparable examples appear regularly at major auctions. That scholarly and market backing supports investment-grade confidence.

4. Original Eames Lounge Chairs (1956–1960s)

Early Eames Lounge Chairs cross into investment territory because they represent a design milestone. First-generation examples used rosewood veneer and specific shock mounts no longer produced the same way. Labels, screws, and construction details distinguish originals from later editions. These chairs combine functionality with design history.

Collectors can verify age through Herman Miller documentation. Demand spans both design collectors and interior decorators. Early examples have shown long-term price appreciation. That crossover appeal helps sustain their investment status.

5. Roman Gold Aureus Coins

Roman aureus coins become investment-worthy due to intrinsic material value and historical importance. Struck in gold, they were high-value currency even in antiquity. Emperors, mints, and dates are well documented. This makes attribution precise compared to many ancient artifacts.

Numismatic scholarship provides standardized grading and references. Auction records go back over a century. Gold content offers a value baseline. Together, these factors reduce volatility and attract serious investors.

6. Vintage Leica Rangefinder Cameras

Certain Leica cameras, especially pre-war models, cross into investment territory because of engineering quality and limited production. Cameras like the Leica II or III were tools used by photojournalists. Many were heavily worn or modified, making original examples scarce. Their importance in photographic history adds weight.

Serial numbers allow precise dating and verification. Leica collectors form an active global market. Condition and originality directly correlate with value. This transparency supports investment confidence.

7. Tiffany Studios Leaded Glass Lamps

Authentic Tiffany Studios lamps become investments due to artistry and documented workshop practices. Each lamp was handcrafted, and patterns can be matched to known designs. Original bases and shades must remain together for full value. These lamps occupy a clear place in American decorative arts.

Scholars have cataloged Tiffany patterns extensively. Auction houses routinely vet and publish detailed descriptions. Demand has remained steady for decades. That stability makes them attractive to long-term collectors.

8. Pre-Columbian Stone Sculptures With Provenance

Certain pre-Columbian stone sculptures cross into investment territory when they have clear pre-1970 provenance. Legal export documentation is essential due to modern cultural property laws. These objects reflect civilizations such as the Olmec or Maya. Their age alone is not enough; legality is key.

Museums and academic publications help authenticate style and period. Ethical clarity protects resale potential. Scarcity is reinforced by export restrictions. This combination elevates them into serious investment assets.

9. Early Fender Stratocaster Electric Guitars

1950s Fender Stratocasters become investments because they shaped modern music. Features like maple necks and specific pickup configurations identify early examples. Many were modified or heavily played, reducing the number of originals. Musicians and collectors compete for the best survivors.

Serial numbers and factory records aid verification. Provenance tied to known players increases value further. Auction sales show strong global demand. Cultural impact drives long-term appeal.

10. Art Deco Platinum and Diamond Jewelry

Art Deco jewelry crosses into investment territory because of design, materials, and craftsmanship. Platinum settings and old-cut diamonds reflect a specific interwar aesthetic. Many pieces were later dismantled for materials, making intact examples scarce. The design itself is no longer mass-produced.

Hallmarks and period construction details support authentication. Demand spans collectors and high-end jewelry buyers. Wearability adds practical value. This dual appeal strengthens investment potential.

11. Rolex Submariner Watches From the 1950s

Early Rolex Submariners cross into investment territory due to their role in defining the modern dive watch. Reference numbers like the 6204 or 6538 are highly sought after because of low production and tool-watch origins. Original dials, hands, and movements are critical to value. These watches are prized not as jewelry, but as historical instruments.

Authentication is supported by serial ranges and component research. Auction results over decades show consistent demand growth. Rolex’s continued brand strength reinforces confidence. This combination of history, documentation, and liquidity makes them investable.

12. Ancient Egyptian Faience Amulets With Documentation

Certain Egyptian faience amulets cross into investment territory when properly documented. These objects were mass-produced, but intact, well-glazed examples are less common. Clear dating and iconography connect them to specific beliefs and periods. Legal export documentation is essential.

Museum parallels help confirm authenticity. Faience composition and wear patterns are studied closely. Prices remain accessible but steadily rising for high-quality examples. That balance attracts cautious investors.

This post What Makes Certain Old Objects Cross Into Investment Territory was first published on Greenhouse Black.